AUD flows: New AUD/USD lows for the year, but...

New lows for the year for AUD/USD overnight but current weakness looks overdone.

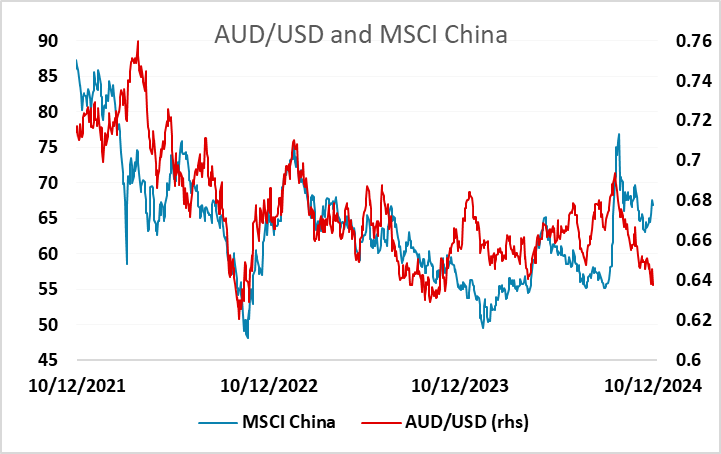

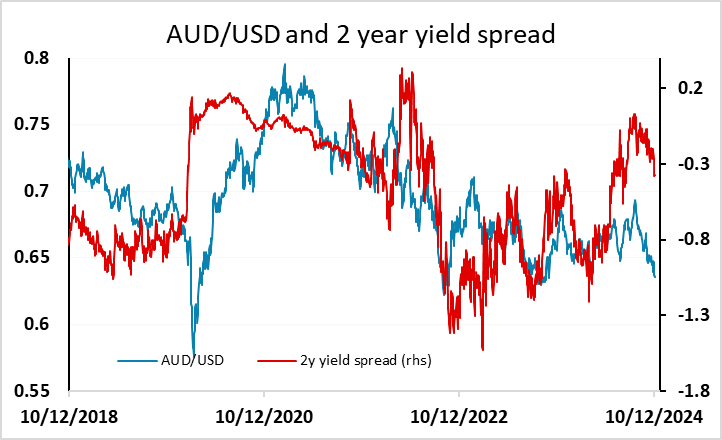

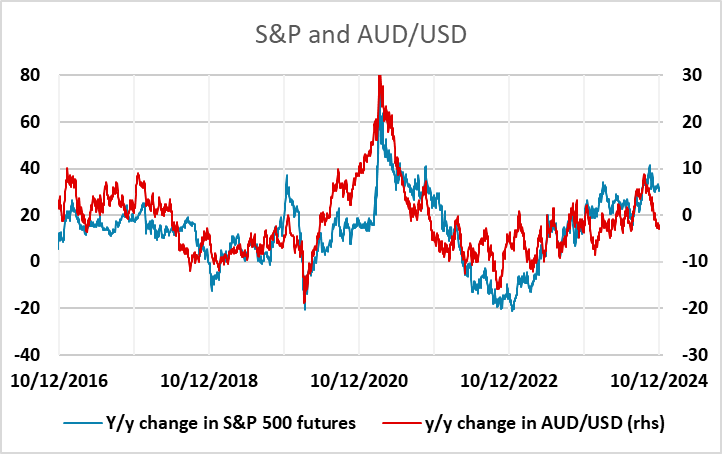

The USD made ground against the riskier currencies overnight, making a new high for the year against the AUD and NZD, and pushing higher against the EUR. The JPY held up better having lost ground on Tuesday, but the underlying tone remains very much USD positive. AUD weakness is perhaps the most puzzling. Normally, the AUD will be driven by a combination of yield spreads and regional and global risk sentiment, with perhaps some impact from individual commodity prices. While yield spreads have moved in favour of the USD in the last few weeks, spreads have moved significantly in the AUD’s favour in the second half of the year, without the AUD benefitting.

While some of the weakness is related to negative sentiment around China, and concerns about global trade if Trump follows through on his threats of significant tariff increases, the resilience of US equities and the recent bounce in Chinese equities would normally be positive for the AUD. December markets are often unreliable and characterised by stop hunting as much as fundamental moves, so the new AUD/USD lows seen overnight may prove short lived. Longer term there looks to be some value in the AUD at current levels.