EUR, SEK flows: EUR well supported, SEK edging lower after data

EUR/USD well supported on general USD weakness; German orders on the strong side. SEK edging lower after weaker Swedish CPI

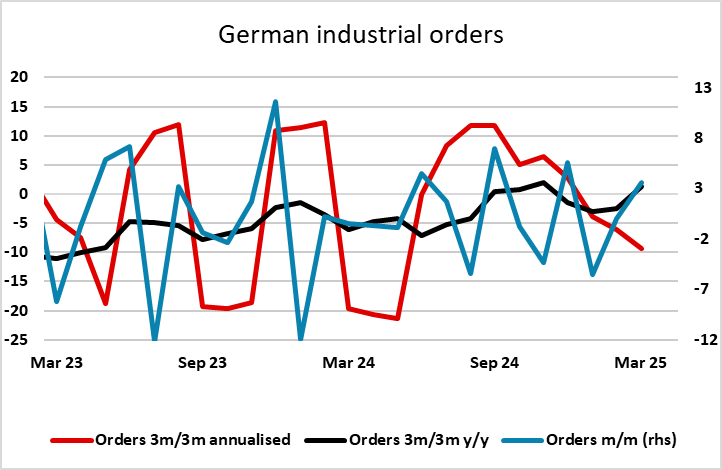

The USD is starting the European session on the back foot, with the EUR and JPY both firming up in late Asia trading, although AUD/USD has slipped back after trading above 0.65 in the early part of the Asian session. This morning’s data should be mildly supportive for the EUR, with German factory orders rising a larger than expected 3.6% m/m in March. However, this data is volatile, and the March rise doesn’t make up for previous weakness. The underlying trend is flat at best, so it is still hard to make a case for EUR strength based on positive European data. EUR/USD remains well supported sub-1.13, but because of a distrust of the USD rather than anything positive in the European economy.

The Swedish CPI data has come in on the soft side of consensus at 2.3% y/y on the targeted CPIF measure, but is not weak enough to suggest that the Riksbank will feel able to cut rates at tomorrow’s meeting, although it could set up a cut in June if we see weak data in the next month. EUR/SEK has slipped lower in the last 24 hours, but has edged up a little this morning after the data, and may have so more upside scope judging by the current yield spread picture.