GBP flows: GBP has upside scope despite weaker data

GBP has scope for recovery even though weaker labour market data suggests rate cut very likely in May

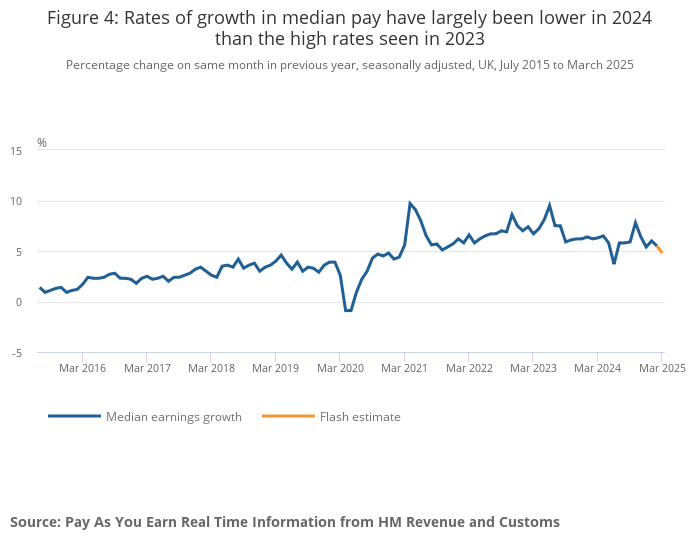

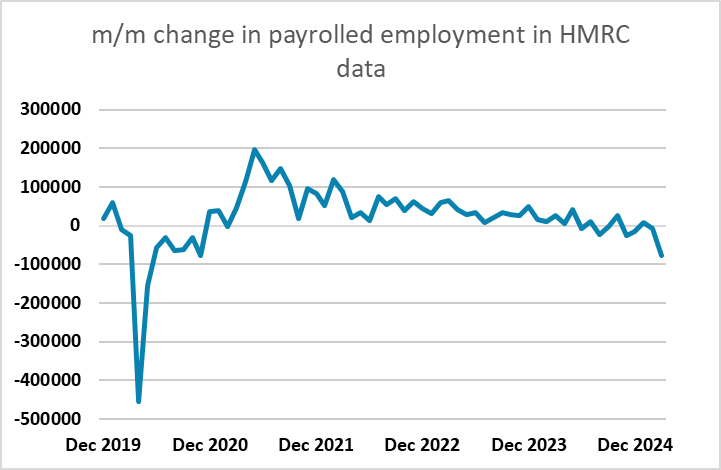

UK labour market data is on the soft side of expectations, with the HMRC data showing a m/m decline of 78k in payrolled employment, the largest since the pandemic in May 2020, and median earnings growth falling to 4.8% y/y, the second lowest since 2021. While the March data is provisional, and the ONS data for February is less weak (but with earnings still on the weak side of expectations), the numbers support a BoE easing in May, although this is already nearly 90% priced in.

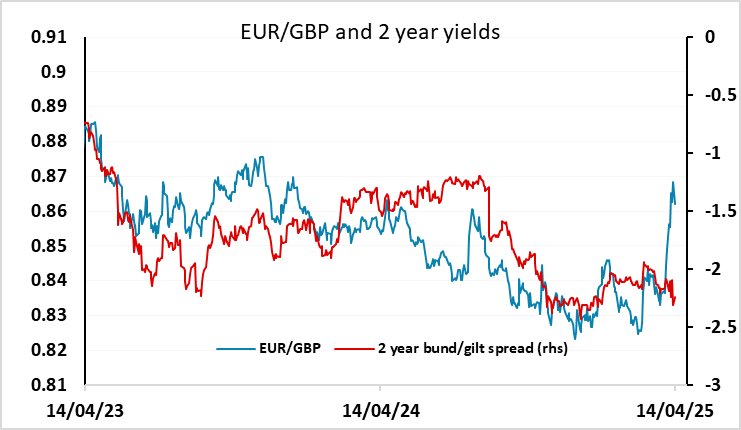

Even so, the data is unlikely to be negative for GBP, as the pound has not been moving with yields in the last couple of weeks, but has sold off against the EUR due to the general decline in risk appetite which has hurt al the higher yielders. But as the markets stabilise, albeit at lower levels, there is scope for GBP to recover, and we have seen some improvement in the last 24 hours. There is still scope for a further GBP recovery, with the latest data generally encouraging from a risk perspective, with the GDP data stronger and the lower earnings growth helping to moderate inflation concerns and allowing some easing in monetary policy. The UK policy of reducing rather than increasing tariffs is also favourable in this environment, so even though a rate cut now looks more certain, this should prove GBP supportive.