CAD flows: CAD firmer after stronger employment data

Strogner employment data pushes CAD yields up and USD/CAD lower. But still a good chance of a June rate cut so risks may be to the CAD downside

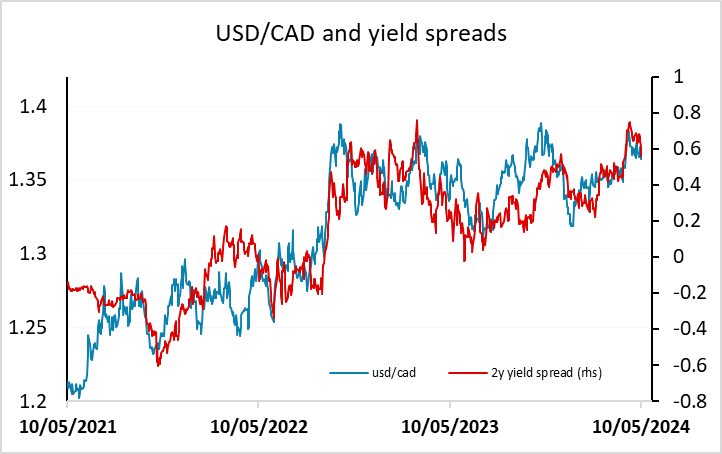

A much stronger than expected Canadian April employment report has pushed USD/CAD around 40 pips lower, with Canadian 2 year yields rising around 6 bps. USD/CAD has moved in line with front end yield spreads, so from here there is unlikely to be much more follow through, at least until there is greater certainty around whether the BoC will cut rates at the June 5 meeting. Currently, this is priced as slightly less than a 50-50 chance, so whichever way the decision goes is likely to have an impact.

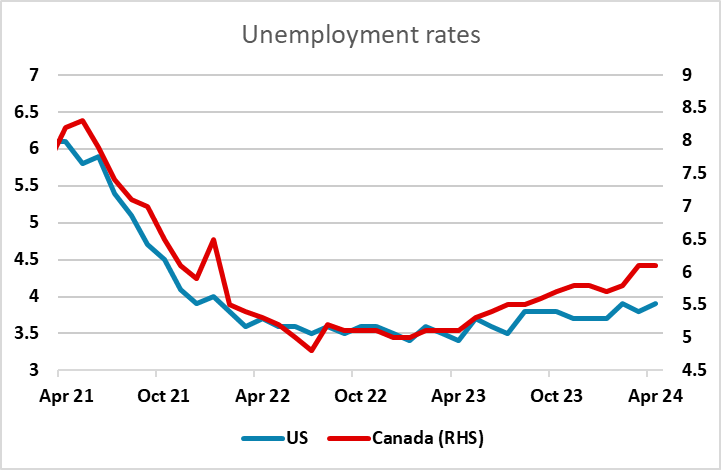

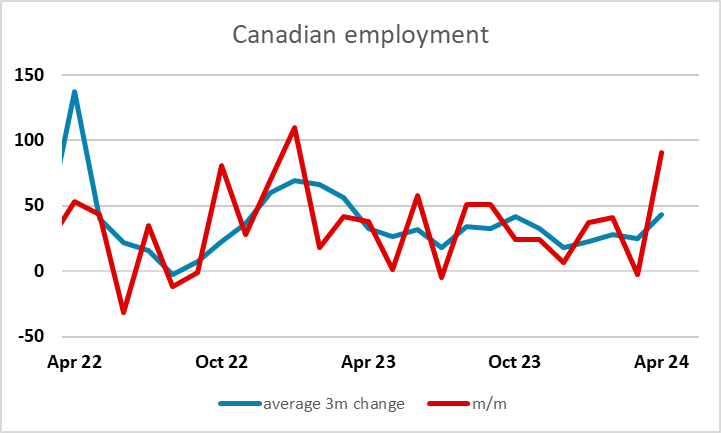

While the monthly employment data was stronger than expected, the 3 month average is fairly steady and the unemployment rate remained at 6.1%, and is still showing an uptrend in the last year. Wage growth also fell to 4.8%, so on balance we still see the risks as being towards a cut in June, suggesting CAD downside risk.