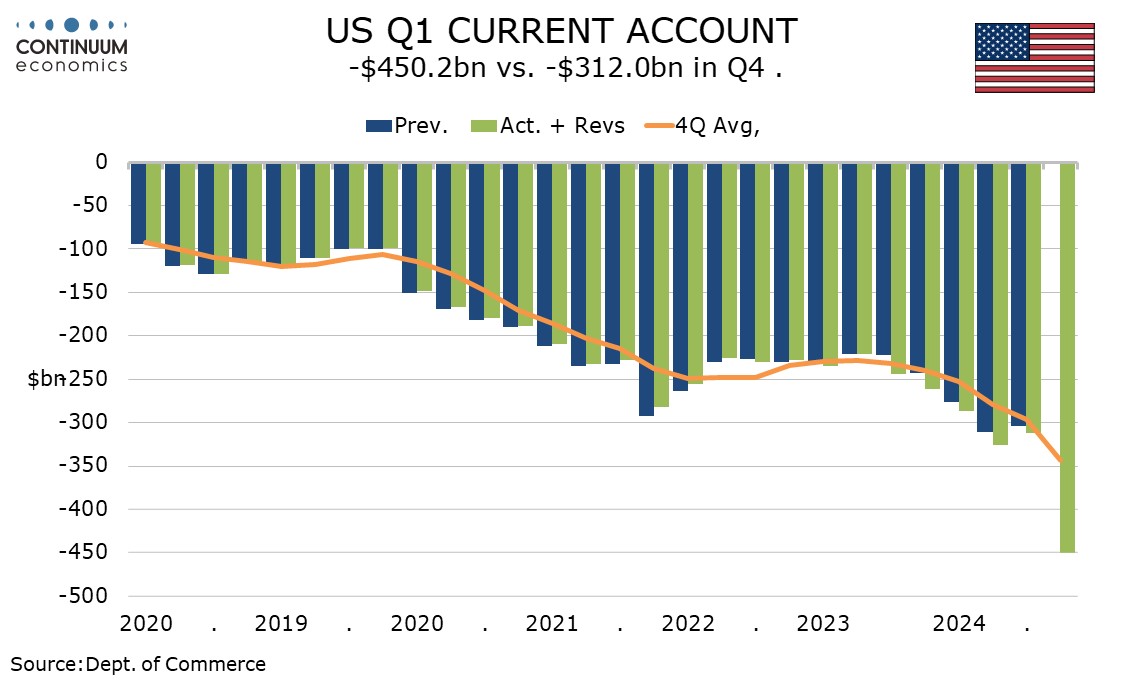

US Q1 Current Account - Record deficit on pre-tariff import surge

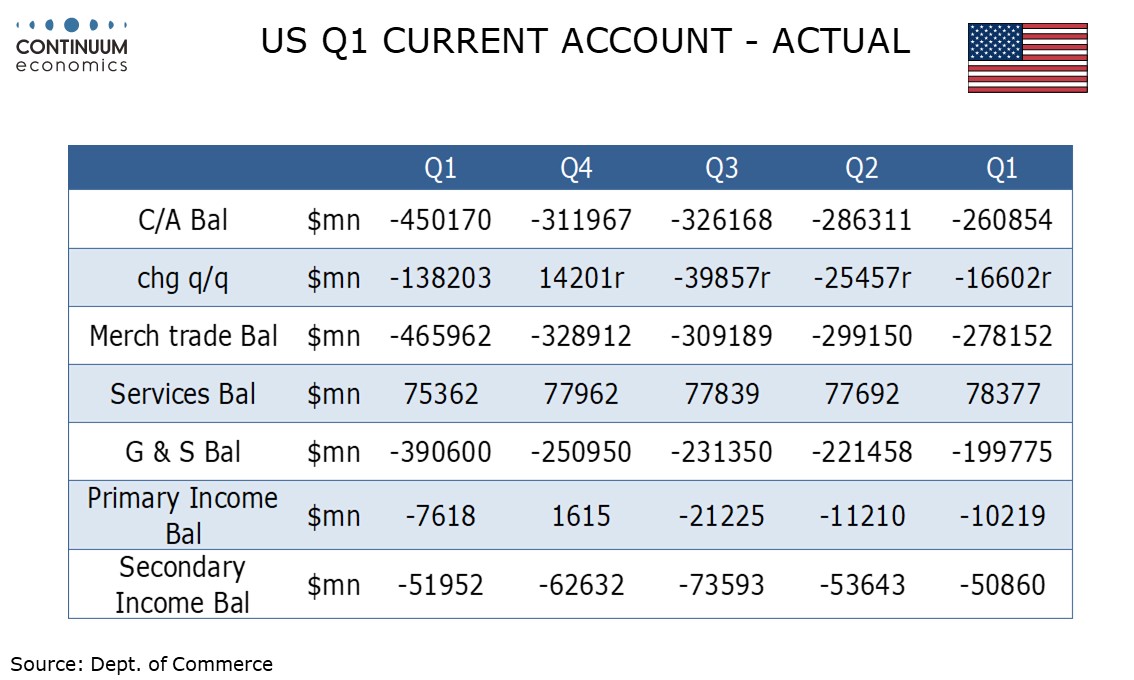

The Q1 current account deficit of $450.2bn is slightly wider than expected and a record high, up from $312.0bn in Q4. As a percentage of GDP, the deficit is 6.0%, the highest since Q3 2006.

A rise in the goods deficit to $466.0bn from $328.9bn and a fall in the services surplus to $75.4bn from $78.0bn were already known. The goods deficit was inflated by a surge in imports ahead of expected tariffs and this is likely to be reversed in Q2. The services surplus was restrained by reduced tourist traffic into the US, something that is likely to persist.

The Q3 primary (investment) income balance returned to deficit at $7.6bn after a small $1.6bn surplus in Q4, though the deficits in the first three quarters of 2024 were revised higher. The deficit in secondary (transfers) income however fell to $52.0bn from $62.6bn in Q4, a return to normal after unusually large deficits in Q3 and Q4 of 2024.