GBP flows: GBP slightly weaker after BoE cut

BoE cuts 25bps as expected, but three way split on MC, with two votes for a 50bp cut and two for no change. GBP slightly firmer in response

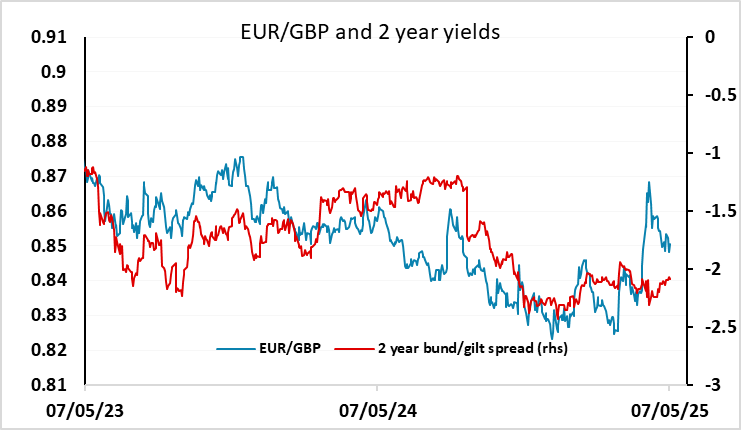

The MPC decision to cut the base rate by 25bps was expected, although the three way split in the vote, with two members voting for no change and two for a 50bp cut, was not expected. The split is more hawkish than expected, with the consensus being that all the members would vote for a cut, and potentially that some might vote for a 50bp move. GBP initially weakened a little on the news, but has rallied and is now stronger. There is nothing particularly surprising in the Monetary Policy Report. This shows and upward revision to the 2025 GDP growth forecast, reflecting the unexpected strength in Q1, but a downward revision to 2026. Wage growth expectations from 2026 have been revised down slightly. All in all, the message is a little more hawkish than expected, with a gradual pace of easing still being emphasised, but FX markets are less sensitive to the nuances of policy than they were, with the focus more on the risks to growth. Inasmuch as these are seen to be on the downside, the implications for GBP are mildly negative, so we doubt there will be much extension of the EUR/GBP decline seen so far.