U.S. Initial Claims higher, Q1 Unit Labor Costs revised down

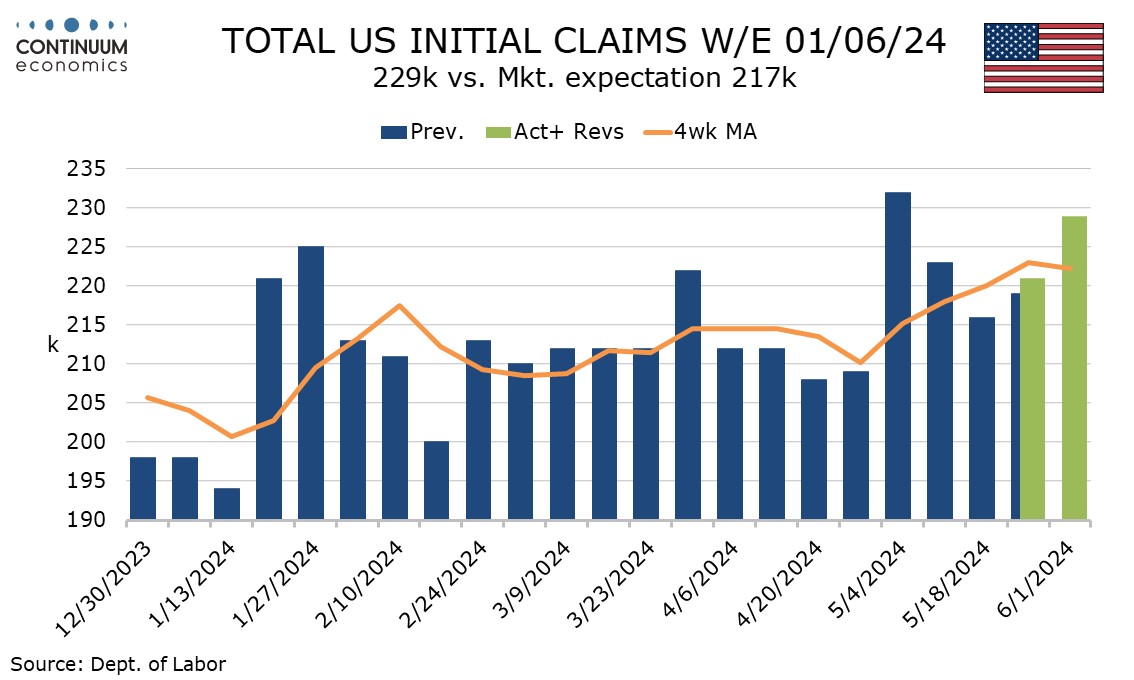

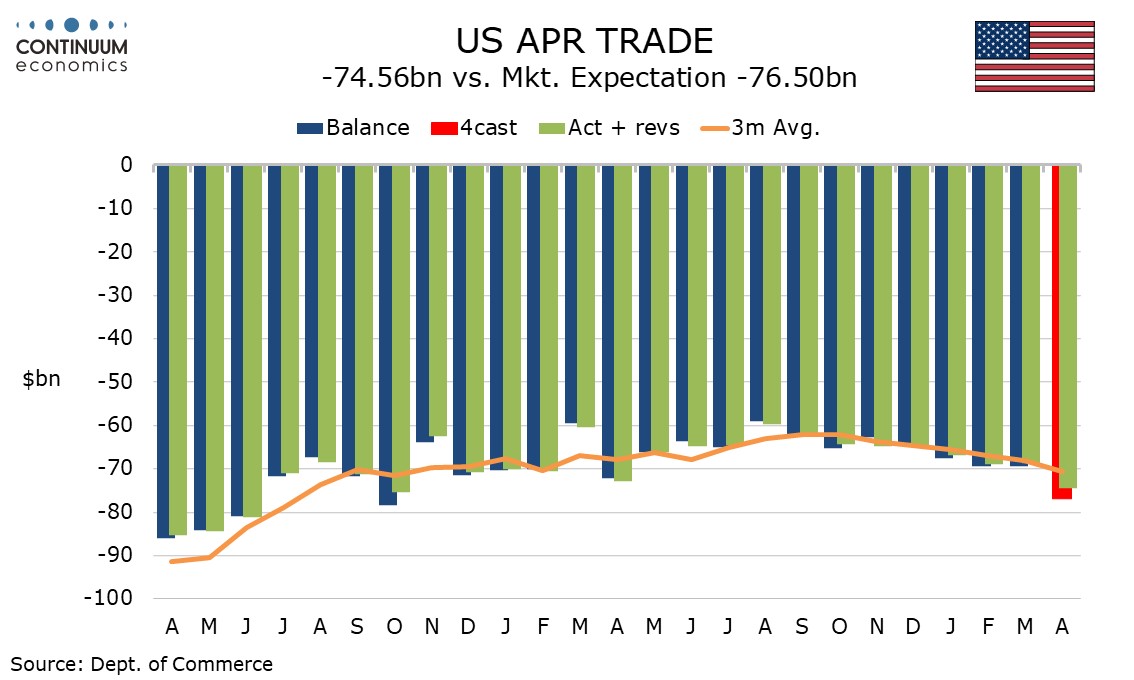

Initial claims are a little higher at 229k in the week to June 1 (two weeks after May’s payroll was surveyed) hinting at some labor market slowing. A downward revision to Q1 unit labor costs to 4.0% from 4.7% was unexpected while April’s trade deficit of $74.6bn from $68.6bn deteriorated a little less than expected.

While the initial claims rise is moderate and fully explained by seasonal adjustments trend does appear to be moving higher, though the 4-week average of 222.25k is slightly down from 230k in the preceding week, which was the highest since the highest September 2023.

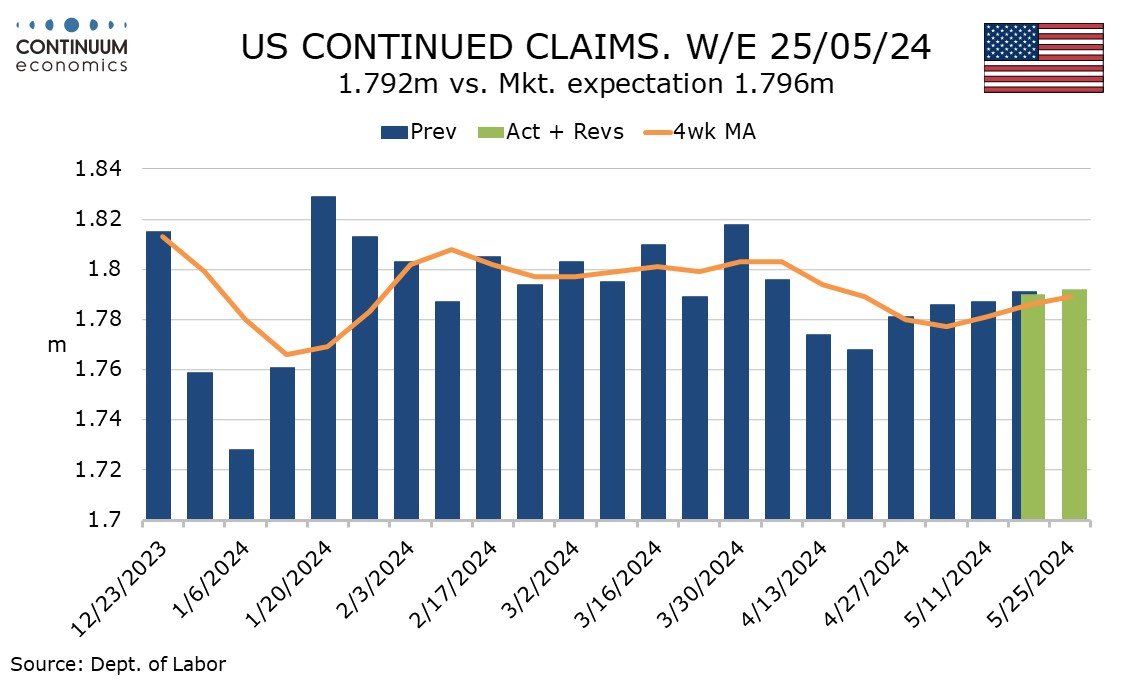

Continued claims, covering the week before initial claims, at 1.792m were however almost unchanged from a preceding 1.79m, and here trend continues to have little direction.

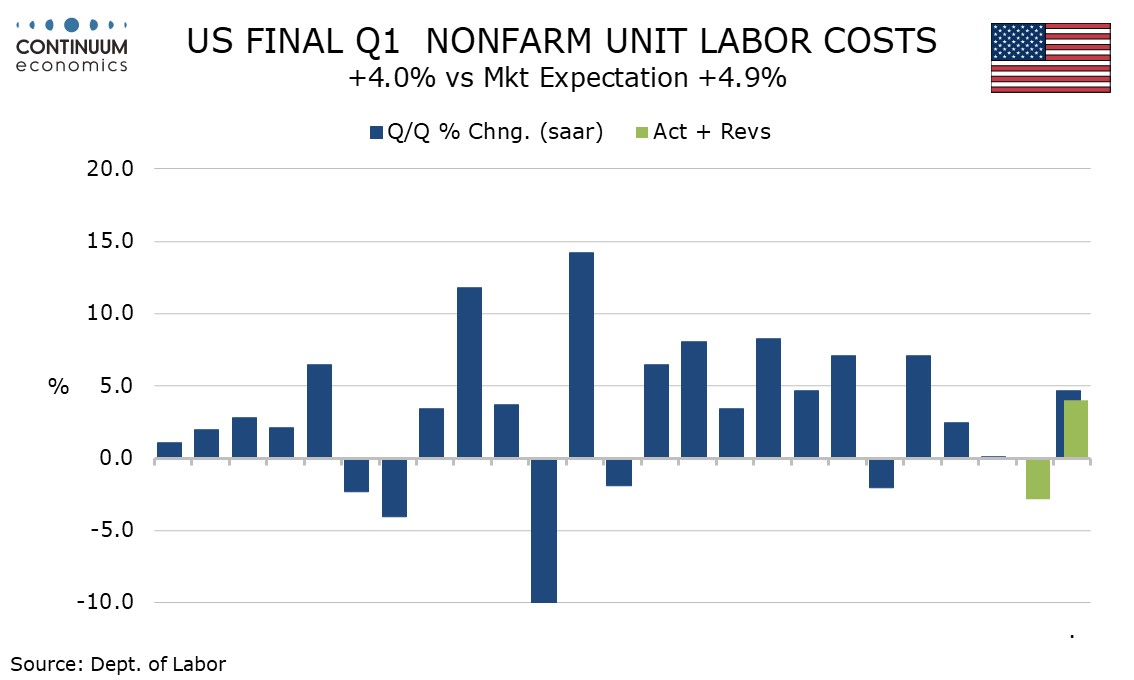

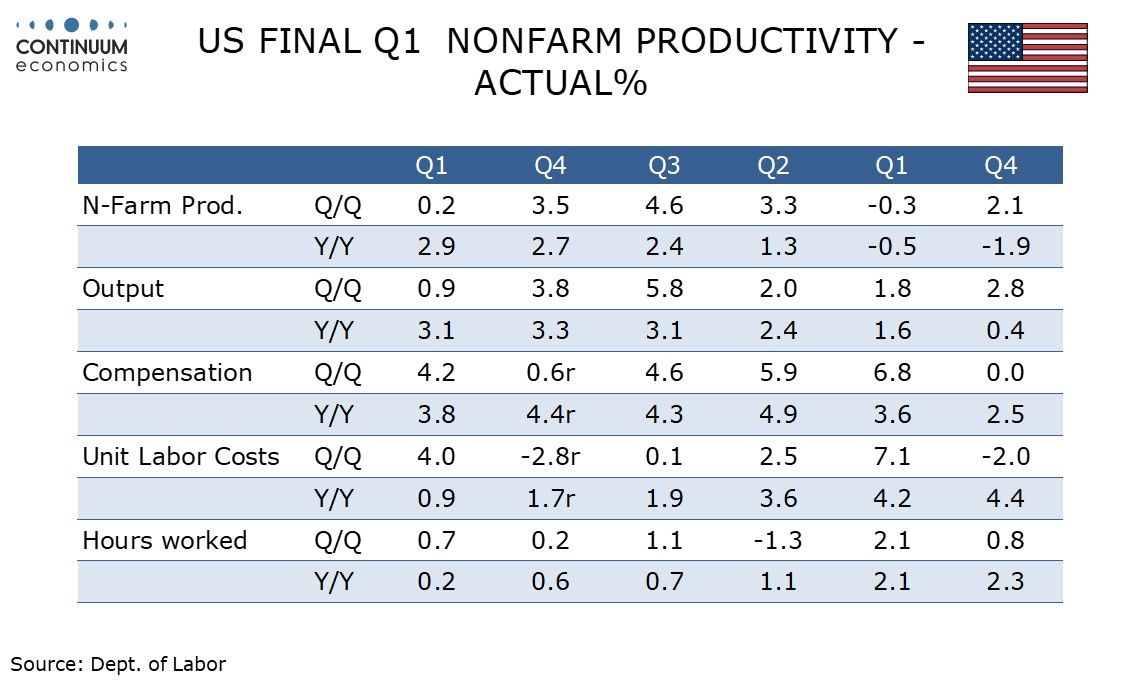

Unit labor costs had been expected to see a modest upward revision due to an expected downward revision to productivity after the downward revision to GDP. However the revision to productivity to 0.2% from 0.3% was marginal with hours worked as well as output being revised down.

With compensation revised down to 4.3% from 5.0% unit labor costs were revised down to 4.0% from 4.7%, with Q4 seeing a bigger downward revision to -2.7% from unchanged.

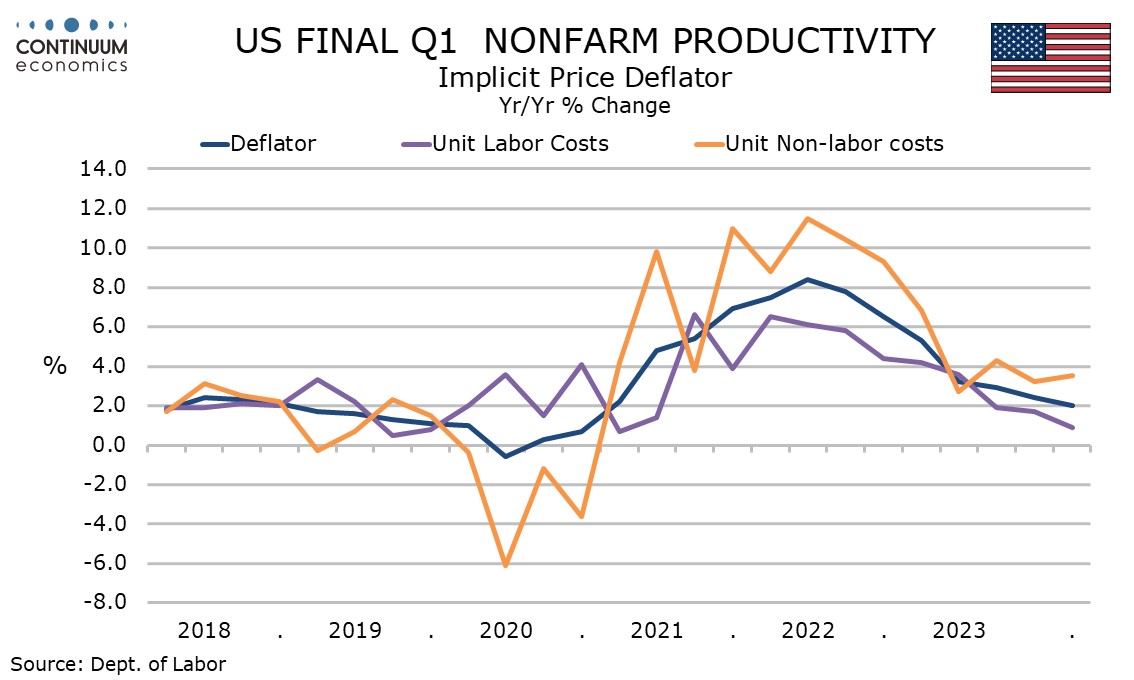

While non-labor payments were revised up to 1.0% from 0.5% in Q1 and to 5.5% from 2.7% in Q4 the Q1 implicit deflator was revised down to 2.6% from 2.8% in Q1 and to 9.9% from 1.2% in Q4. A 1.9% yr/yr data now looks consistent with target inflation.

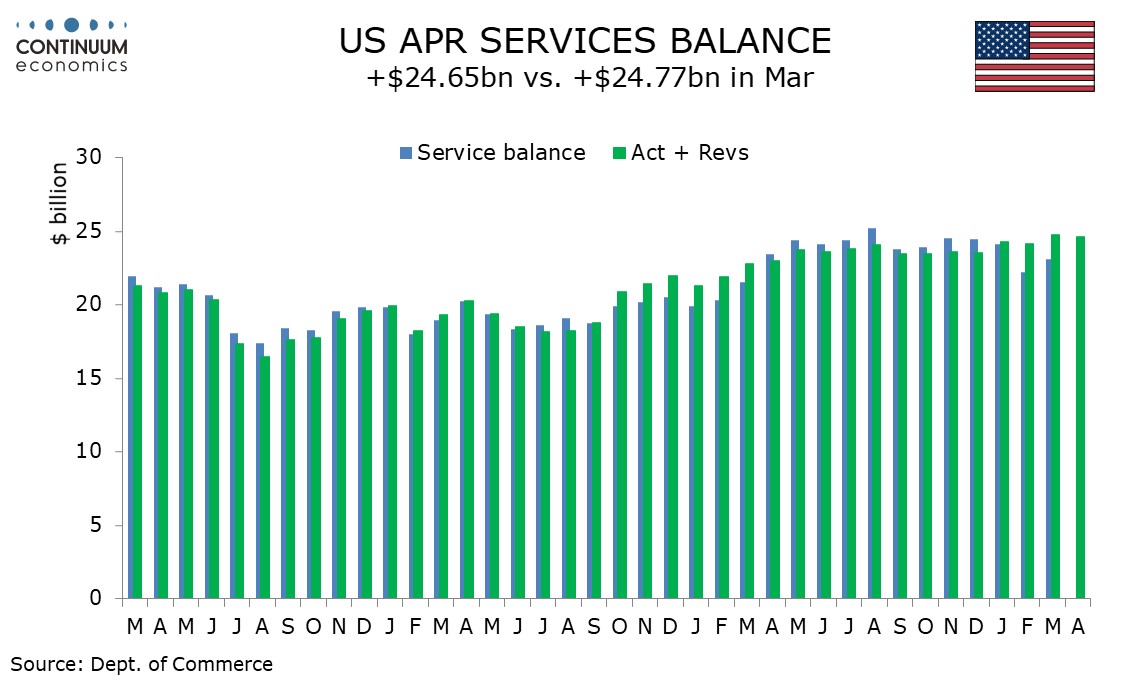

April’s trade balance showed exports up by 0.8% and imports up by 2.4%. Goods data saw exports up by 1.3% and imports up by 3.1%, both stronger than respective gains of 0.9% and 2.7% seen in advance data.

The overall deficit was narrower than expected mainly on upward revisions to recent service surpluses. April’s services surplus was little changed from the upwardly revised March, with exports down by 0.2% and imports down by 0.1%.