CAD flows: 1.40 broken for the first time since the pandemic

USD/CAD moves abve 1.40 for the first tme since the pandemic and there is scope for further gains

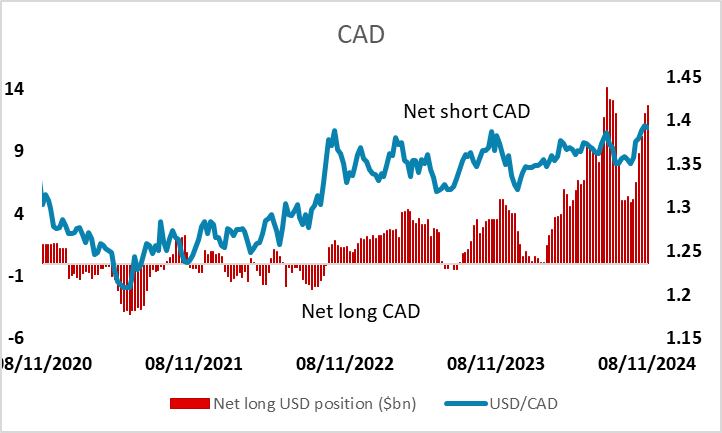

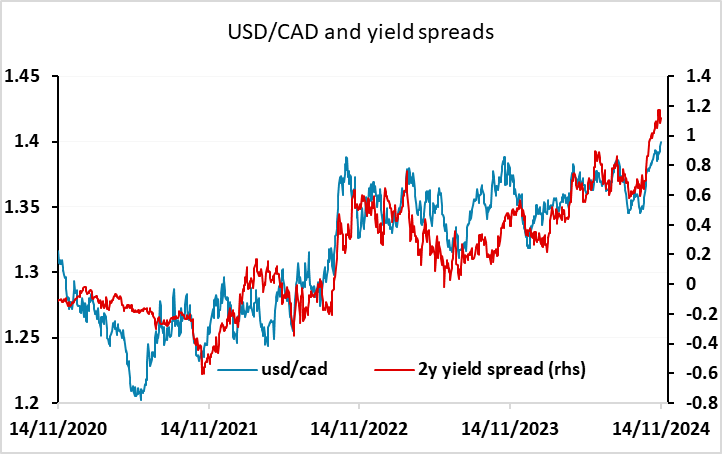

USD/CAD traded above 1.40 overnight for the first time since the pandemic. The move is well supported by the rising yield spread in favour of the USD, but the CFTC data shows the speculative market is significantly short CAD, which could slow down CAD losses. USD/CAD hit a high of 1.4667 in the pandemic and 1.4689 in January 2016 but both of these moves were very short-lived spikes. This time around the move is better supported by yield spread moves, and may therefore last longer, especially if we see the budgetary expansion in the US that Trump has indicated he is seeking. Of course, longer term this budgetary expansion may also be the thing that kills ISD gains if higher US yields undermine US growth, but this is a longer term concern. For now, it’s hard to oppose USD strength in general and specifically against the CAD.