U.S. June S&P PMIs - Impressive May gains, particularly in services, unexpectedly extended

June preliminary S and P PMIs have extended the unexpected strength seen in May with manufacturing increasing to 51.7 from 51.3 and services rising to 55.1 from 54.8. While the gains on the month are modest, the change in tone over the last two months, particularly in services, is impressive.

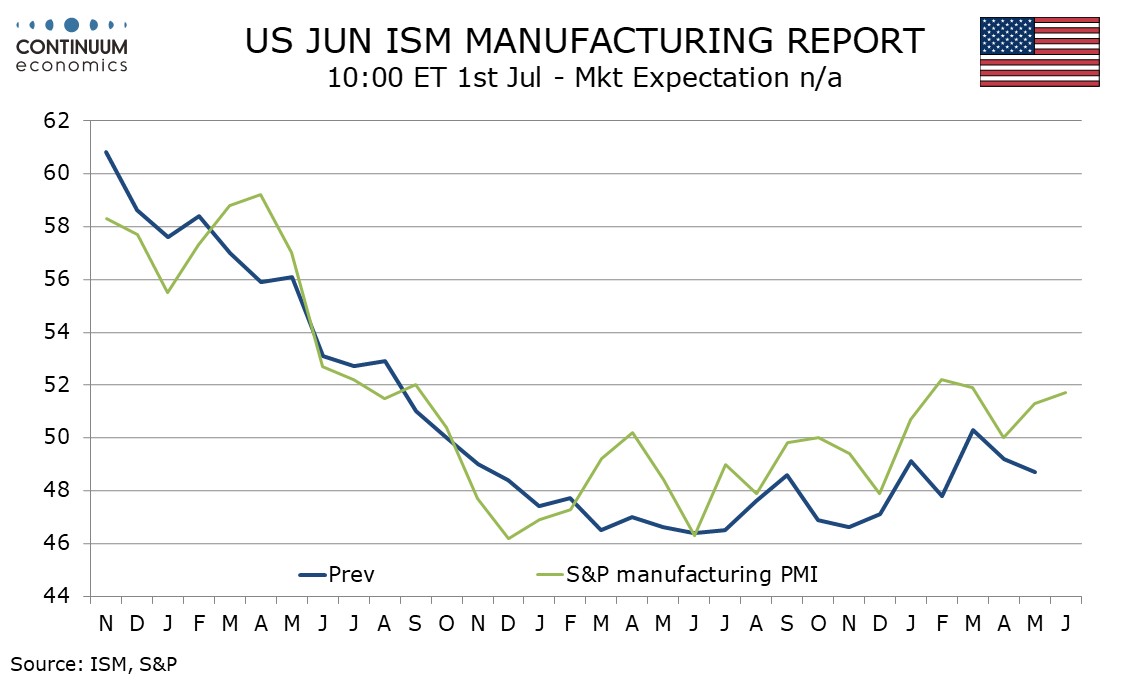

The manufacturing index is still below levels seen in February and March but has seen two straight gains since slipping back to a neutral 50 in April. This hints that dips in the ISM manufacturing index in April and May after March briefly reached neutral will not extend much further. The data also follows an improved manufacturing output report for May.

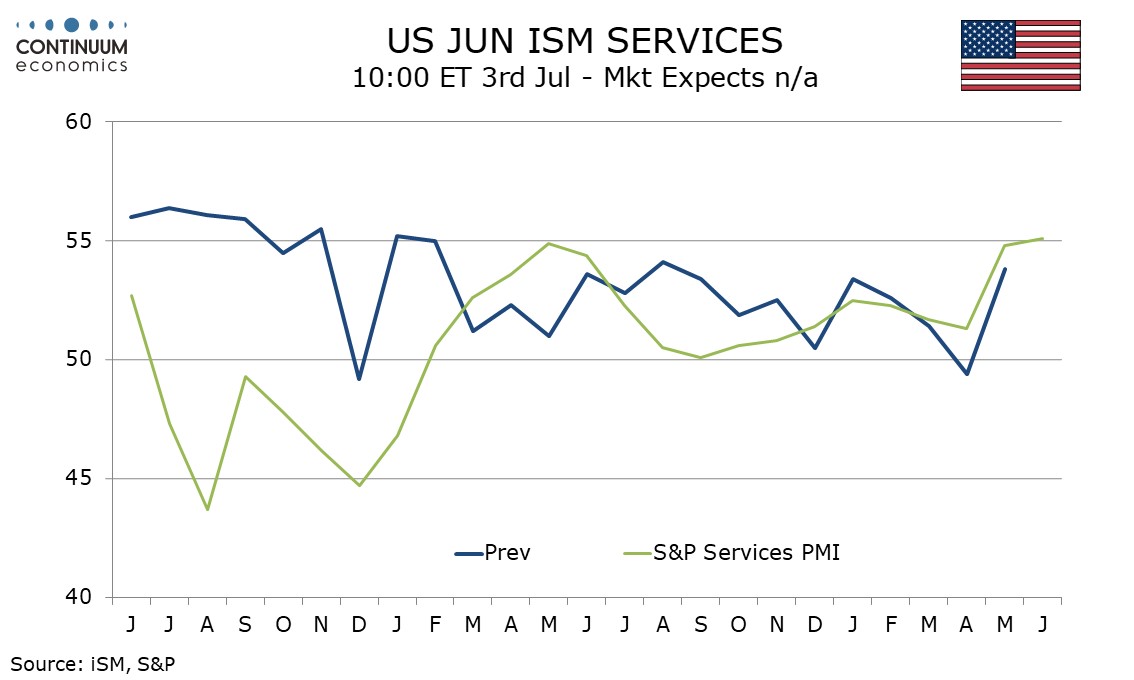

While the S and P services index is not well correlated with its ISM counterpart both series improved significantly in May and the continued strength in the S and P data for June is a positive signal. The S and P data historically has been responsive to moves in bond yields and recent softer inflationary data may be asserting the recent strength. The latest reading is the highest since April 2022.