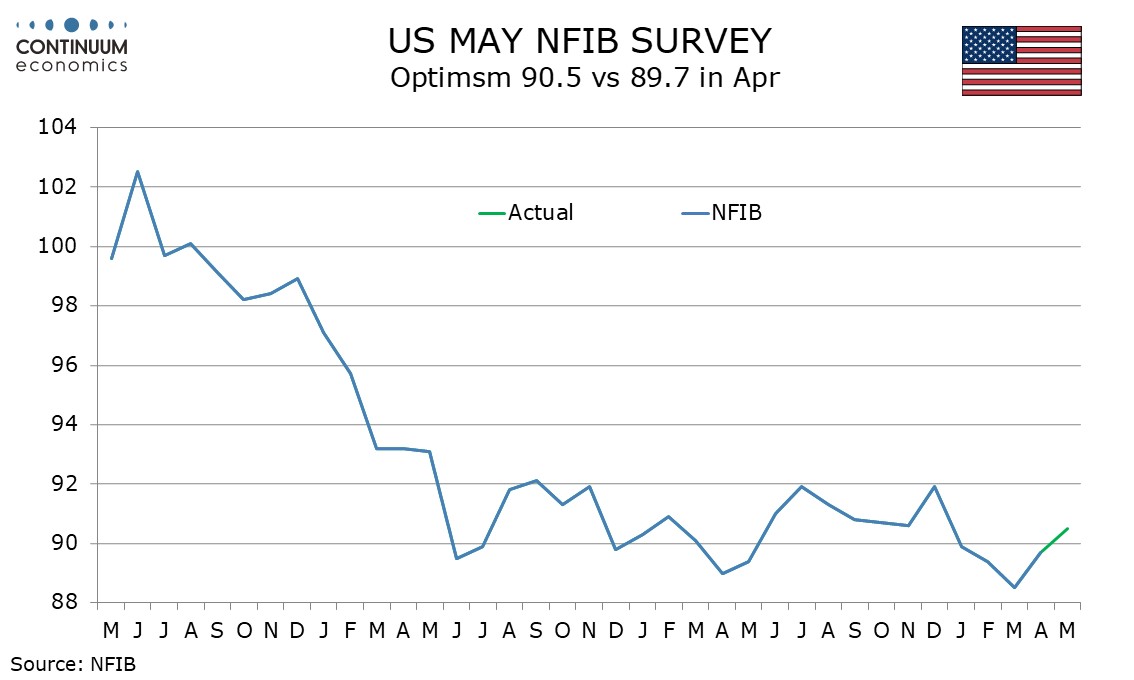

U.S. May NFIB survey - Second straight gain from a weak March

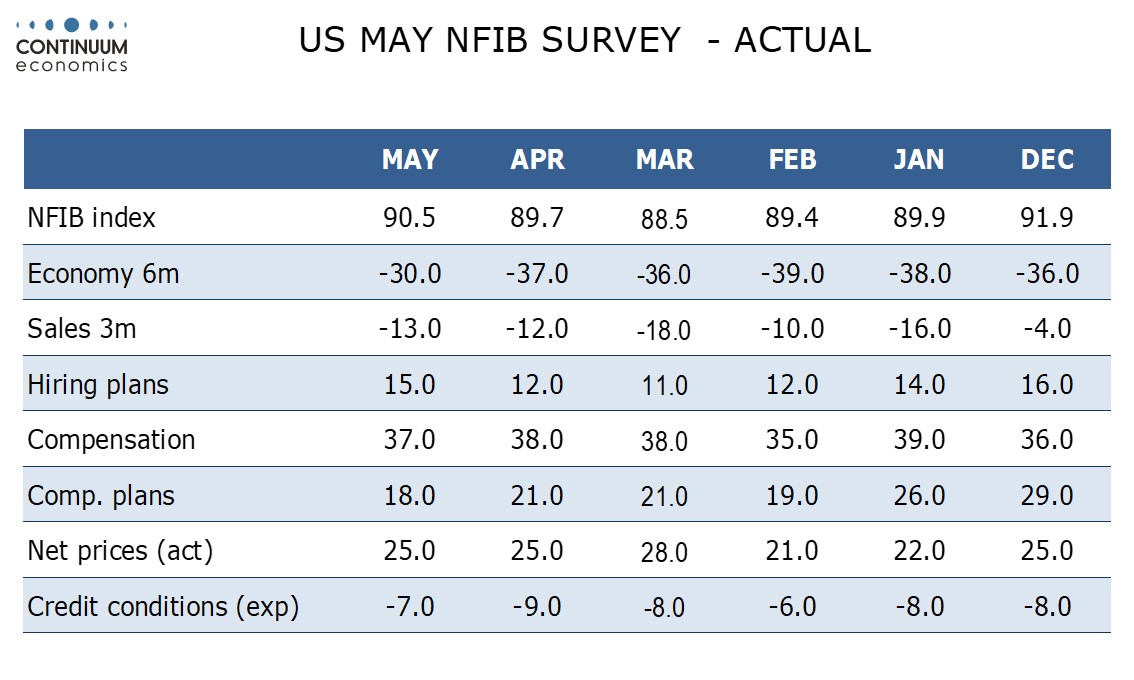

May’s NFIB small business optimism index of 90.5 from 89.7 has seen a second straight rise in a continued correction from March’s 88.5 reading that was the weakest since December 2012.

This is consistent with an economy that has lost some momentum but with limited risk of falling into recession. Hiring plans rose to a 4-month high but compensation plans fell to their lowest since March 2021, a sign that a firm labor market is not necessarily inflationary.

Net prices are unchanged at 25 and appear to have stabilized after slipping through 2023 after peaking in early 2022. They remain above pre-pandemic levels, suggesting that the final part of getting inflation back to the 2% target could prove difficult. Expectations for net prices rose to 28 from 26 but remain well below March’s 33. This series is closer to pre-pandemic levels than the current net prices reading.