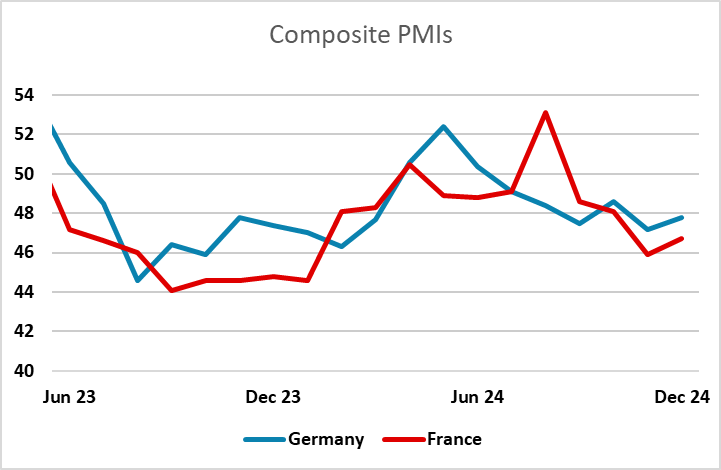

EUR flows: PMIs allow small EUR/USD bounce, but...

EUR/USD moves slightly higher as French and German PMIs rise modestly

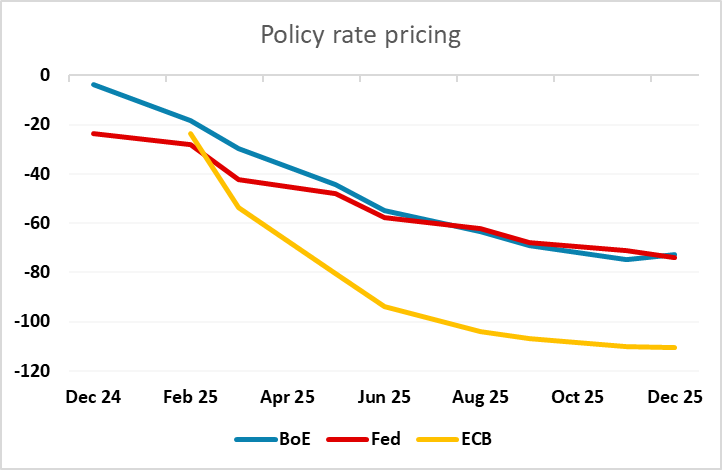

French and German December PMIs showing slightly weaker manufacturing but stronger services and composite indices. This is mildly supportive for the EUR, which has gained around 10 pips on the data, but won’t practically make any difference to ECB policy, and should consequently have little impact on front end EUR yields. With front end USD/EUR yield spreads being the primary driver of EUR/USD, this makes it hard for EUR/USD to move far from 1.05 until the FOMC, which might give a better idea of the future Fed path. Currently, the ECB is priced to ease significantly more rapidly than the Fed. As time goes on and more Fed easing is captured in 2 year yields, we may see spreads move slightly in favour of the EUR. But for now the spread, and EUR/USD, is likely to be driven by changes in expectations of the Fed after this week’s FOMC.