GBP flows: GBP stays soft after retail sales

GBP stayn on the back foot after mildly softer retail sales with the MPC vote and statement suggesting downside risks

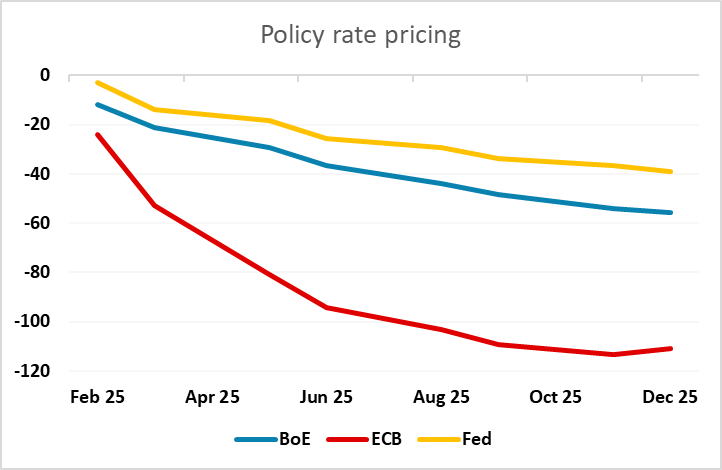

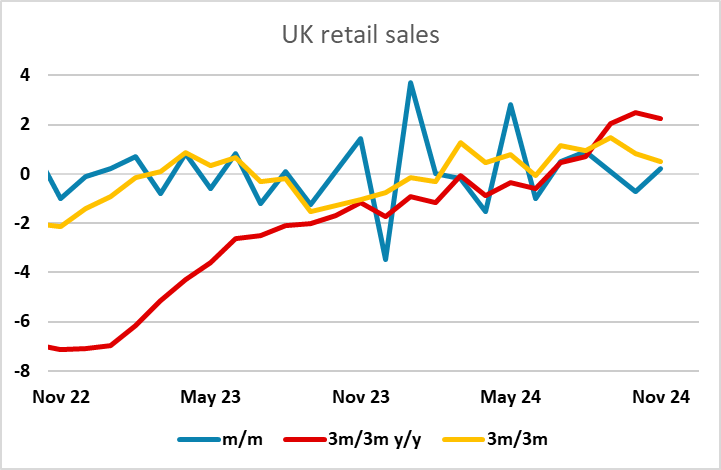

UK retail sales have come in slightly below expectations. GBP has softened slightly, and remains under pressure following the losses after yesterday’s BoE MPC meeting. The meeting undermined the pound both because of the 6-3 vote, which included one more vote for easing than expected, and because the statement downgraded growth expectations, in part due to the Budget measures. The reluctance to ease reflected concerns about the impact of the Budget rise in the minimum wage and National Insurance contributions on inflation, rather than any positive feelings about the economy, and suggests that we could see substantial decline sin rates next year. Thus far,, UK yields have only fallen modestly, but there is a strong case to suggest that BoE policy will look more similar to ECB policy than the Fed-like policy path that is currently priced in, and that would suggest a substantially lower pound.