Preview: Due February 27 - U.S. January Durable Goods Orders - Aircraft to lead a sharp fall

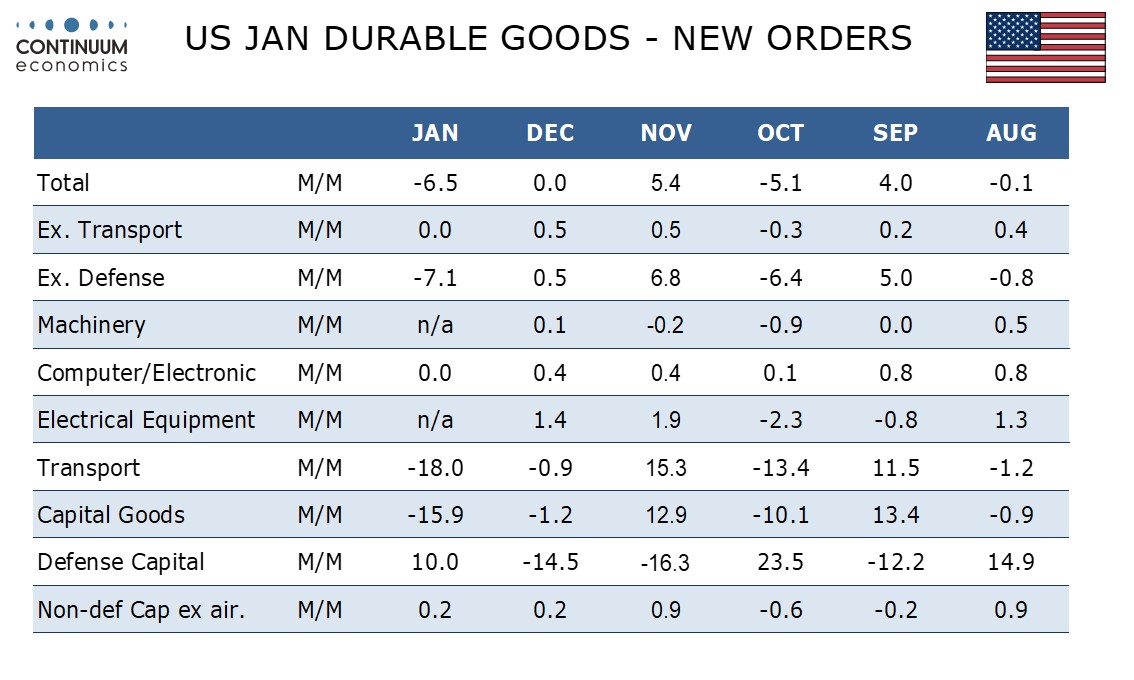

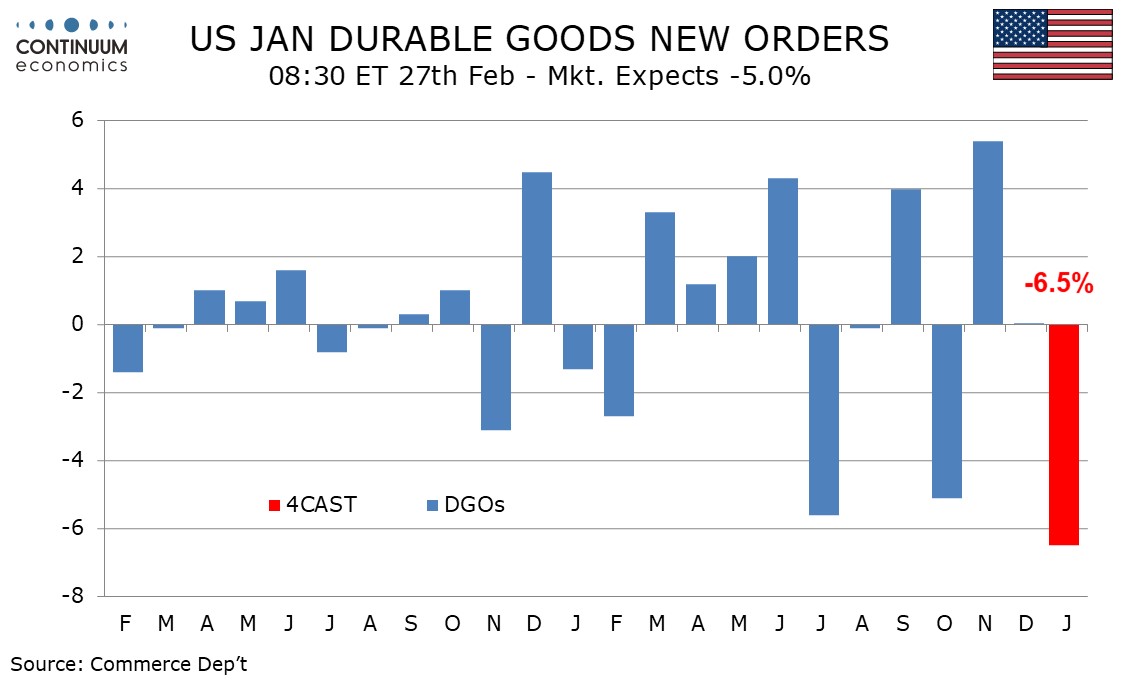

We expect January durable goods orders to see a plunge of 6.5%, largely due to aircraft slipping sharply from two straight strong months. Ex-transport we expect an unchanged outcome in a pause after two straight gains of 0.5%.

Boeing data shows a near empty order book in January after a very strong December. This suggests aircraft orders will fall sharply after sustaining a strong November rise in December. Aircraft led November’s 5.4% rise in durable goods orders, which was sustained with December unchanged.

We expect transport orders to see a negative contribution from autos where sales slipped in January, but a positive contribution from defense, which has a large overlap with transport and is due for a correction after two straight declines. Ex defense we expect orders to fall by 7.1%.

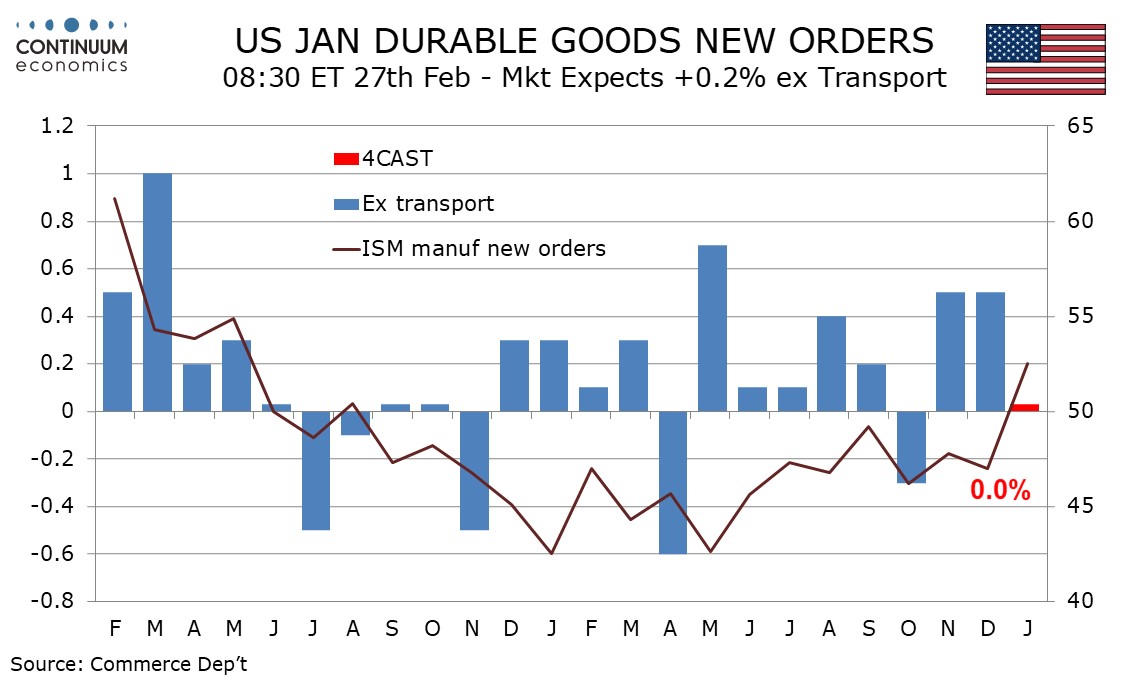

ISM manufacturing new orders picked up in January, but this may be a lagged response to two straight slightly above trend 0.5% gains in durable goods ex transport. With manufacturing output having fallen by 0.5% in January we expect ex transport orders to pause with an unchanged outcome, though the manufacturing output drop was in part due to weather, which orders may be less sensitive to than output.

We expect non-defense capital orders ex aircraft, a key indicator of business investment, to rise by 0.2%, matching a December gain. This series is a little more volatile than the ex transport one but trends are similar, with both marginally positive.