RBNZ Review: No Hikes in Sight

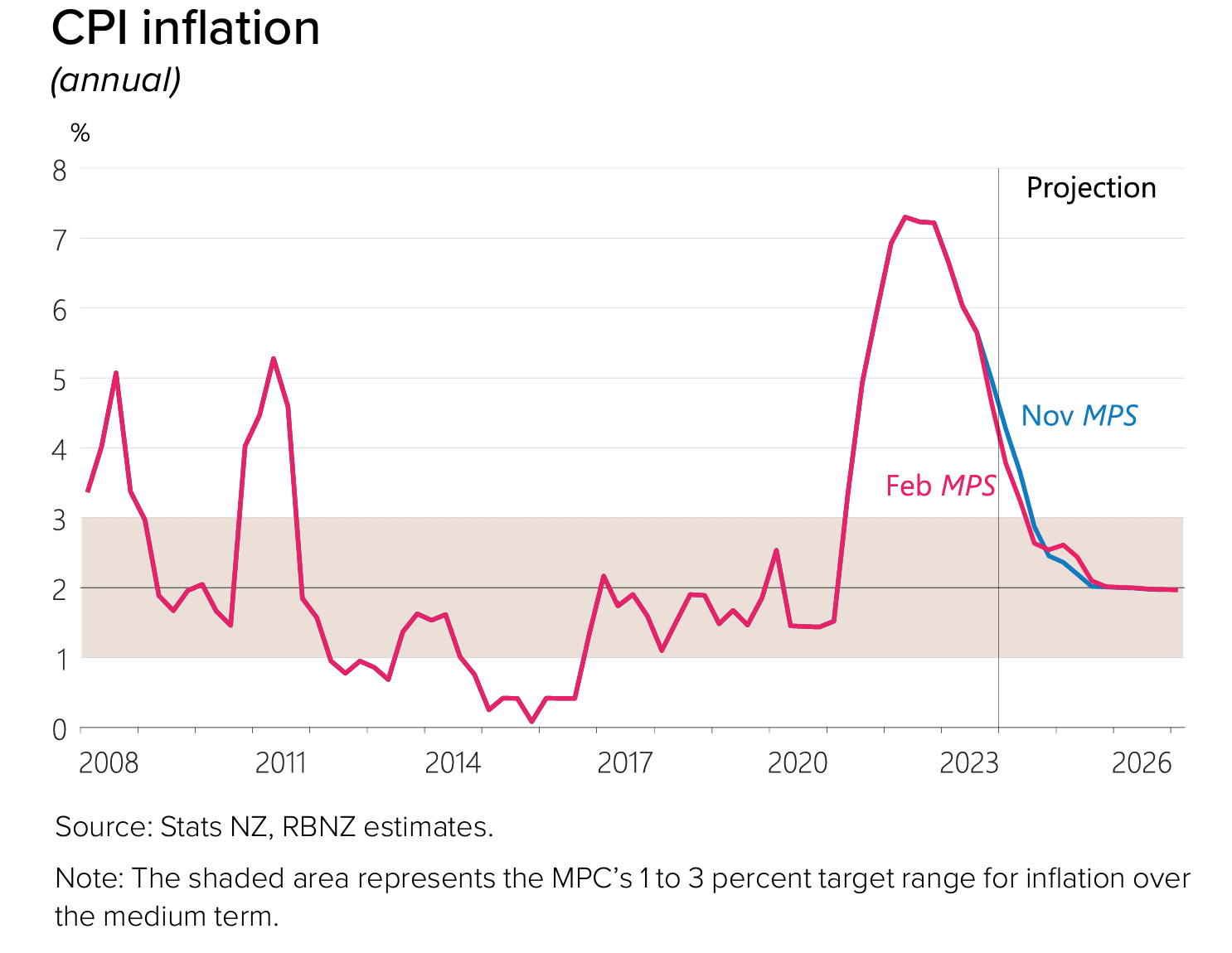

RBNZ kept rate unchanged but revised inflation forecast higher

ANZ and TD proven wrong

RBNZ Kept Rates Unchanged and made mixed revision for inflation and OCR

2024 Inflation forecast are revised higher and OCR forecast revised lower. Some key takeaways:

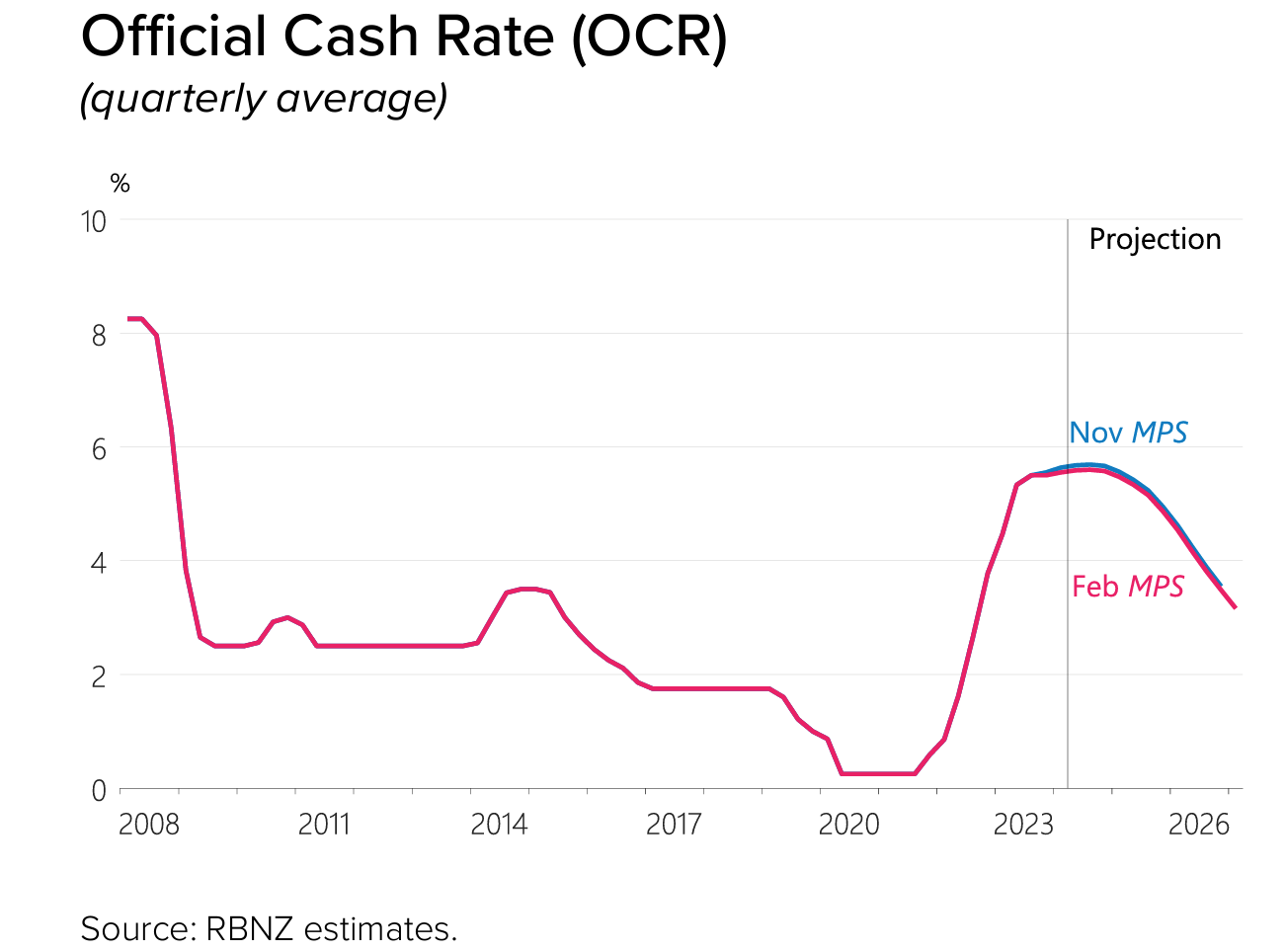

- OCR Forecast Revision: RBNZ now see OCR at 5.59% in June 2024 with prior at 5.67%, at 5.47% in March 2025 with prior at 5.56%. It seems to suggest hawkish speculators are wrong for the coming OCR path from RBNZ as they are signalling no more rate hikes.

- CPI Forecast Revision: They also see annual CPI to be higher throughout 2024 and at 2.6% by March 2025 from prior 2.4%

- Signalling No More Tightening: "The Committee remains confident that the current level of the OCR is restricting demand....The OCR needs to remain at a restrictive level for a sustained period of time to ensure this (ensure headline inflation returns to 1-3 percent)occurs." The forward guidance from RBNZ suggested that they are comfortable the current OCR will bring headline inflation back to target range, which kills hawkish speculation. Yet, they also reinforce the need for OCR to remain at current level for a longer period of time, signalling rate cuts will not arrive as soon as their American counterpart.

The key to the February meeting from the RBNZ is that while they recognize inflation will be higher than forecast in 2024, there will be no more rate hike as the RBNZ is confident current restrictive rates is sufficient in bring inflation back to target range. To the contrary, the RBNZ has revised the OCR forecast marginally lower from the November forecast, which is essentially a reversal of previous upward revision. Neither revision ig enough to call for a rate hike or cut. The RBNZ forecast inflation to be higher in 2024 with no change to forecast in 2025. They highlighted population growth to support spending,global economic growth to be below trend and weak Chinese economic outlook, all catching the eye of the RBNZ in assess future inflation dynamic.

We believe there will unlikely be more upward revision in the coming meeting as the RBNZ has made it clear the higher 2024 headline inflation will not see a change in OCR.