FX Daily Strategy: N America, December 21st

Quiet Calendar Highlighted by U.S. Data

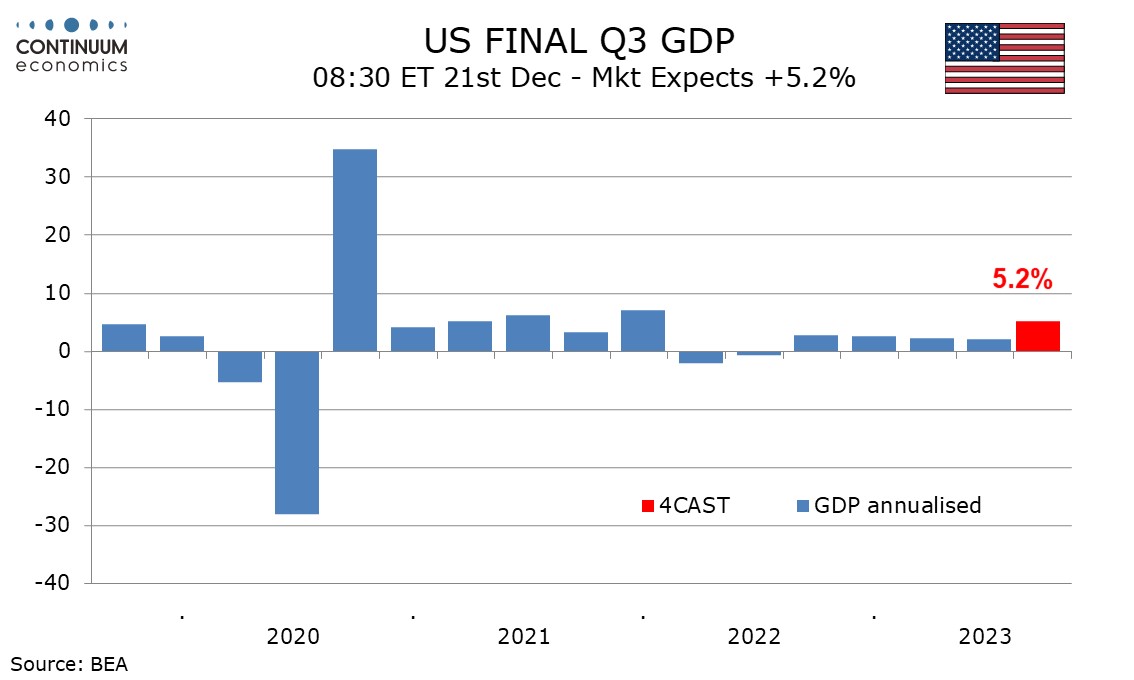

U.S. Q3 GDP Staying strong, though Q4 seen slower

DXY Consolidating Post FOMC Losses

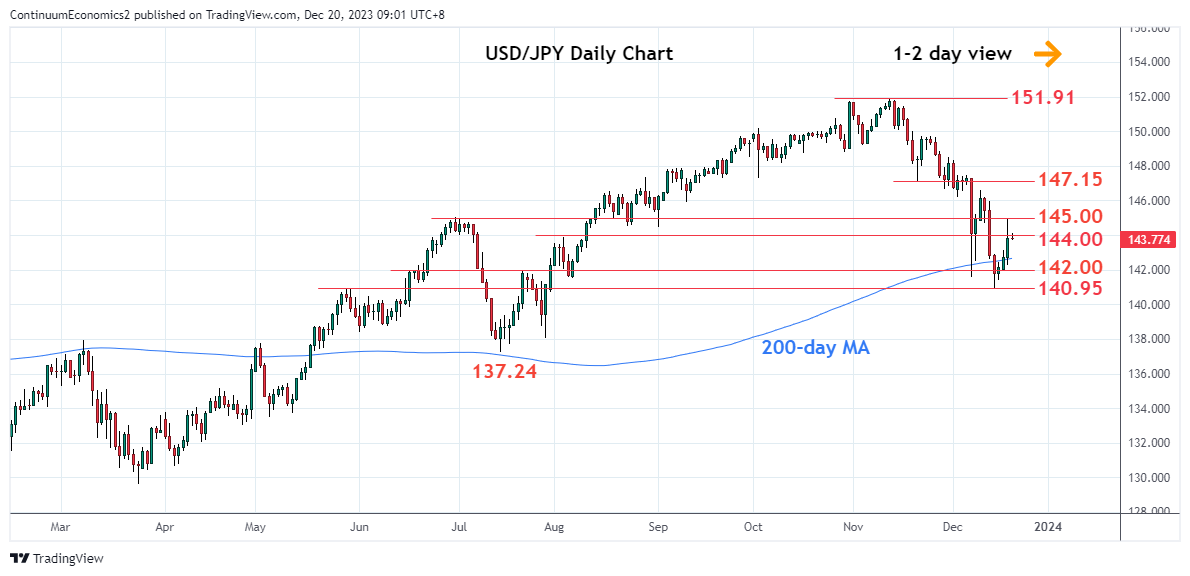

USD/JPY Still Poised For More Downside

Quiet Calendar Highlighted by U.S. Data

U.S. Q3 GDP Staying strong, though Q4 seen slower

DXY Consolidating Post FOMC Losses

USD/JPY Still Poised For More Downside

Thursday would a quiet calendar day when market moving economics data only coming out in New York session. Leading the NA calendar will be U.S. Q3 GDP and jobless claims. The last Initial claims on 9th December cam in at 202k from 221k, are the lowest since October 14 and an upturn in the 4-week average seen into early November appears to be peaking. While Continued claims, which cover the week before initial claims, rose by 20k to 1.876m, a modest rise rising after a 69k decline in the preceding week. The last four weeks have seen continued claims alternate direction, that following eight straight increases. The 4-week average is still rising, but the pace is slowing. And we are not seeing a major shift in momentum for this week.

We expect the third (final) estimate for Q3 GDP to be unrevised from the strong second (preliminary) estimate of 5.2%. Momentum is likely to slow in Q4 though consumers remain resilient. We expect an upward revision to construction, led by private non-residential, but with contributions also coming from housing and government, to be largely offset by a downward revision to inventories. Final sales (GDP less inventories) is likely to be revised up to 3.9% from 3.7%. There will also be a marginal downward revision to non-durable consumer spending. We do not expect any revisions to the price indices, from 3.6% for GDP, 2.8% for overall PCE and 2.3% for core PCE.

The USD has slumped against major peers since the FOMC suggest rates may not be higher for longer. U.S. Treasury Yields have also come down significantly with 10yr yields breaking 4% and 2yr yield reaching 4.3%. Global equity spaces cheered the outcome and see the interest for the haven USD falls. This time, the dollar is not benefiting from the "high yield smile" and could see a further leg lower.

On the chart, the consolidation around 102.50 is giving way to a pullback, as overbought intraday studies unwind, with immediate focus turning to congestion support at 102.00. Daily studies are mixed, suggesting any initial tests could give way to fresh range trade, before deteriorating weekly charts prompt a break. A close below 102.00 will turn sentiment negative and open up strong support at the 101.40 Fibonacci retracement, where oversold weekly stochastics could prompt fresh consolidation. Meanwhile, resistance is up to congestion around 103.00 and should cap any immediate tests higher.

After the BoJ's inaction in the December meeting, USD/JPY has a knee-jerk reaction to be sharply higher because the details suggested they are kicking the can down the road to wait for the spring wage negotiation. While the BoJ's idea of waiting for wage growth data for support is logical, it seems to be sending a signal to the market the BoJ is in no rush to exit even when inflation remains stubborn and forecasted to be far above 2% in 2024. However, in the medium run, JPY has more room to roam given its extreme weakness against the USD and potential yield narrowing.

On the chart, the pair is extending gains from the 140.95 low as prices unwind the oversold daily studies to reach towards the 145.00 level. Further gains not ruled out and higher will see scope to the strong resistance at the 146.00/22 congestion and 147.15 previous low. However, gains are seen corrective of losses from the November high and expected to give way to selling pressure later. Meanwhile, support is raised to 143.15 and should now underpin pullback. Break here will return focus to the downside and open up the 142.00 congestion and 140.95 low to retest and see scope to further retrace the January/November rally.