U.S. Initial Claims and GDP improve, Durables and Trade deteriorate, on balance weaker

The latest round of US data is mixed but on balance we would see it as on the weak side of expectations, despite a fall in initial claims and upward revisions to Q1 GDP and core PCE price indices. Weakness is visible in advance goods trade and core durable goods orders for May.

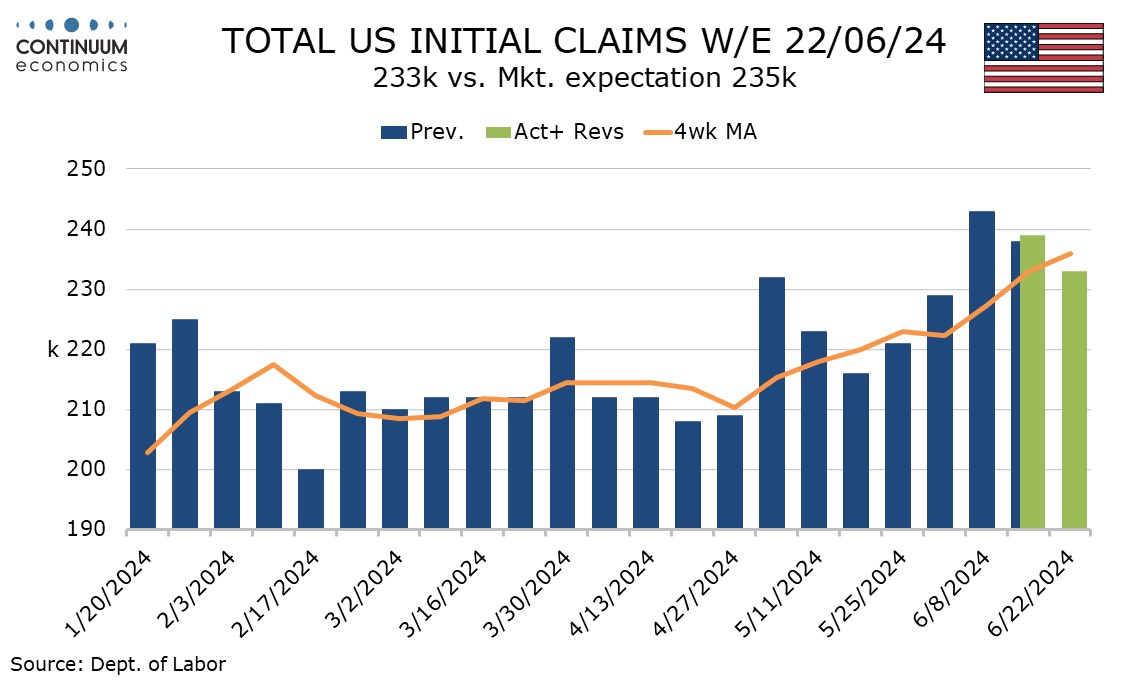

Initial claims with a 6k decline to 233k extended last week’s 4k decline though have still not fully erased the 14k spike seen two weeks ago. The 4-week average of 236k is the highest since September 2023.

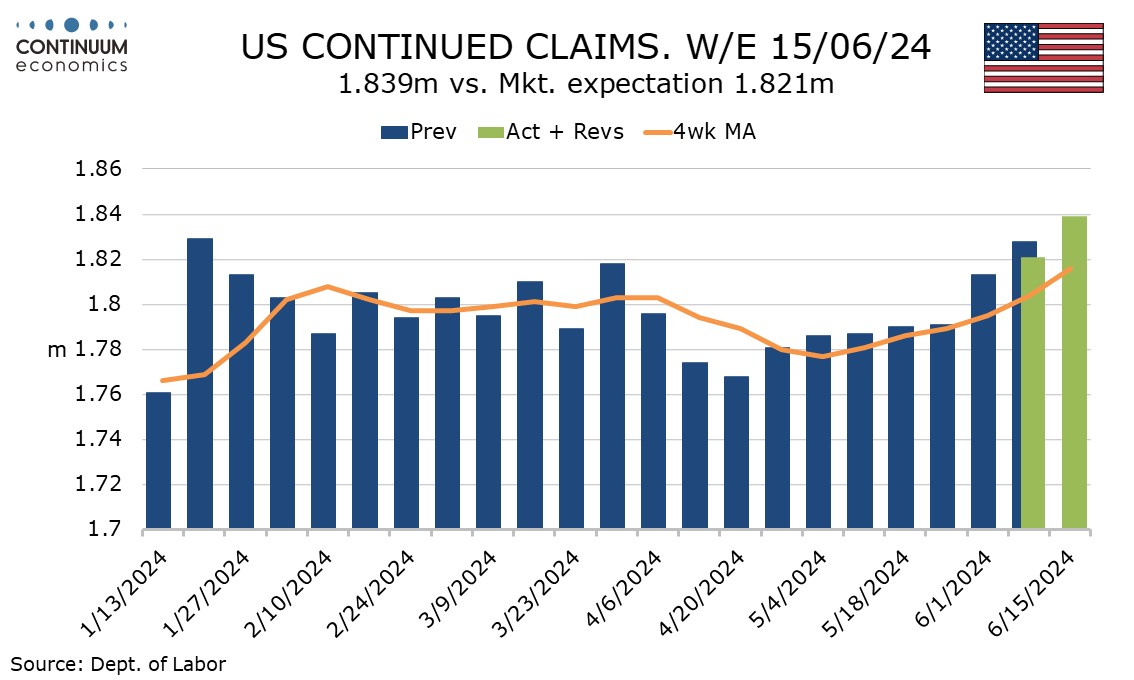

Continued claims, covering the week before initial claims and also the survey week for June’s non-farm payroll rose by 18k to 1.839m, an eighth straight increase and putting the 4-week average at its highest since December 2021.

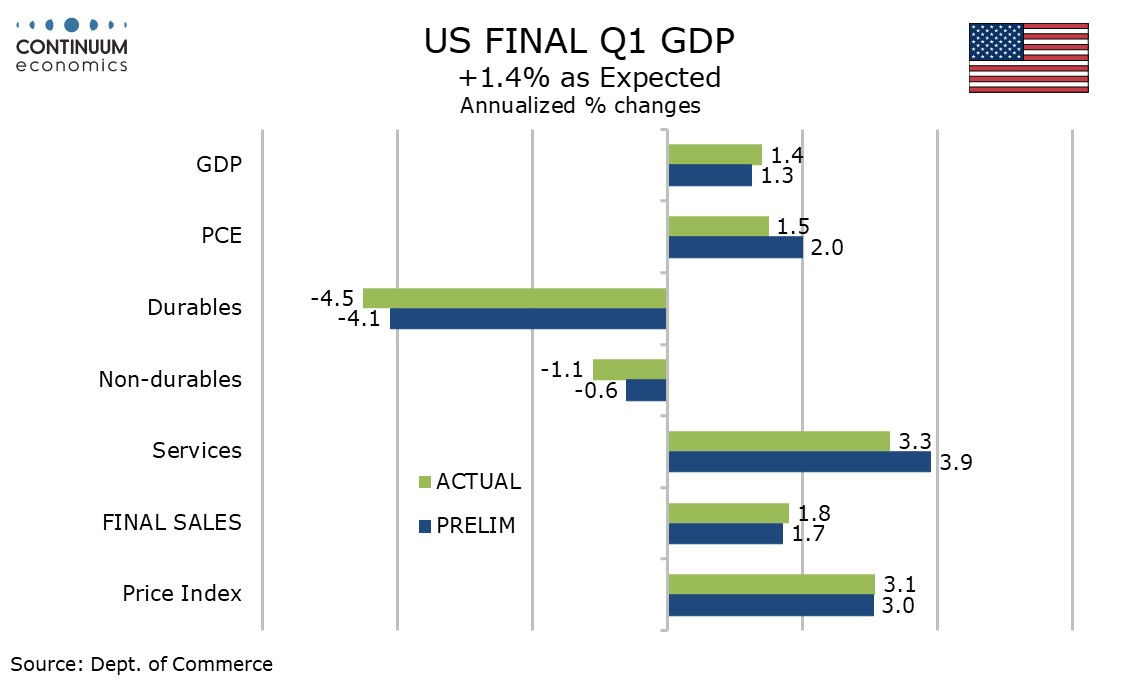

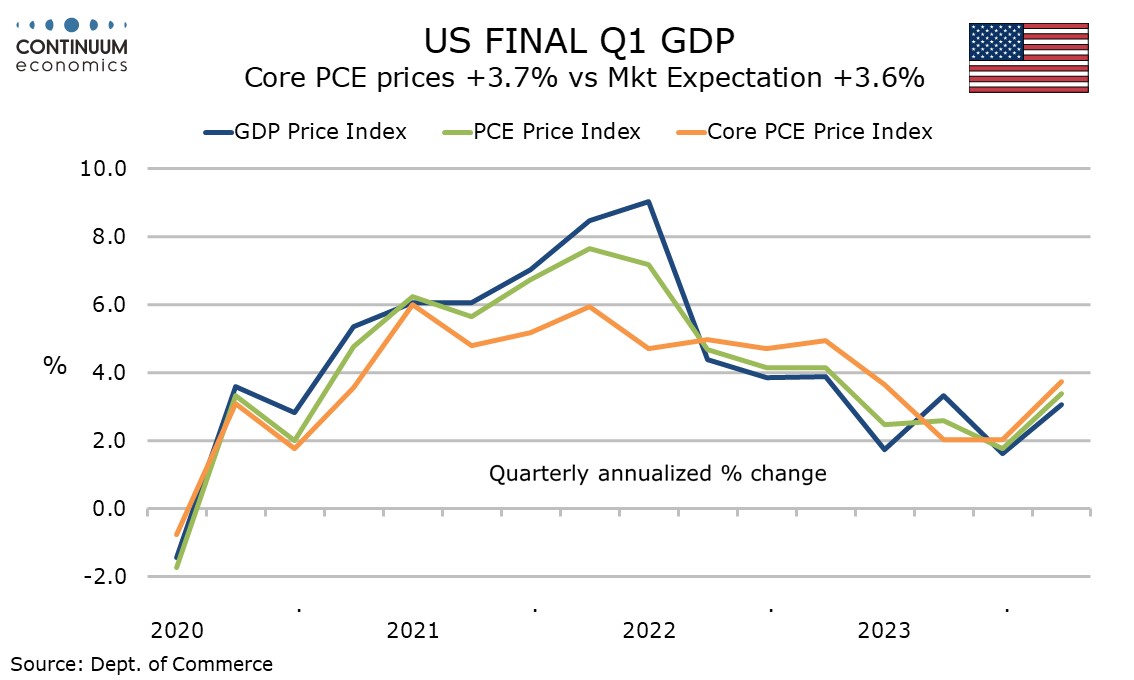

The upward revision to Q1 GDP to 1.4% from 1.3% was as expected but the upward revision to core PCE prices to 3.7% from 3.6% was disappointing.

There were a few surprises in the breakdown, with consumer spending revised significantly lower to 1.5% from 2.0% with goods as suggested by retail sales revisions revised to -2.3% from -1.9% and less expectedly services revised to 3.3% from 3.9%.

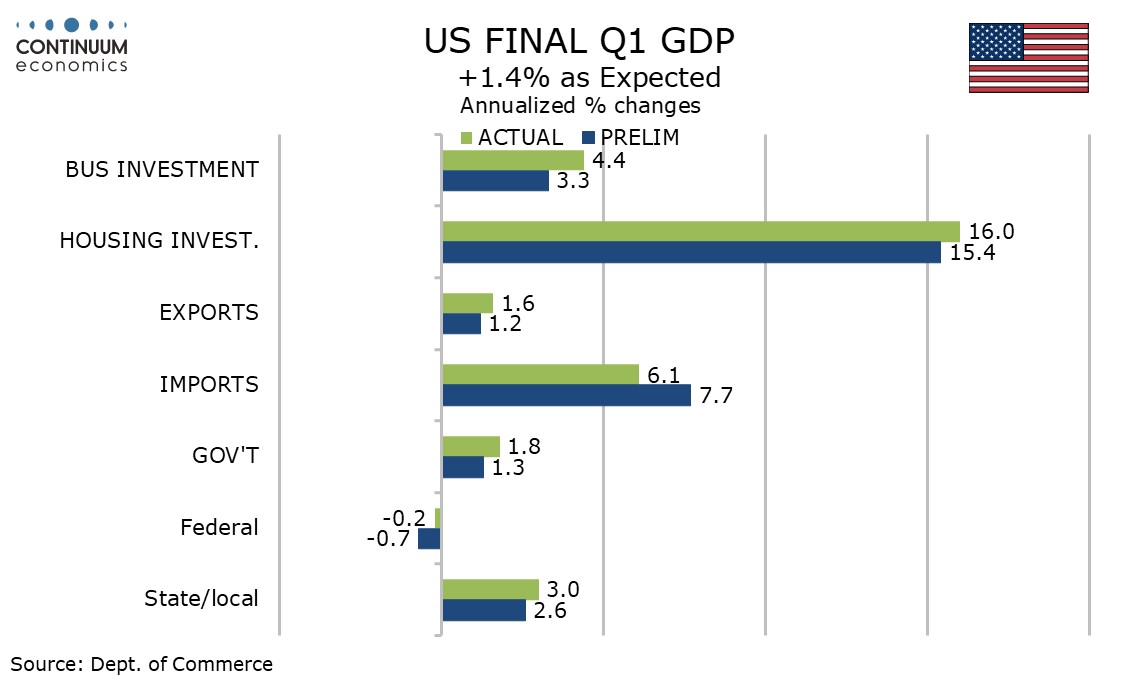

There were upward revisions elsewhere to business and housing investment, government and net exports, the latter with exports revised higher and imports revised lower, both revisions led by services as suggested by recent trade revisions.

Inventories saw a marginal upward revision but final sales (GDP less inventories) were revised marginally higher to 1.8% from 1.7% in line with the GDP revision but final sales to domestic purchasers (GDP less inventories and net exports) were revised lower to 2.4% from 2.5%.

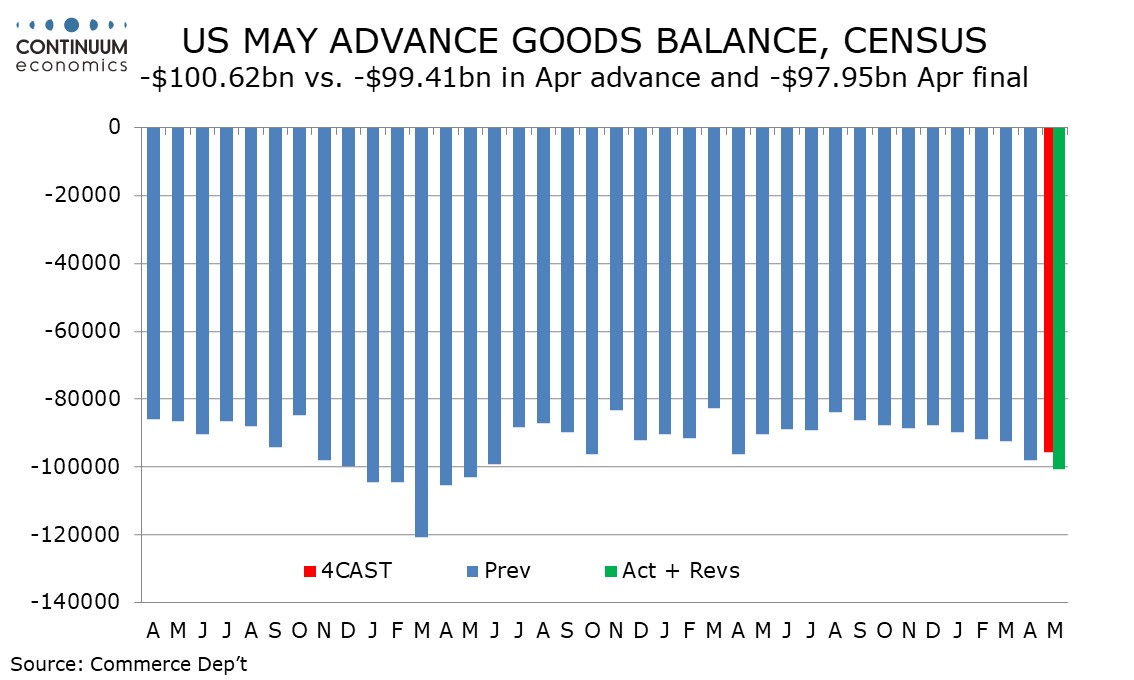

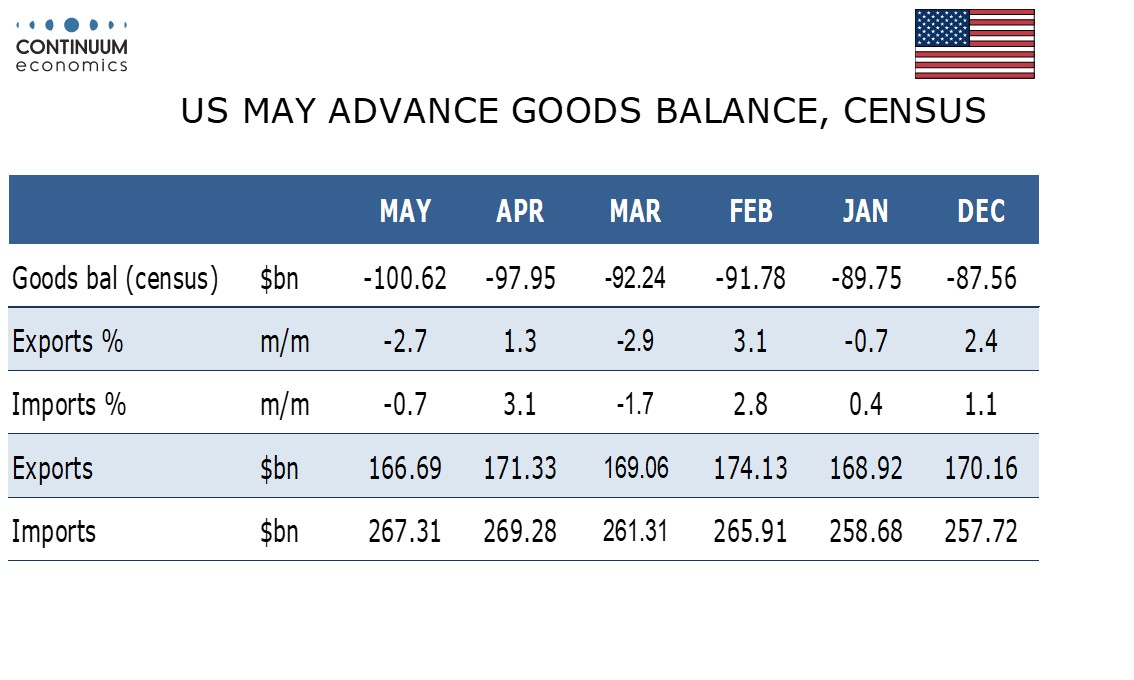

Even with the upward revision net exports remain negative in Q1 and look set to be more negative in Q2 with the advance goods trade deficit increasing to $100.6bn from $98.0bn, extending an April deterioration. Exports fell by 2.7% after a 1.3% April increase while imports fell by 0.7% after a 3.1% April increase.

Partly offsetting the negative trade implications for Q2 GDP were gains in advance May inventory data of 0.6% in wholesale and 0.7% in retail. Advance May durable goods inventories were also above trend with a rise of 0.3%.

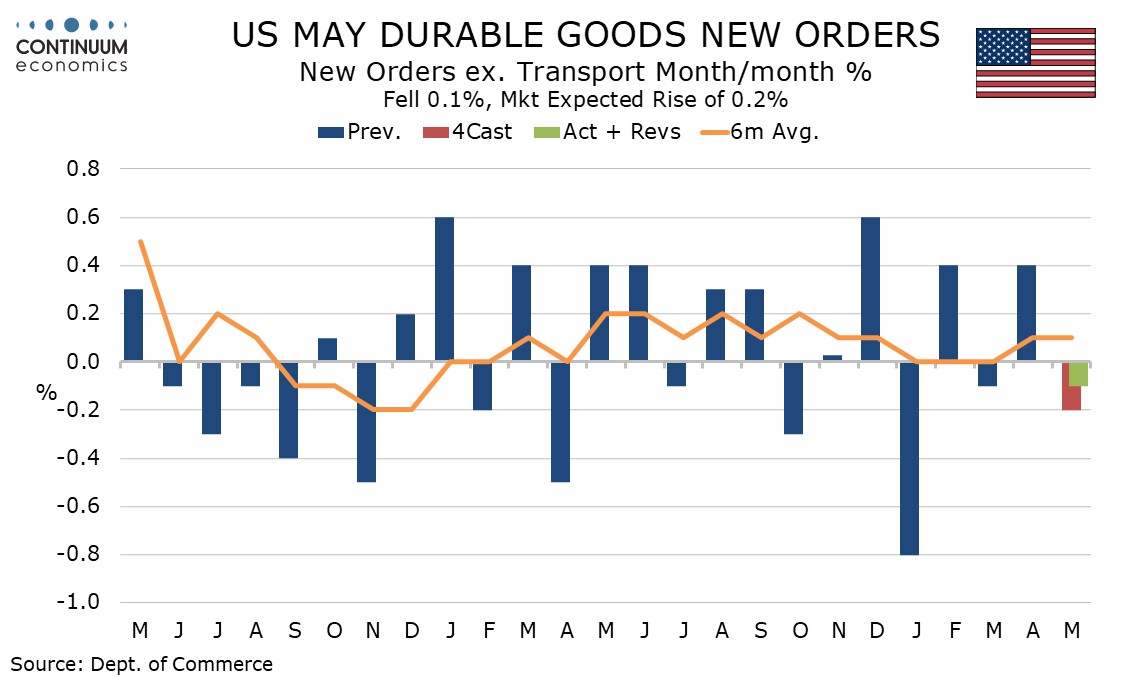

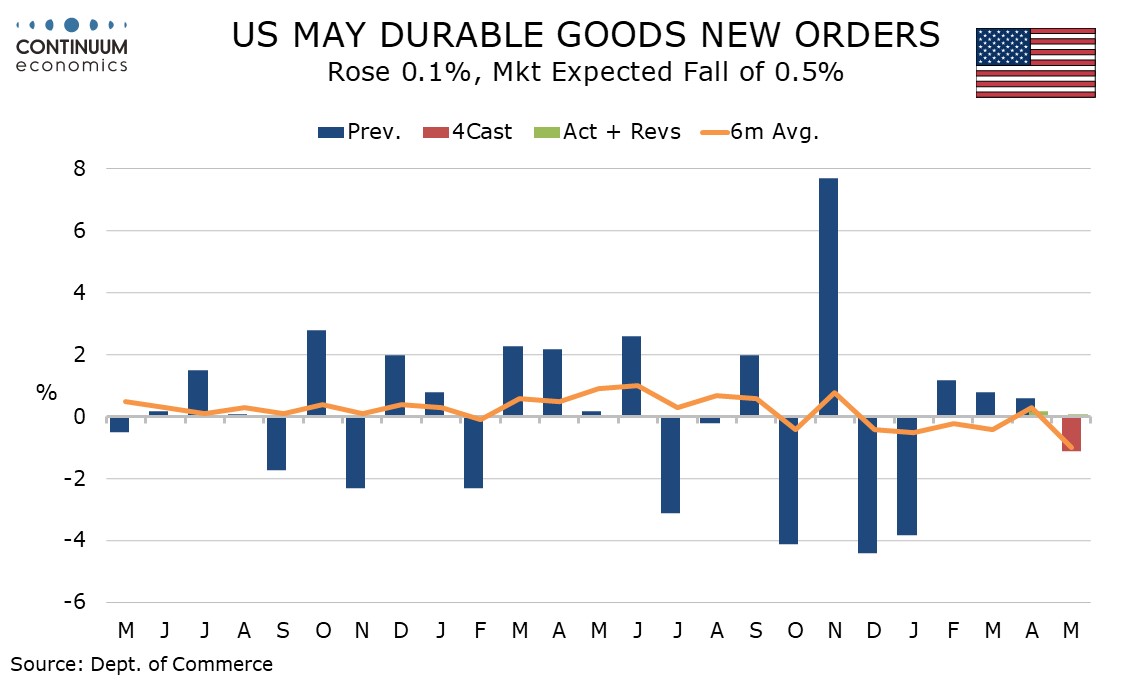

Durable goods orders remain subdued on an underlying basis, with a 0.1% decline ex transport. Non-defense capital ex aircraft, a key signal for business investment, showed more significant weakness, falling by 0.6% for orders and 0.5% for shipments.

Overall durable goods orders did exceed expectations with a 0.1% increase. Civil aircraft did see a modest decline as expected but there were gains in autos and defense aircraft. Orders fell by 0.2% ex defense.