Published: 2024-01-31T15:12:15.000Z

Preview: Due February 1 - U.S. January ISM Manufacturing - Remaining marginally negative

Senior Economist , North America

-

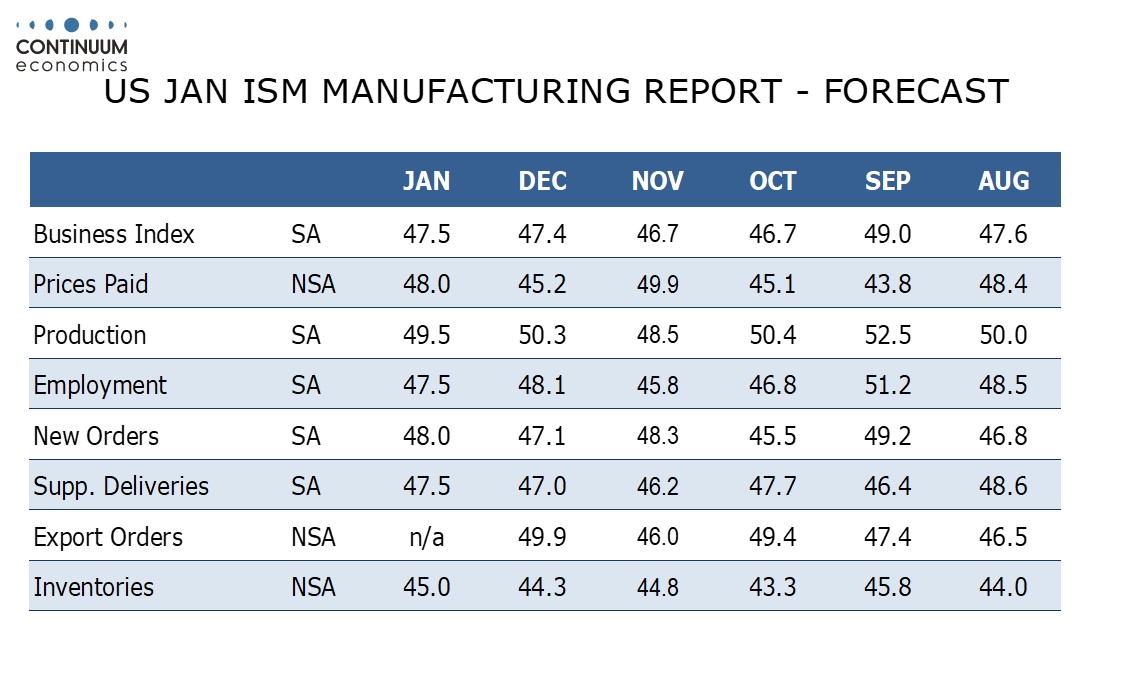

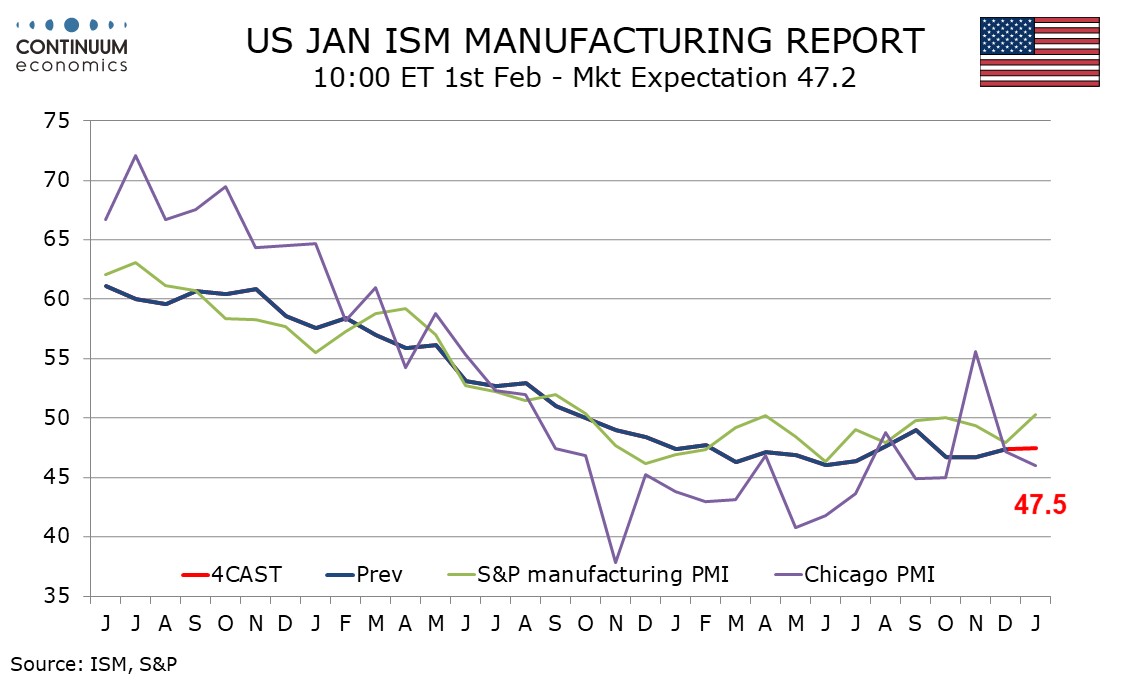

We expect a January ISM manufacturing index of 47.5, little changed from December’s 47.4. This would maintain a marginally negative picture that persisted through 2023.

January’s S and P manufacturing PMI moved above the neutral 50 but this series saw two moves to neutral or above in 2023 which the ISM manufacturing index was not able to match.

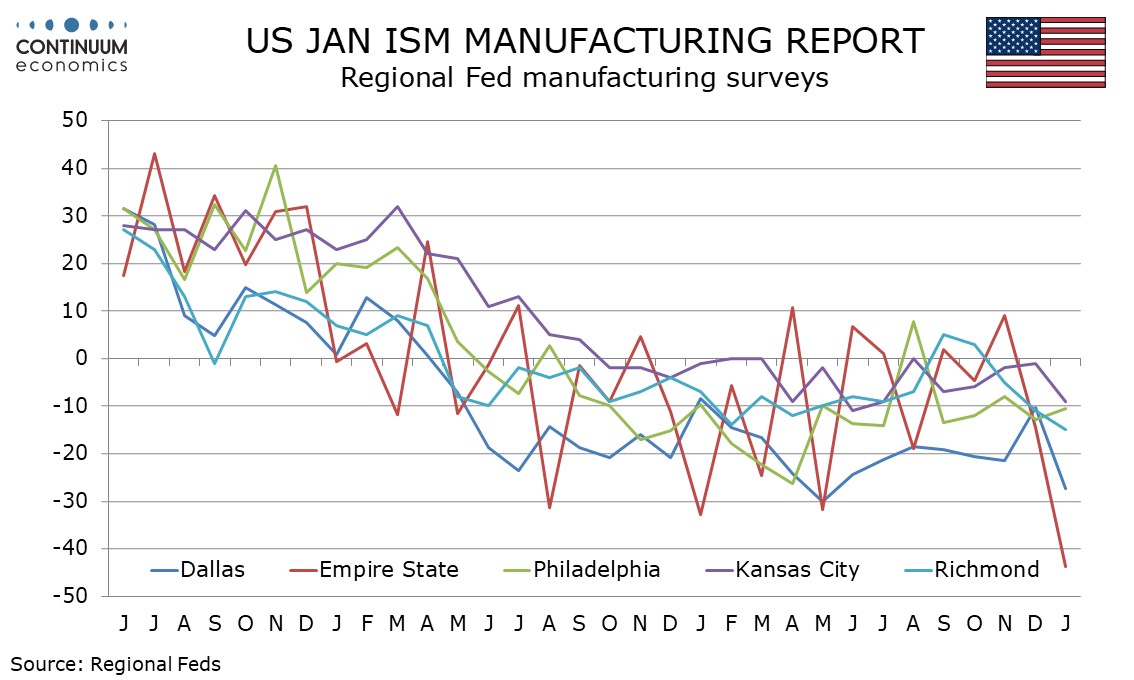

Regional surveys still give a mostly modestly negative picture, mostly increasingly so in January, with the Empire State’s particularly weak, though we expect that will prove erratic.

We expect all five components that make up the composite to come in marginally negative, production at 49.0, new orders at 48.0, delivery times and employment at 47.5 and inventories at 45.0. Prices paid do not contribute to the composite. Here we expect a rise to 48.0 from 45.2, reversing most of a December dip, but still a ninth straight outcome below the neutral 50.