U.S. May Consumer Confidence - Rebound due to fewer pessimists

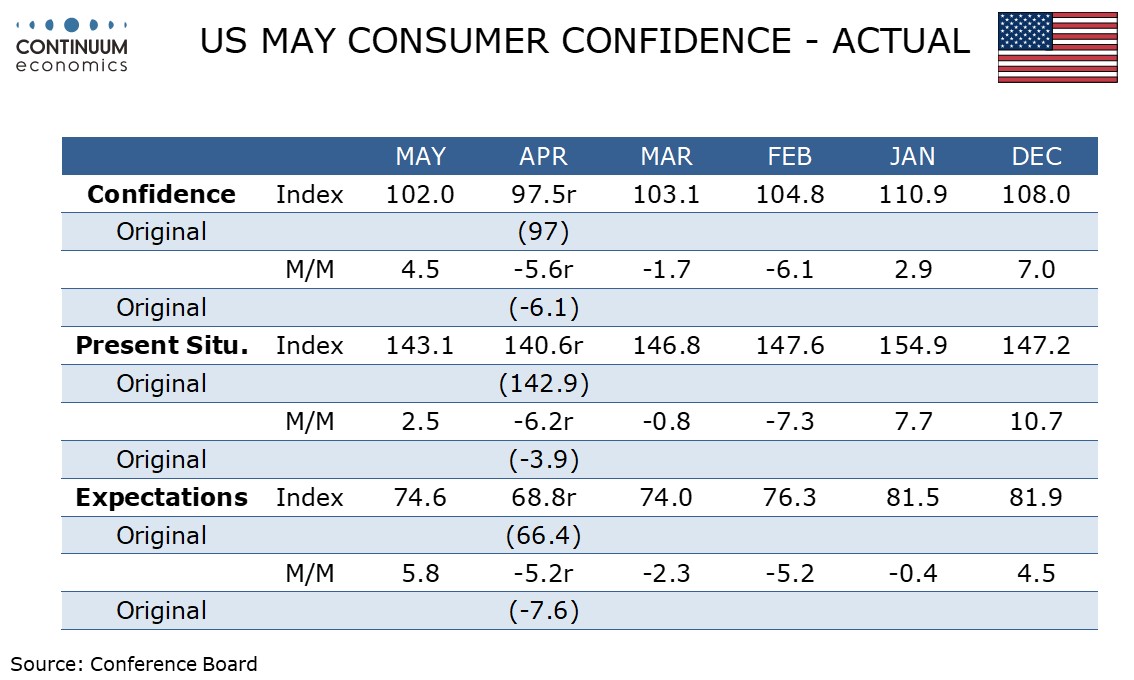

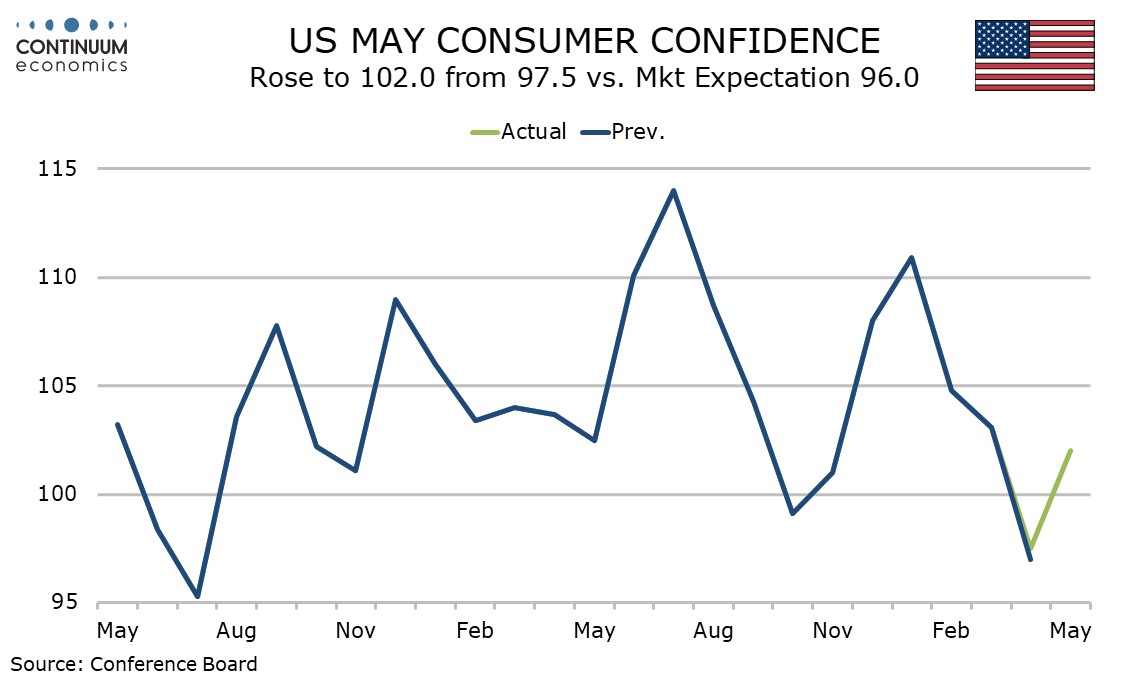

May consumer confidence has shown an unexpected rebound to 102.0 from April’s weaker 97.7, and is now only marginally below March’s reading of 103.1. Details however show only a modest improvement in labor market perceptions and an increase in inflation expectations.

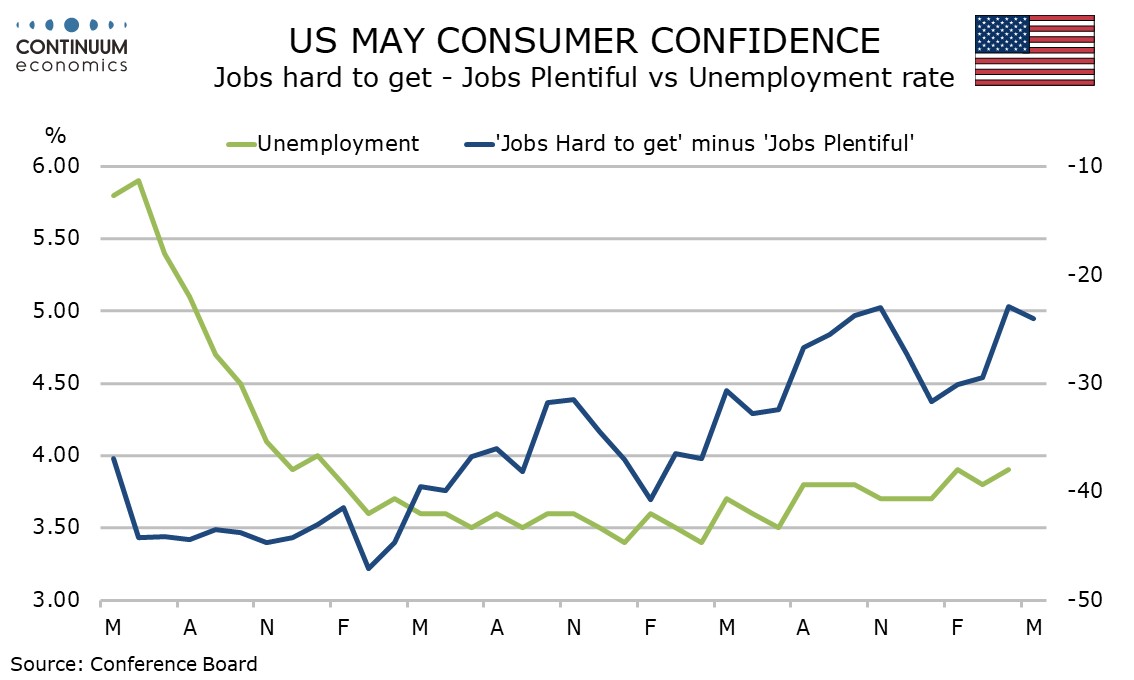

The jobs differential showed an excess of 24.0% in these seeing jobs as plentiful less those seeing them as hard to get, which is up from 22.9% in April but well below 29.5% in March and even further below the differentials seen in January and February, so the labor market signal is not a strong one.

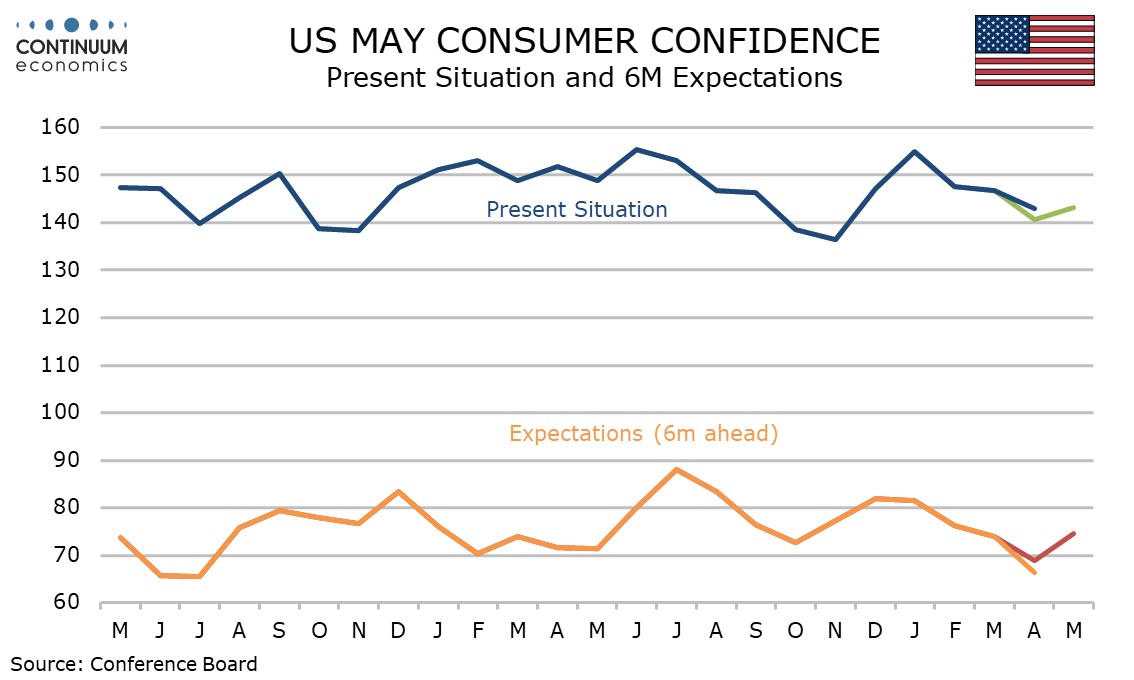

The increase was stronger for future expectations, to 74.6 from 68.8, than it was for the present situation, to 143.1 from 140.6. Expectations moved above their March level.

The detail for future expectations on income, employment and business conditions all show the improvement led by fewer pessimists rather than an increase in the number of optimists. The number expecting things to stay as they are increased.

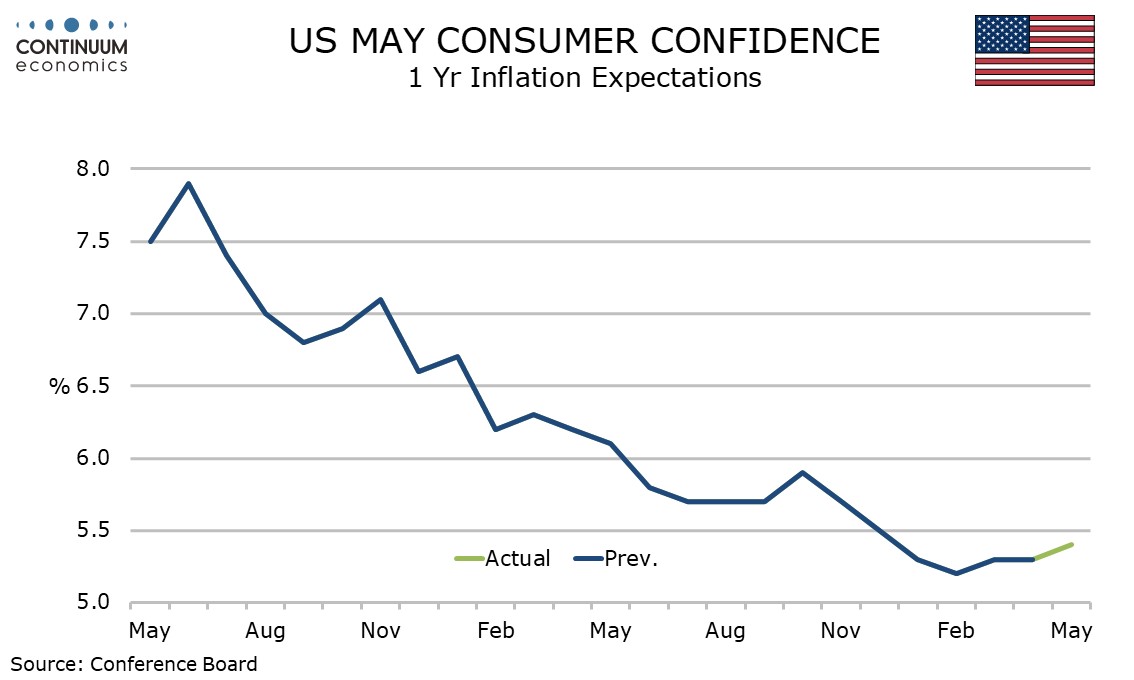

Despite a moderately encouraging April CPI release, inflation expectations edged up, the median to 5.4% after two months at 5.3% and the average to 4.4% after two months at 4.3%. The median being lower than the average reflects the average being influenced by the most pessimistic, who probably have political bias.

The rise in the index contrasts continued slippage in the Michigan CSI, though the Michigan CSI was less weak in its final reading than its preliminary, if still down from April.