CHF flows: EUR/CHF dips slightly after SNB cut

SNB cuts 25bps as generally expected. Small EUR/CHF dip due to minority view that SNB would cut rates to negative

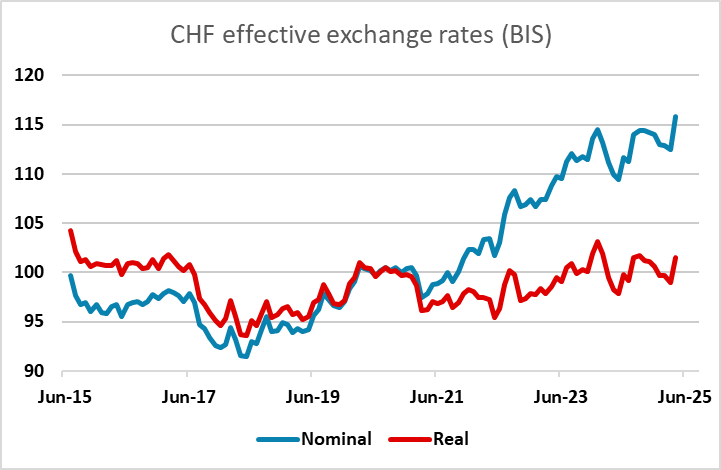

There is nothing particularly surprising in the SNB decision to cut rates to zero. Some were suggesting the possibility of a move to negative rates, so EUR/CHF has dipped around 20 pips in response, but the majority view was always that rates would be cut to zero. There is always the possibility of a move to negative rates in the future, and the SNB once again highlighted their willingness to intervene in the FX market if necessary. But the CHF isn’t ruinously strong at this point, with the low Swiss inflation rate meaning that the CHF has only gained fairly modestly in real trade-weighted terms, so for now EUR/CHF looks likely to continue to hover close to 0.94.

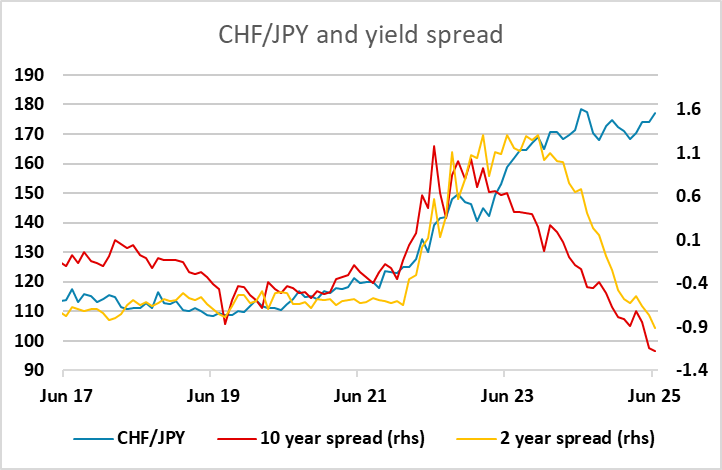

In general, the CHF shows little sensitivity to yield spread moves, being driven more by general risk sentiment, so rate cuts are not usually terribly effective in weakening the currency. However, currencies with similar risk characteristics could benefit from a larger yield pick up against the CHF. The obvious case is the JPY, which suffered against the CHF when yield spreads widened in the early part of this decade, but now offers a yield pick-up, and CHF/JPY remains 50% below the level seen pre-pandemic.