U.S. June Consumer Confidence - More resilient than Michigan CSI

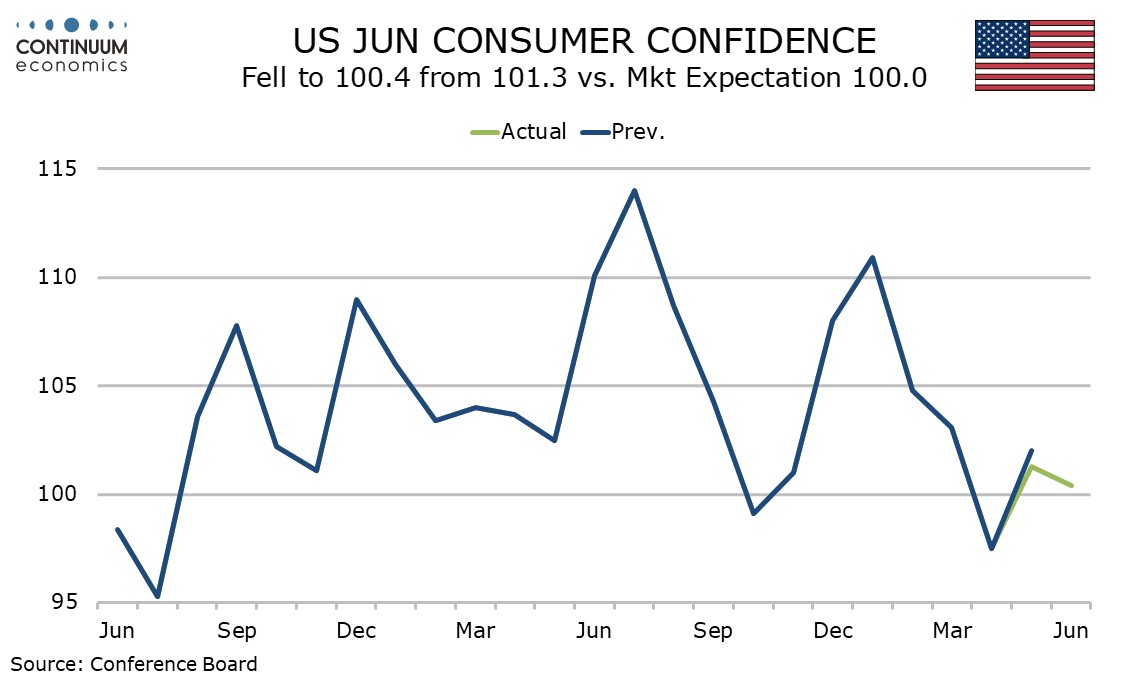

June consumer confidence is in line with expectations at 100.4, little changed from 101.3 in May and showing more resilience than a weaker preliminary June Michigan CSI reading, though not strong by recent standards..

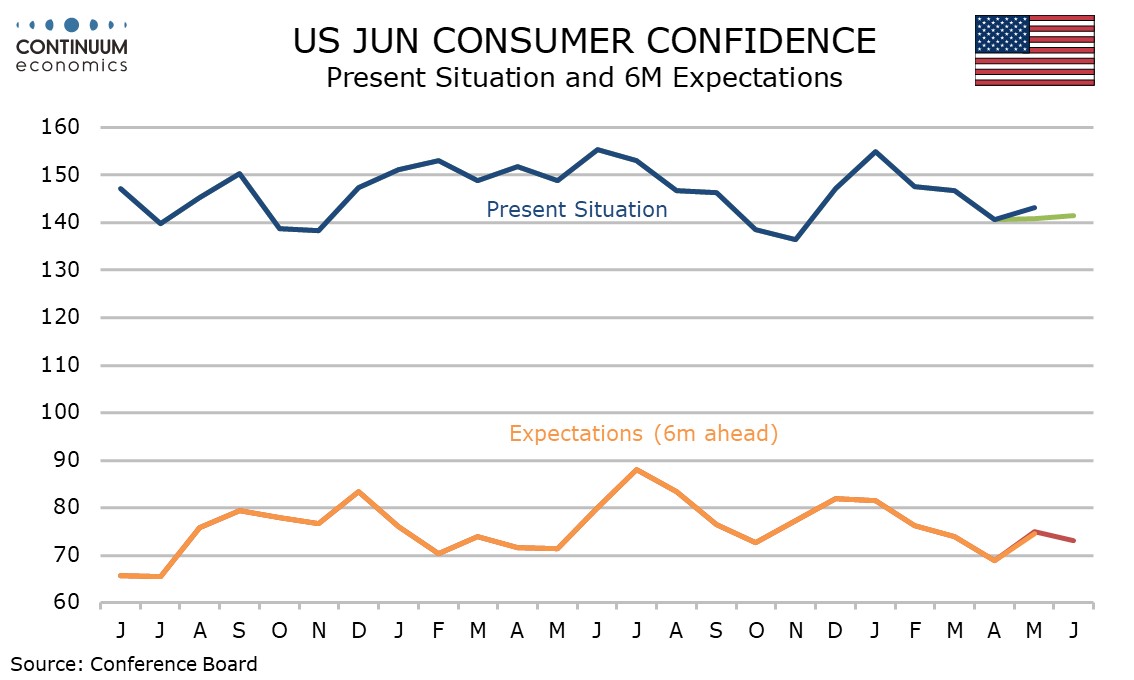

The Michigan CSI was led lower by current conditions. In this survey released by the Conference Board the present situation index was marginally improved at 141.5 from 140.8 while expectations were marginally weaker at 73.0 from 74.9.

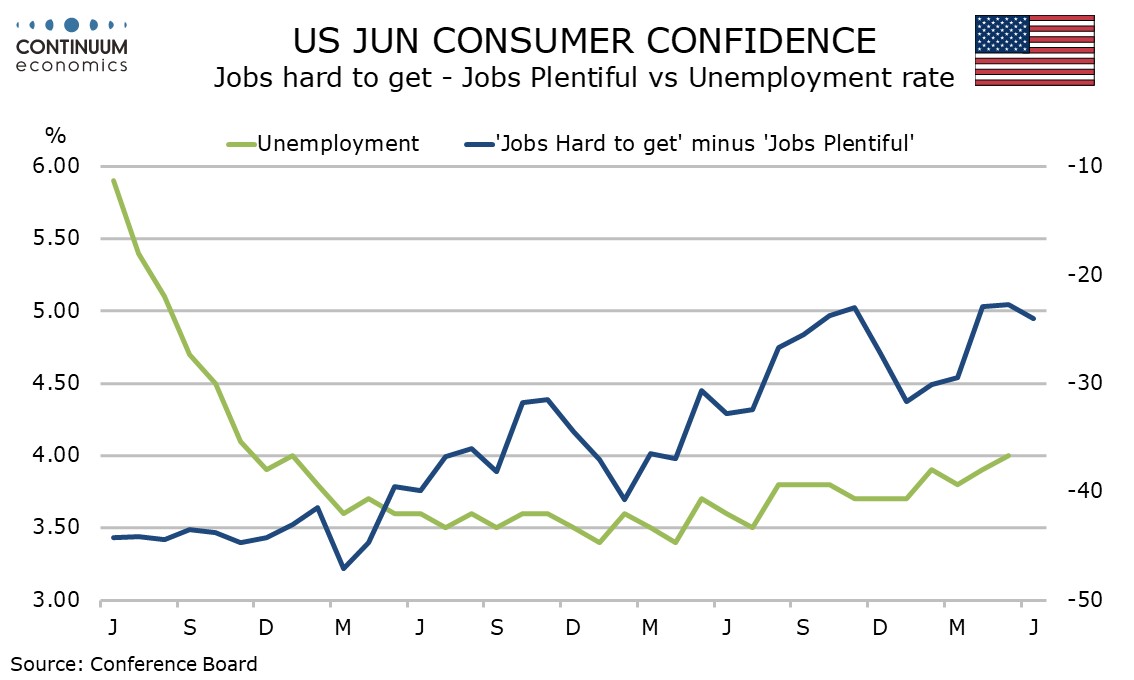

The present situation index was supported by a more positive view of the labor market, those seeing jobs as plentiful exceeding those seeing them as hard to get by a 3-month high of 24.0%, up from 22.9% in May, though well below March’s 29.5%.

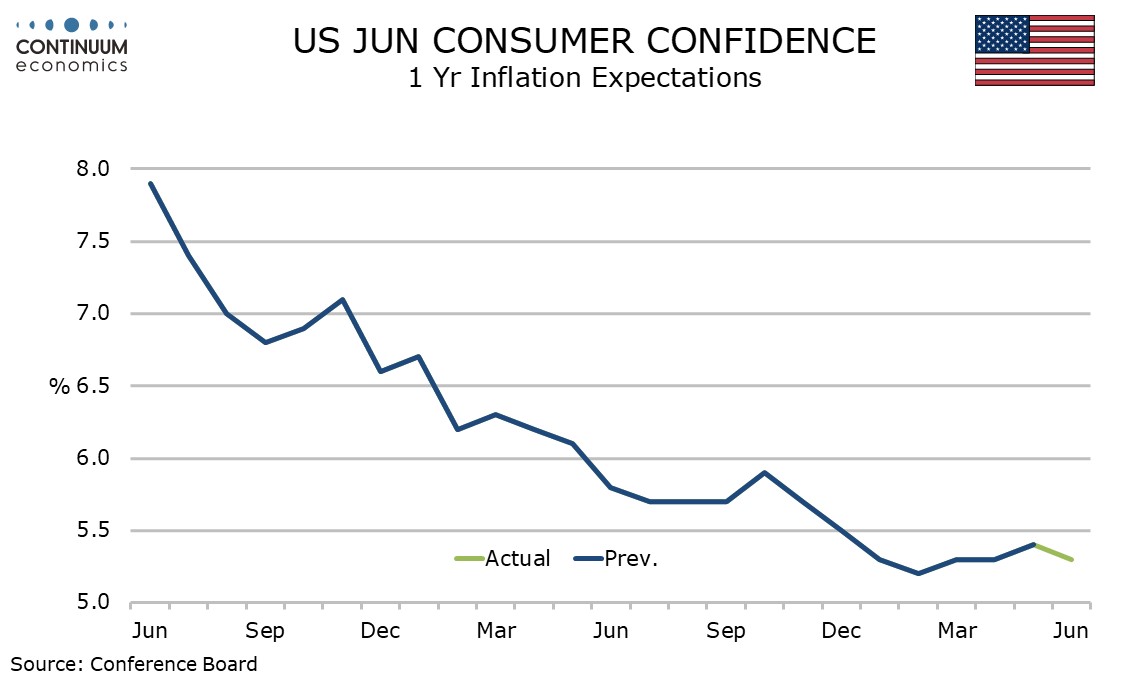

Inflation expectations were marginally weaker, the average 1-year view at 5.3% from 5.4% and the median at 4.3% from 4.4%, both returning to April levels after a marginal increase in May.

The contrast between Conference Board resilience and the Michigan CSI falling to its lowest since November is not easy to explain, but the Conference Board data tends to be more sensitive to the labor market, where iys June findings were stronger.