Published: 2024-04-10T14:26:55.000Z

CAD flows: Scope for CAD to weaken further after BoC

2

BoC suggest June rate cut still very likely. Upside risks for USD/CAD

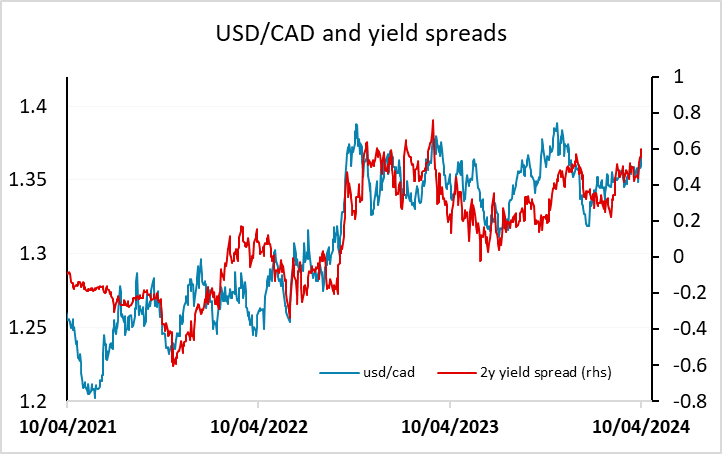

The BoC statement was if anything on the dovish side of expectations, seemingly encouraged by the progress on inflation and suggesting a rate cut in June is likely. This was near fully priced before the US CPI data, but Canadian front end yields have risen with the US, so is currently only around 80% in the market. But the relatively dovish language combined with the rise in US yields leading to spread widening in favour of the USD, plus the weaker equity market after the US CPI data all point to more CAD weakness. As it stands, the CAD has outperformed other currencies post-US CPI, but we may now be due some catch-up, with potential to 1.37, but the highs above 1.38 seen last November should be out of reach near term.