NOK flows: NOK slightly higher after strong GDP

NOK has moved higher after stronger than expected GDP, but case for bigger gains remains

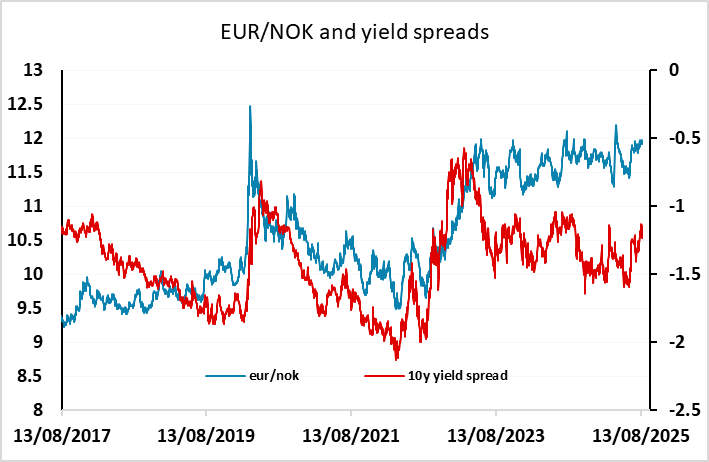

Stronger than expected Norwegian GDP has helped EUR/NOK decline a couple of figures in early trade. Mainland GDP has grown 0.6% in Q2 after a 1.2% rise in Q1, and while this followed a decline in Q4, it maintains the impression that Norway is in a comparatively solid position, with one of the best European growth performances in recent years. While Norges Bank retains a bias to ease, with at least one more rate cut expected thus year, NOK yields are relatively attractive compared to most other European countries, the UK excepted.

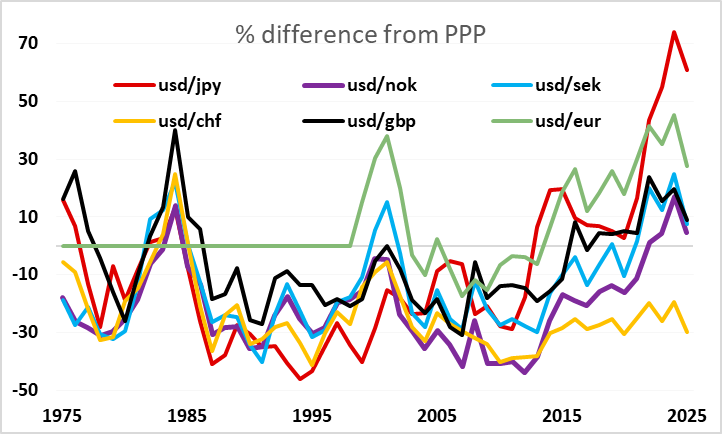

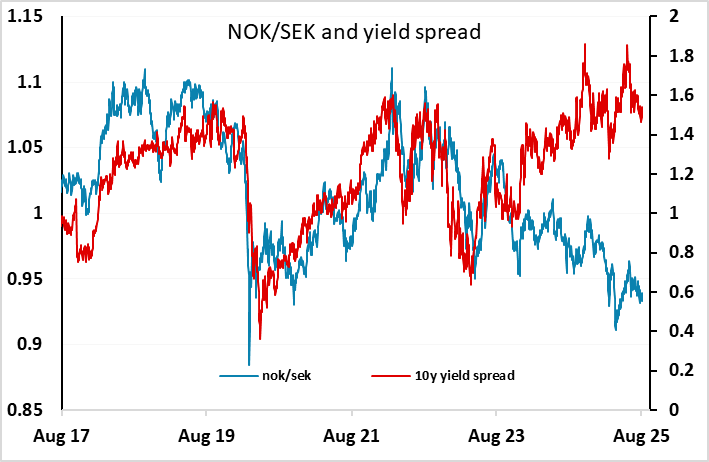

The weakness of the NOK is consequently hard to understand, with EUR/NOK still close to the all time highs above 12 and NOK/SEK in particular looking dramatically out of line with historic performance versus yield spreads. Some of this likely relates to the longer term overvaluation of the NOK, which was one of the world’s most expensive currencies around 13 years ago. However, relative to PPP the NOK is now on a similar level to the SEK, despite its yield advantage, superior growth performance, and huge budget and current account surpluses. The failure to recover in the last year nevertheless makes it hard to expect a recovery in the near term, but it is harder still to find a reason for further NOK weakness.