Published: 2024-07-02T12:22:04.000Z

Preview: Due July 3 - U.S. June ISM Services - A correction lower

1

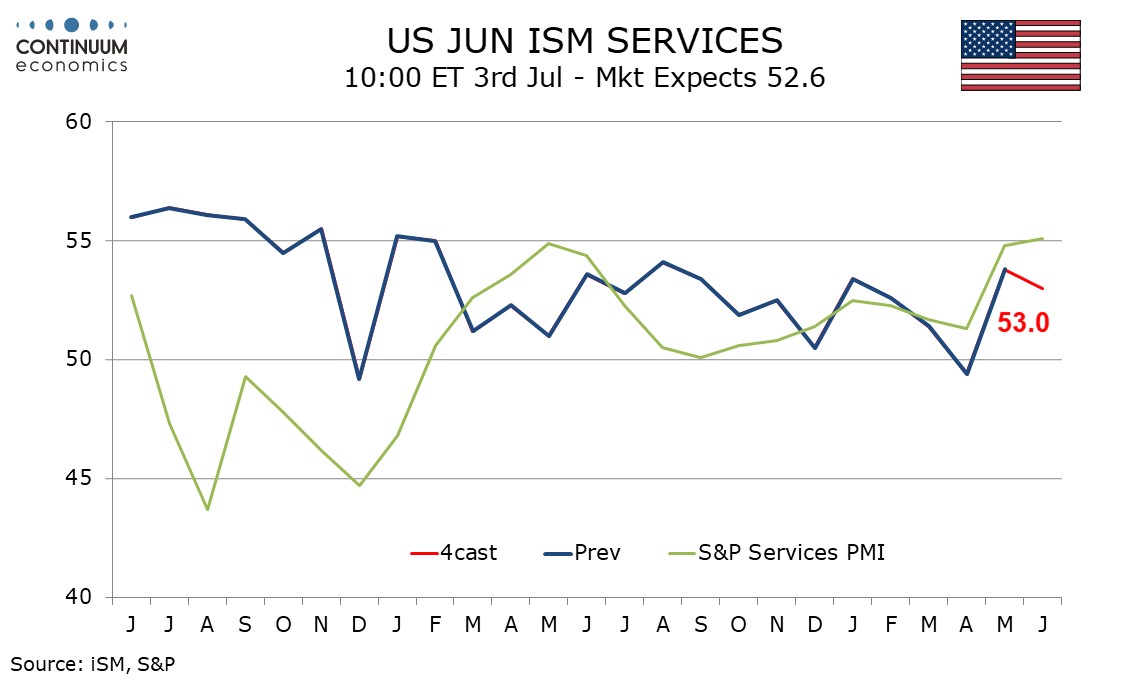

We expect June’s ISM services index to correct lower to 53.0 after rising to 53.8 in May, which was the highest reading since August 2023.

While the historical correlation between the ISM services index and the S and P services PMI is not good the relationship has been stronger recently, and June’s S and P services PMI unexpectedly extended a strong May increase. Regional Fed service surveys however are mixed, and on balance still fairly neutral.

We expect the ISM services breakdown to show corrections lower from strong May bounces above trend in business activity and deliveries, though further moderate gains in new orders and employment, completing the breakdown of the composite. Prices paid do not contribute to the composite. Here we expect little change, with a June index of 58.0 from 58.1 in May, leaving trend with little direction.