USD, JPY flows: USD recovery looks overdone

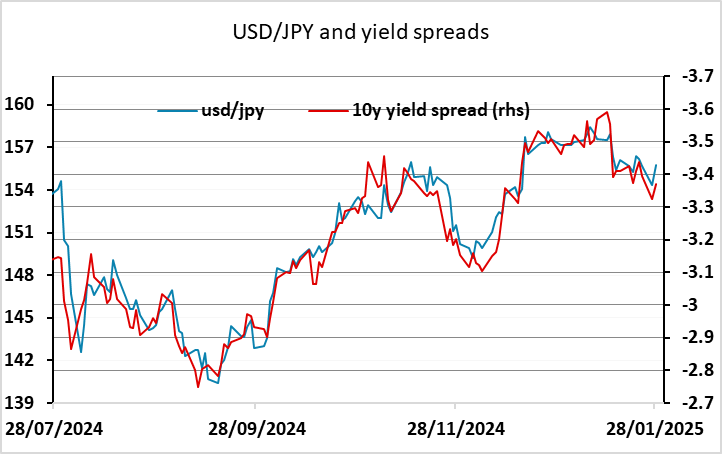

USD/JPY gains look excessive given the modest rise in US yields

The USD has rallied overnight, even though the equity market losses seen on Monday have not reversed. US yields have edged a little higher, but yield spreads have only moved marginally in the USD’s favour, and at current levels the rally in USD/JPY looks excessive relative to the move in yield spreads. Of course, it may be the case that the decline in US yields is fully reversed in the next few days. After all, the impact of the DeepSeek news on US equities need not mean anything significant for Fed policy or US growth, so even if equities remain lower, we may well see US yields return to previous levels. Nevertheless, we would favour the USD/JPY downside from here.

The more equity sensitive currencies may have more difficulty recovering. If we do see US yields go back up, the likelihood is that equities will remain lower or even fall further. US equity valuation remains extreme, and with Trump’s tariff threats also on the horizon, they seem to be pricing the best of all possible worlds at this point. There isn’t much on today’s calendar that is likely to be market moving, so for now we would favour renewed JPY gains both against the USD and on the crosses.