Published: 2024-06-11T15:09:49.000Z

Preview: Due June 21 - U.S. June S&P PMIs - Corrections seen from surprising strength in May

0

4

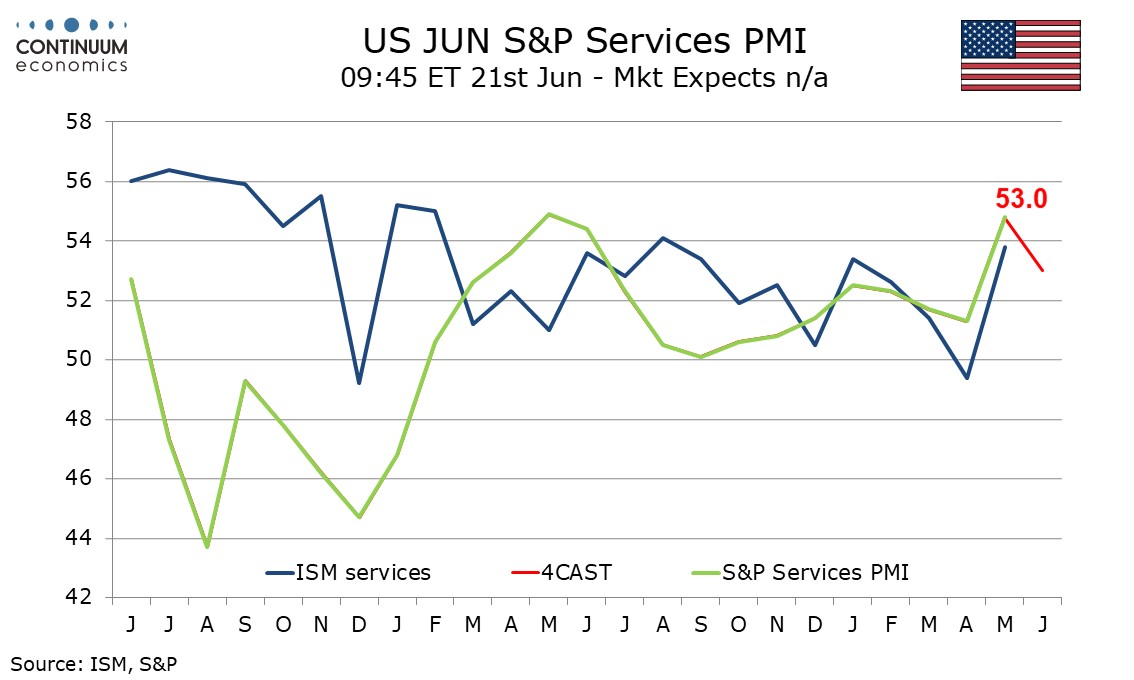

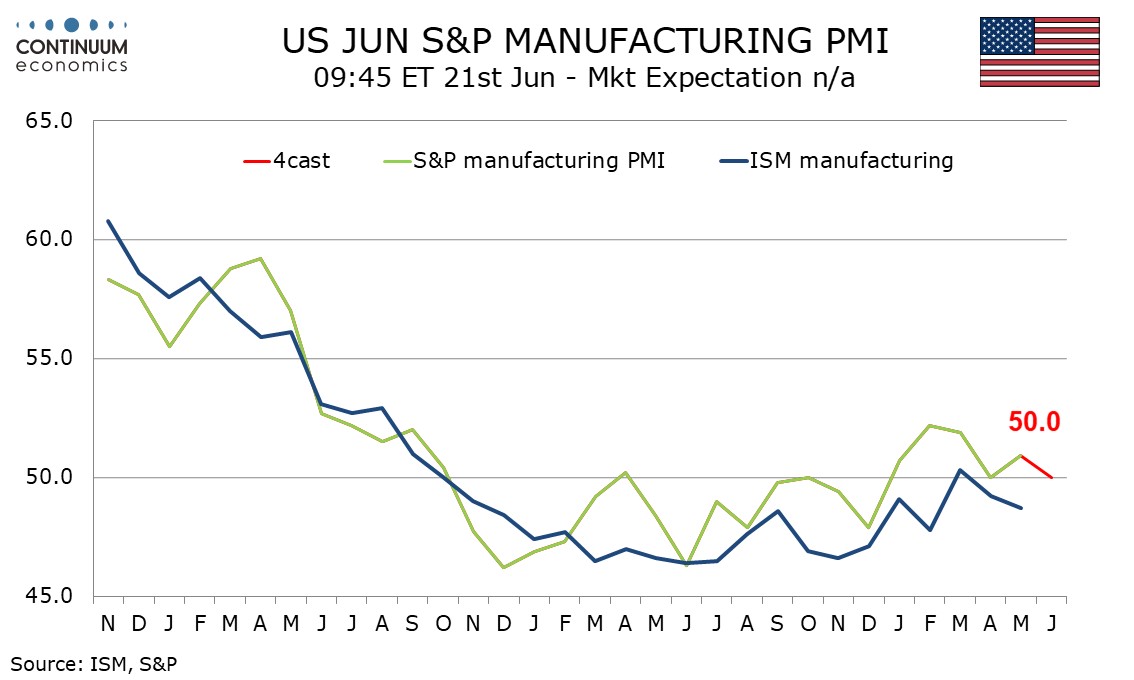

We expect June’s S and P PMIs to show slippage after surprising improvements seen in May, though we do not expect June’s data to show any clear signs of weakness.

We expect manufacturing to return to April’s neutral 50.0 level after bouncing to 50.9 in May. This would resume a move off the recent 19-month high of 52.2 seen in February. ISM manufacturing data in April and May has also been edging off a March move above neutral.

We expect the services index to correct lower to 53.0 from a 12-month high of 54.8 seen in May. The strength of May’s bounce was difficult to explain, but it was backed by a bounce in the ISM services index and there is no strong reason to expect a sharp reversal in June. An index of 53.0 would still be stronger than the 10 months that preceded May’s bounce.