EUR flows: Little impact from ECB minutes

ECB minutes deliberately neutral, but Rehn comments help maintain pressure on USD

There’s nothing of any great significance in the ECB minutes, and EUR/USD is little changed. Most members saw inflation risks as broadly balanced, and interest rates as in broadly neutral territory. However, there was a slight bias towards downside inflation risks, as “several” members saw risks tilted to the downside, while only “a few” member saw risks tilted to the upside. Whether we should take any notice of the minuets at all is questionable, since they also record an intention that communication should be “deliberately uninformative”.

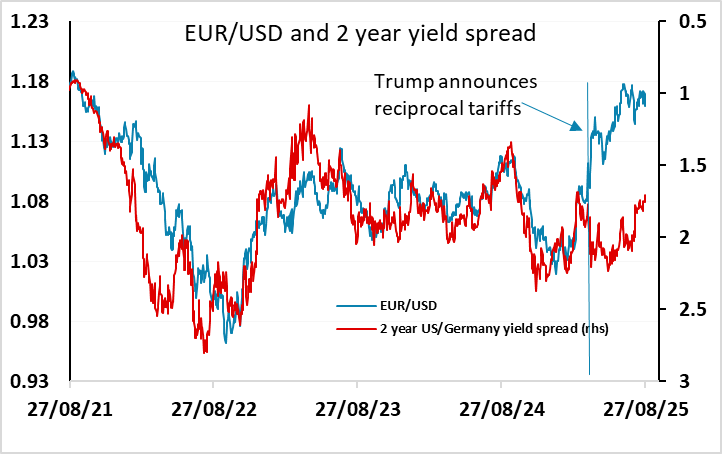

The minutes are in line with market pricing for the ECB, which has less than one rate cut fully priced in, with the lowest rate seen in July 2026, so there is little reason to expect a market reaction. More significant may be the comments from council member Rehn highlighting the danger that Trump’s attacks on the Fed could lead to higher inflation in the US and globally. The USD retains a mildly soft tone due to this Fed uncertainty.