Published: 2024-09-23T13:59:52.000Z

U.S. September S&P PMIs - Manufacturing weak, Services not quite as strong

3

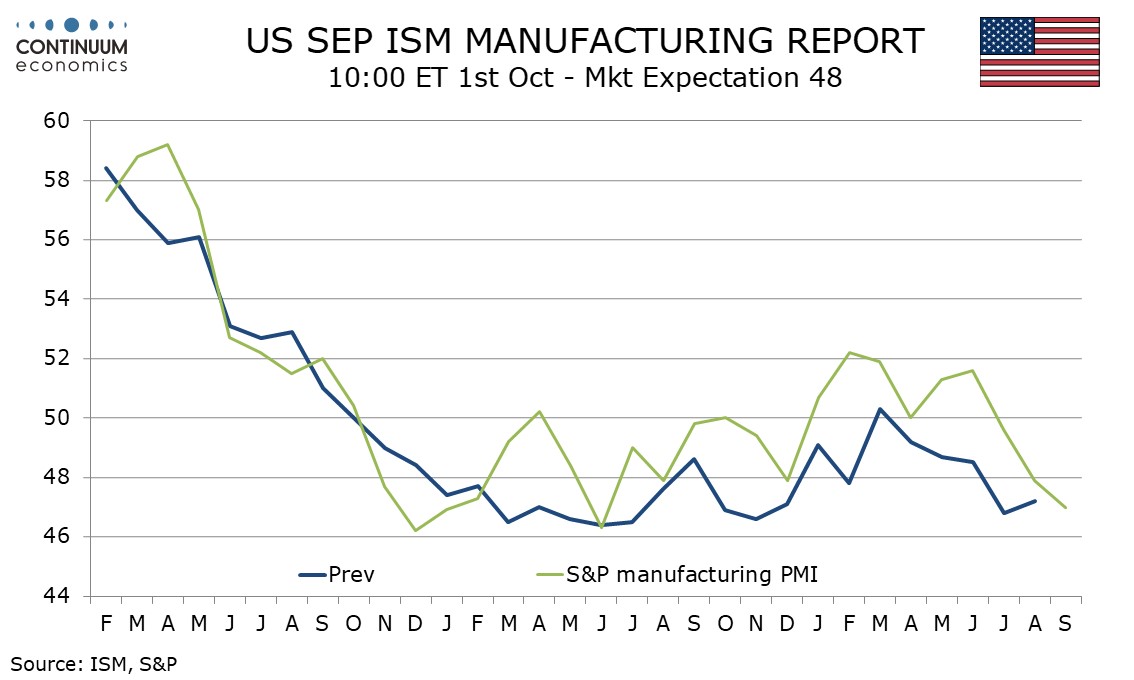

September preliminary S and P PMIs are weaker, with manufacturing at 47.0 from 47.9 the weakest since June 2023 but services still quite strong at 55.4 from 55.7.

The manufacturing index is disappointing after stronger data from August industrial production and the September Empire State and Philly Fed manufacturing surveys. If the ISM manufacturing index avoids a decline it would then be stronger than the S and P survey for the first time since June 2023.

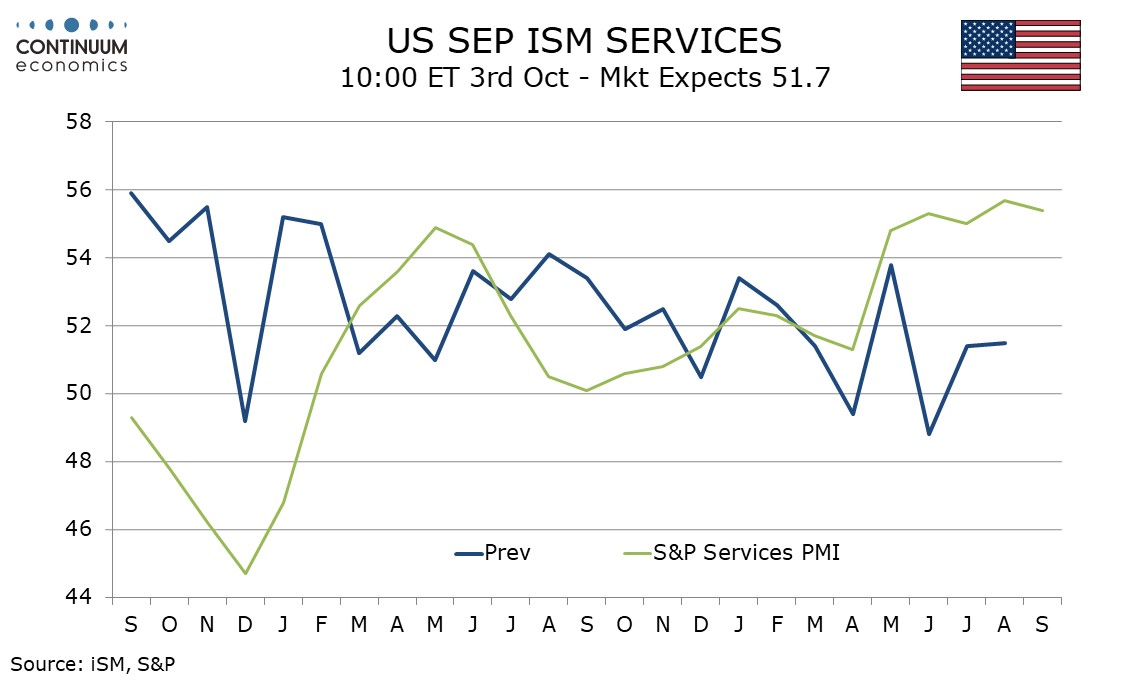

The S and P services index is not well correlated with the ISM counterpart, and has now seen a fifth straight quite firm reading near 55.0 while the ISM services index has a marginally negative trend. The S and P services index appears more sensitive to interest rate expectations than the ISM but the benefits from that may be approaching their limit even as the Fed starts to ease.