JPY flows: Ueda comments support JPY range trading

Ueda indicates markets are still unstable, suggesting no monetary policy tighening is imminent, but emphasises the significance of FX moves

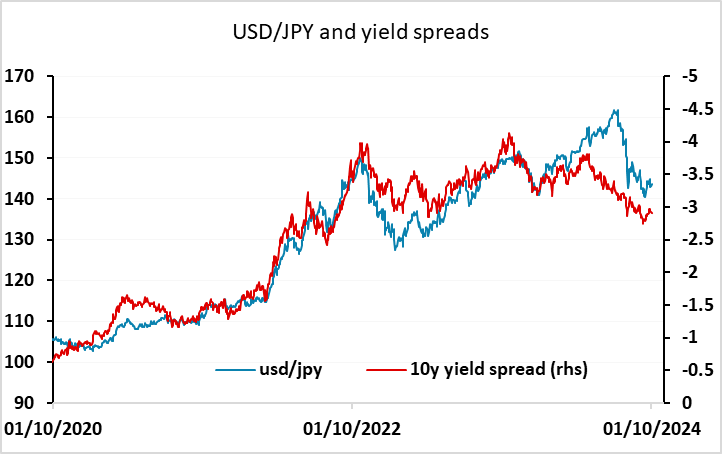

Latest Ueda comments suggest there is still no urgency for any further policy tightening as Ueda is using the code that the markets are still “unstable”. This has pushed USD/JPY slightly higher in early trading, but there is only 1bp of tightening priced in for the October 31 meeting, so the markets are not expecting anything imminently, and the JPY impact from such comments should be minor. However, Ueda is also emphasising the increased significance of FX moves, which suggests the BoJ might become more interested in tightening if USD/JPY were to make significant gains above 145, and will be less inclined to tighten if USD/JPY falls back below 140. His comments therefore support a period of range trading, at least against the USD, although the JPY may still be favoured against the riskier currencies if concerns around the Middle East intensify.