RBNZ Review: Front Loading Cuts

RBNZ cut its cash rate by 50bp to 4.25%

The RBNZ cut its cash rate by 50bp to 4.25% in the November meeting, revised the August OCR to indicate more front loading of rater cut in 2025 and sees CPI, core CPI & expectation to be closer to the middle of target range with further moderation momentum. Some key takeaways:

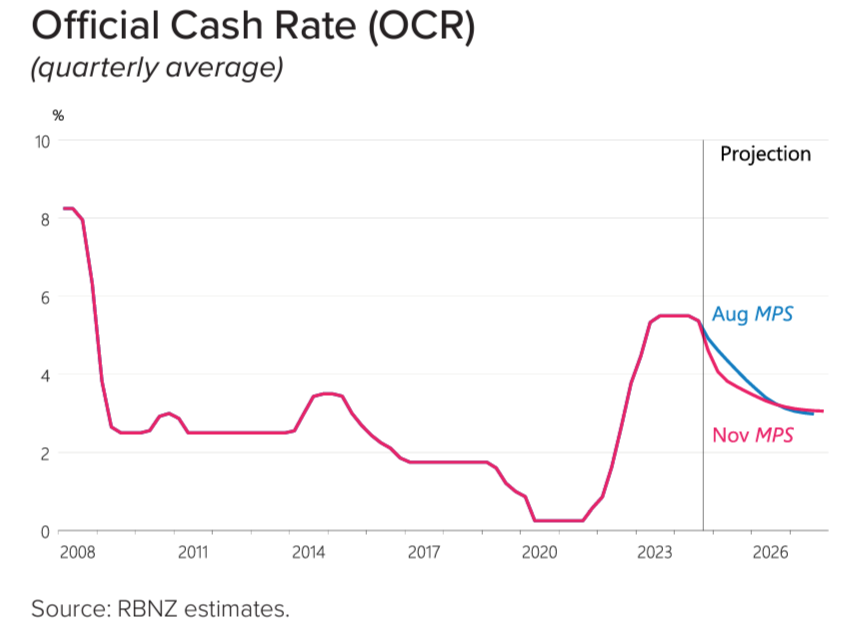

Front Loading Cuts: "If economic conditions continue to evolve as projected, the Committee expects to be able to lower the OCR further early next year". The RBNZ cut by 50bps, more than what the August OCR forecast showed. The November OCR forecast now see the RBNZ to front load one more 50bps cut in February 2025 before smoothly cutting 25bps between meetings till 3% in 2026.

Inflation Expectation: The RBNZ sees CPI, core CPI & expectation to be closer to the middle of target range and they are forecasting such momentum to roll through 2025. Thus, the RBNZ is comfortable to remove the restrictive rate. Within the lines, it also seems that the RBNZ believe there is a chance inflation will be below target range in 2025, that is why we believe they try to front load the cuts.

Forward Guidance Change: The forward guidance is changed to "If economic conditions continue to evolve as projected, the Committee expects to be able to lower the OCR further early next year." from "The Committee confirmed that future changes to the OCR would depend on its evolving assessment of the economy." with RBNZ Governor Orr saying "projections are consistent with 50bp cut in February depending on economy". The RBNZ is signaling they will be front loading cuts and is expecting to cut rate till 2.25% by 2026.

The November meeting shows the RBNZ sees the inflation picture is cooling rapidly and "Significant spare productive capacity expected over the next year", persuading the RBNZ to cut more rather earlier than later.