SEK, CAD flows: SEK unmoved by softer GDP, CAD little changed on election

EUR/SEK little changed but has some upside scope after softer GDP. CAD can extend weakness on crosses after election result.

Swedish Q1 GDP data has come in weaker than expected at flat q/q, with the y/y rise even further below consensus at 1.1%. However, the 0.6% rise in March after declines in January and February suggests a better Q2 starting from a higher base, and EUR/SEK isn’t much changed in response to the data. We still see some downside risks for the SEK, having outperformed the EUR and NOK in recent weeks, but any losses are likely to be gradual.

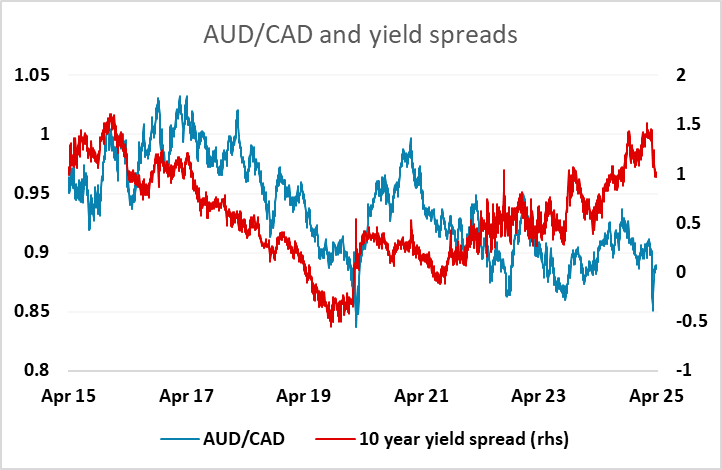

The Canadian election overnight also hasn’t had much impact on the CAD, with USD/CAD little changed, although the USD is slightly weaker in general so the CAD is modestly lower on most crosses. The minority Liberal government is unlikely to enjoy much favour from Trump, as it was hoped that a Conservative government might, but the result is as expected and while there was some potential for CAD gains on a surprise Conservative win, this result only justifies very mild CAD losses. Even so, we continue to see the CAD as vulnerable on the crosses given the relatively larger impact of tariffs on a Canadian economy that sends 77% of its exports to the US, with the AUD and JPY having the most potential to gain, depending on market risk appetite.