Published: 2024-02-22T17:49:36.000Z

Preview: Due March 1 - U.S. February ISM Manufacturing - Improving to neutral

-

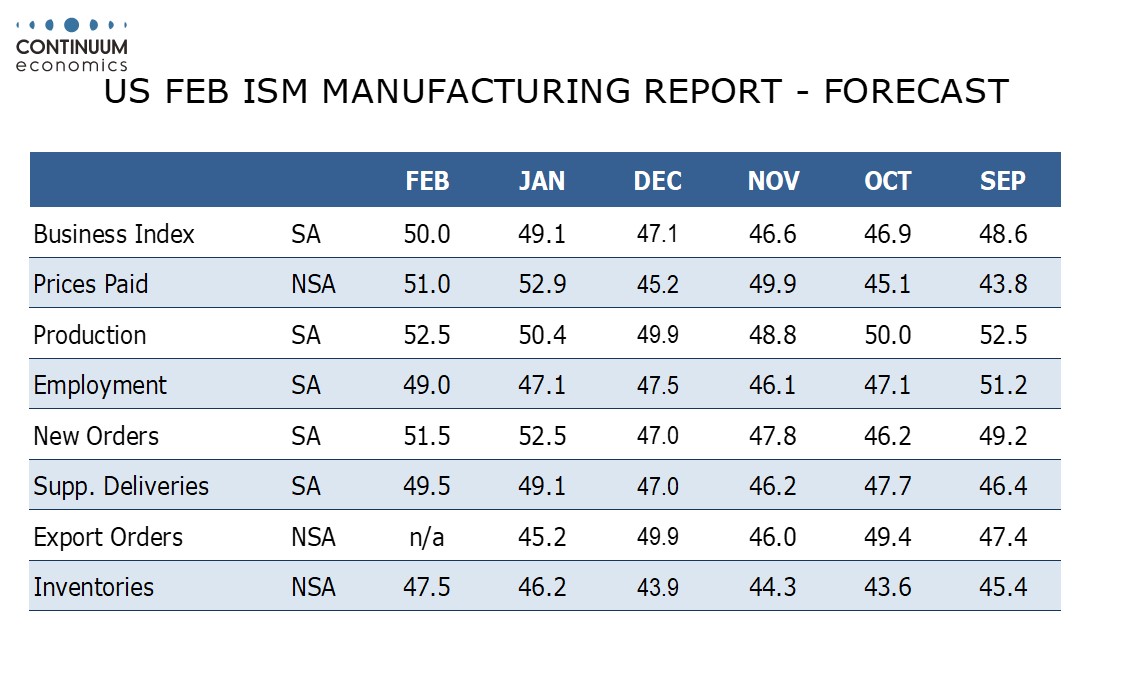

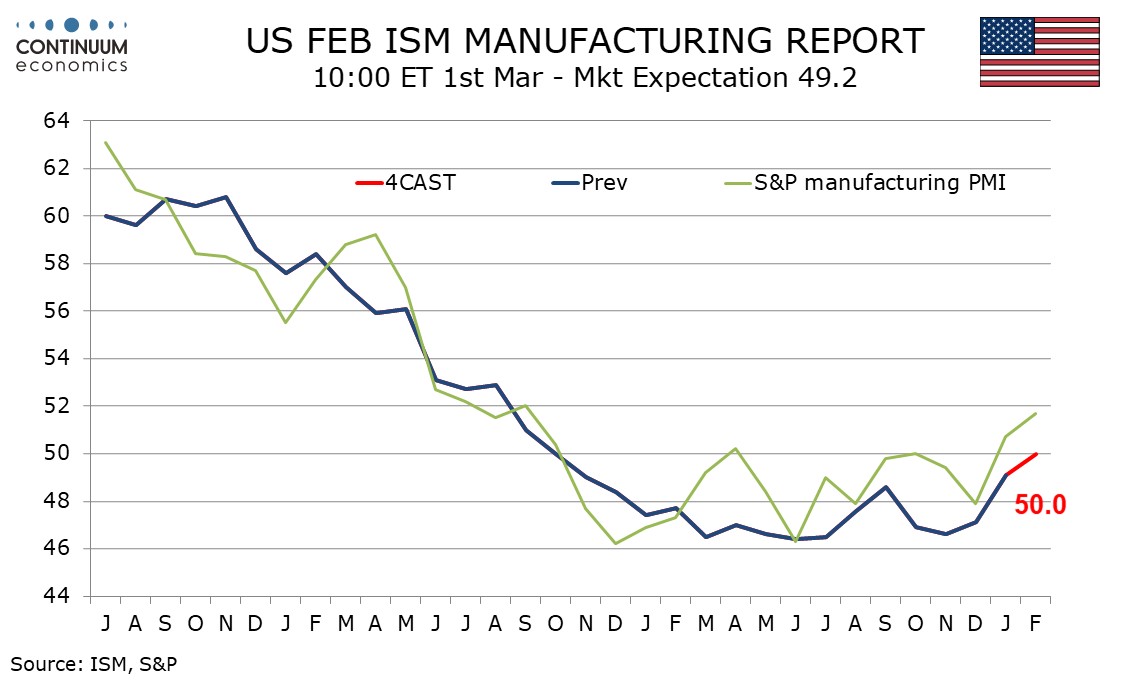

We expect a February ISM manufacturing index of 50.0, up from 49.1 in February, extending the significant improvement from December’s 47.1 and reaching a neutral level for the first time since October 2022.

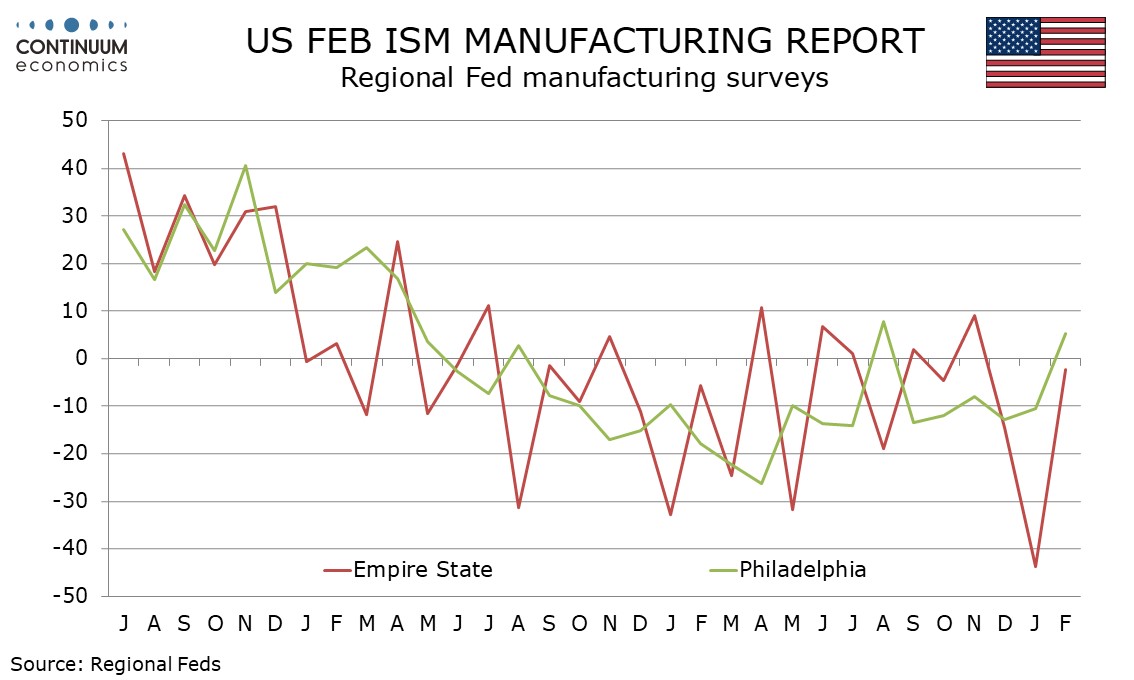

February’s S and P manufacturing PMI at 51.7 saw a second straight increase to its highest level since September 2022. The Philly Fed’s manufacturing index also turned positive in February, while the Empire State’s was also significantly improved, without reaching neutral.

We expect four of the five components that make up the ISM’s composite to show improvement, the exception being new orders which see tougher seasonal adjustments, making January’s sharp bounce to 52.5 from 47.0 difficult to fully sustain.

Prices paid do not contribute to the composite. Here we expect a modest correction lower to a still positive 51.0 from January’s 52.9, which saw a sharp bunce from December’s significantly weaker 45.2.