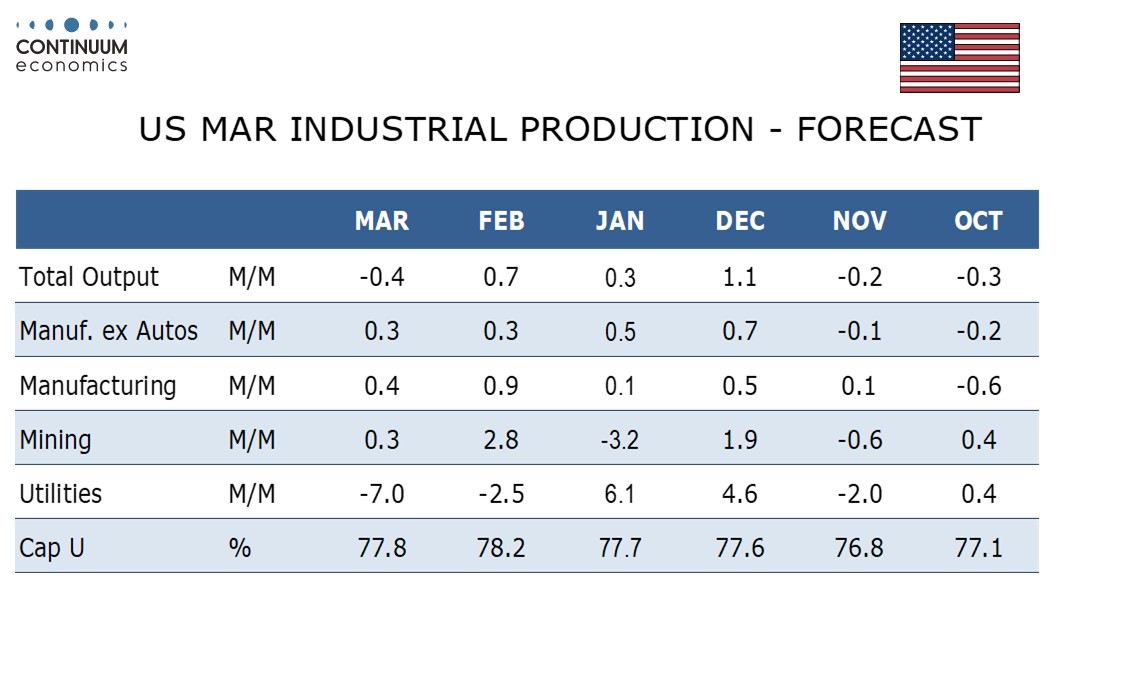

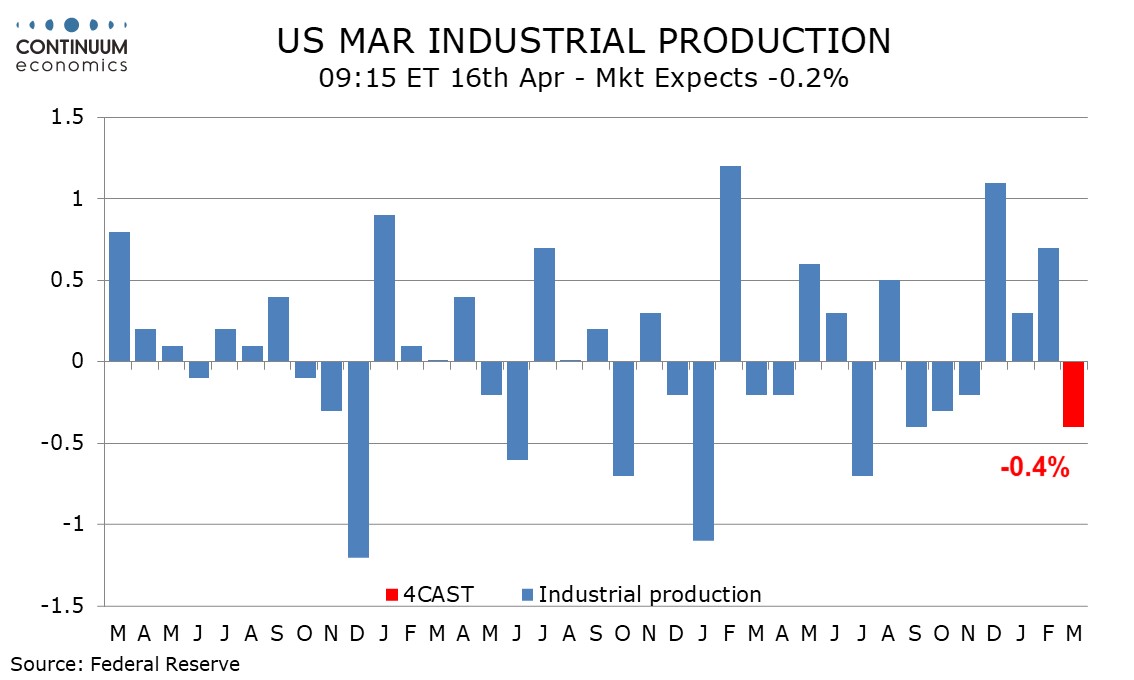

Preview: Due April 16 - U.S. March Industrial Production - Utilities to slip, manufacturing to rise

We expect March industrial production to see a significant 0.4% decline overall due to a sharp fall in utilities on warmer weather. However we expect a respectable 0.4% increase from manufacturing, maintaining a recent improvement in trend.

Utilities rose sharply in December and January and after a modest correction lower in February are likely to come close to completing a reversal in March, assisted by warmer weather. Mining however, after volatility in January and February, is likely to see only a modest rise, of 0.3%.

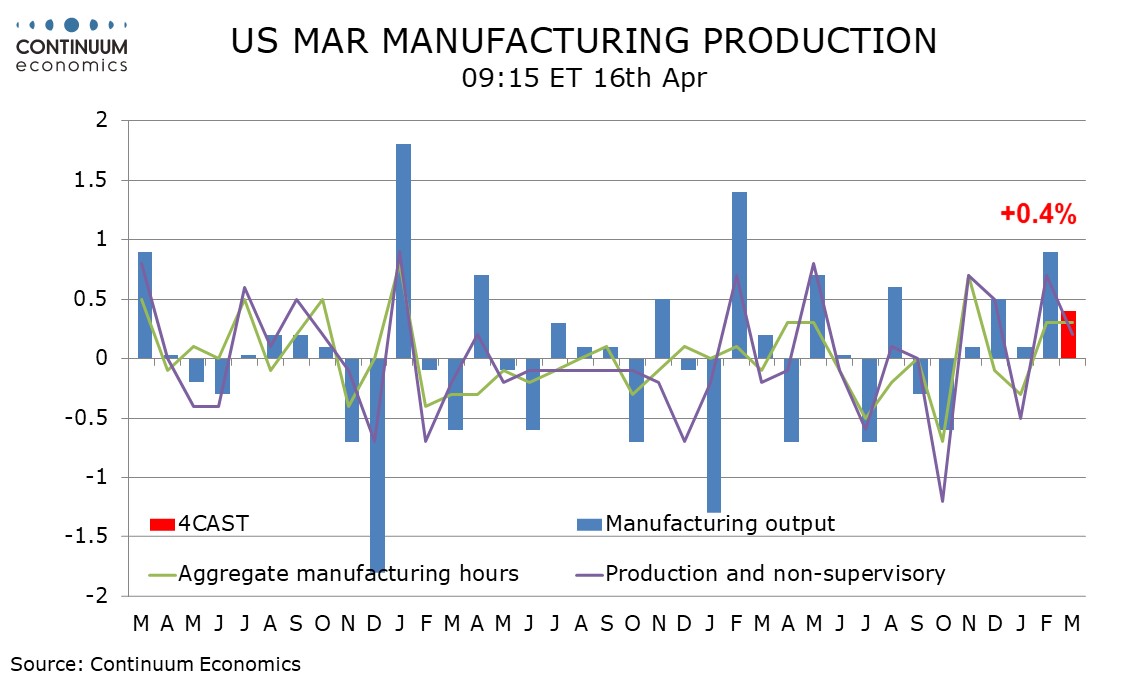

Manufacturing tend has gained momentum in recent months and with payroll aggregate manufacturing hours worked seeing a modest rise, we expect a 0.4% rise in manufacturing. This may be supported by a desire the get ahead of a trade war, with autos likely to extend a strong positive contribution seen in February. However there are downside risks going forward. ISM manufacturing data, as well as several regional surveys, saw slippage in March, even before the tariff announcement.

We expect capacity utilization to slip to 77.8% from 78.2% overall, but to rise to 77.2% from 77.0% in manufacturing. The latter would be the highest since June 2024.