Preview: Due June 5 - U.S. May ISM Services - Back above neutral

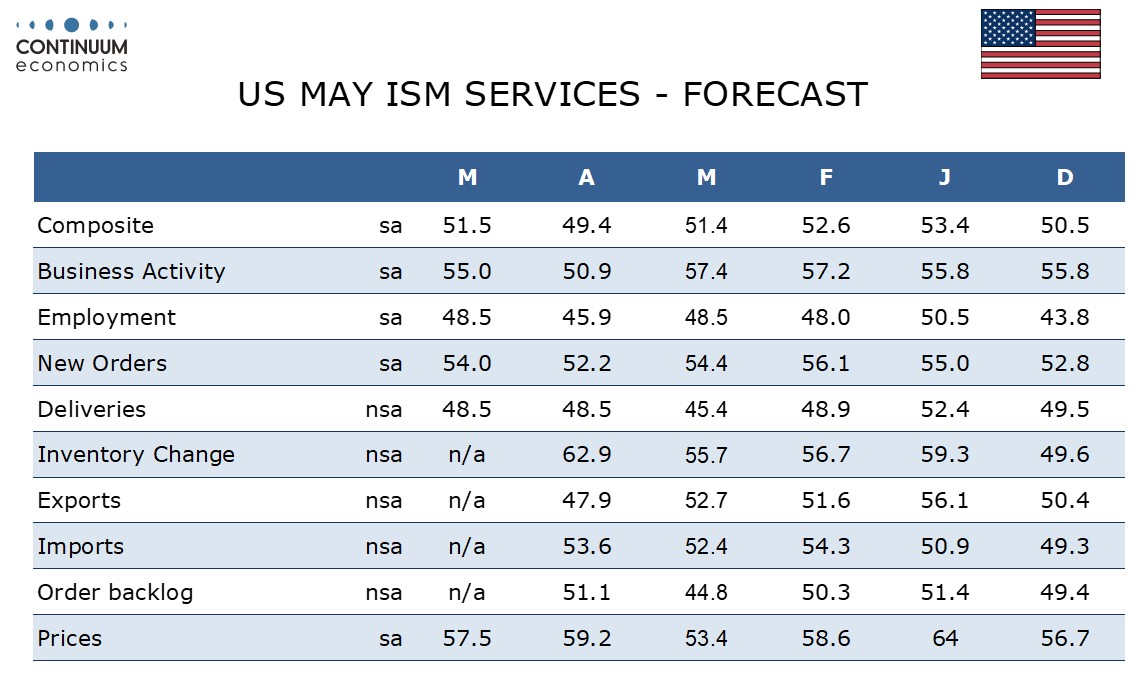

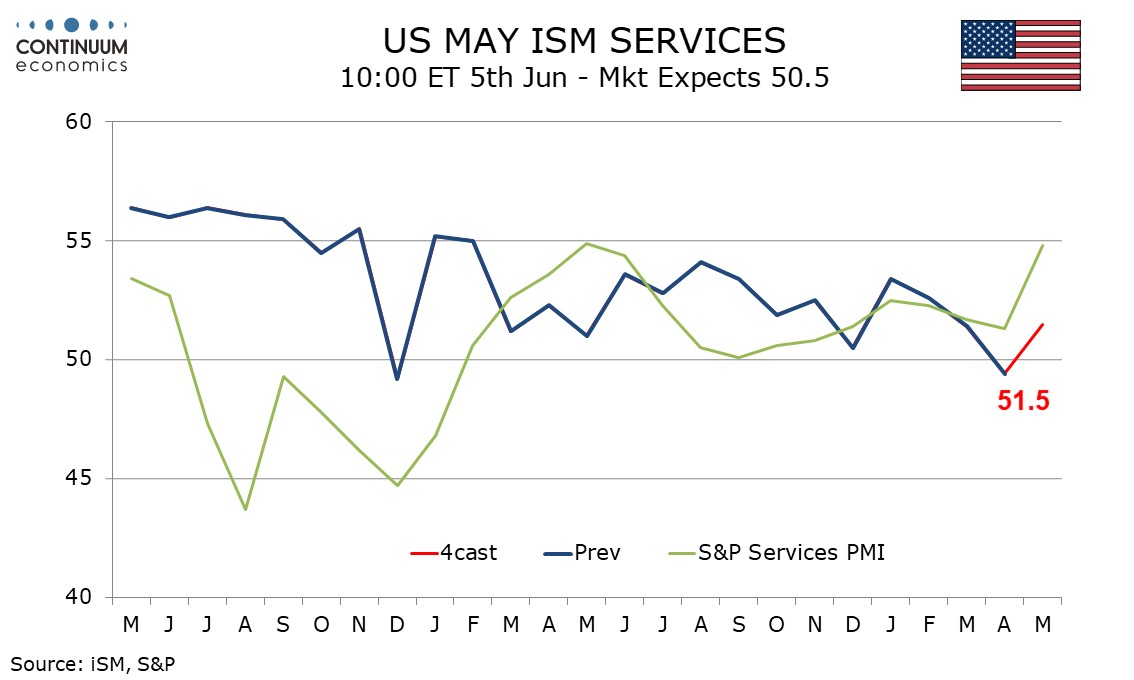

We expect May’s ISM services index to recover to 51.5, after a fall below neutral to 49.4 in April saw the weakest reading since December 2022. May’s index would be back near March’s level of 51.4.

The S and P services index saw a surprisingly sharp bounce in May after four straight declines to reach its highest level in twelve months at 54.8. The S and P index is not a reliable guide to the ISM’s however and most regional Fed service surveys, while on balance improved, are still quite subdued.

We expect improvement in three if the four components that make up the composite, with the sharpest in business activity which slipped particularly sharply in April, though new orders and employment should also recover from weaker April readings. We expect deliveries to be stable, sustaining an April bounce. Prices paid do not contribute to the composite. Here we expect a modest correction lower to 57.5 after April at 59.2 saw a significant bounce from a weak March reading of 53.4.