Canada June Employment - Subdued, acceleration in wages may be misleading

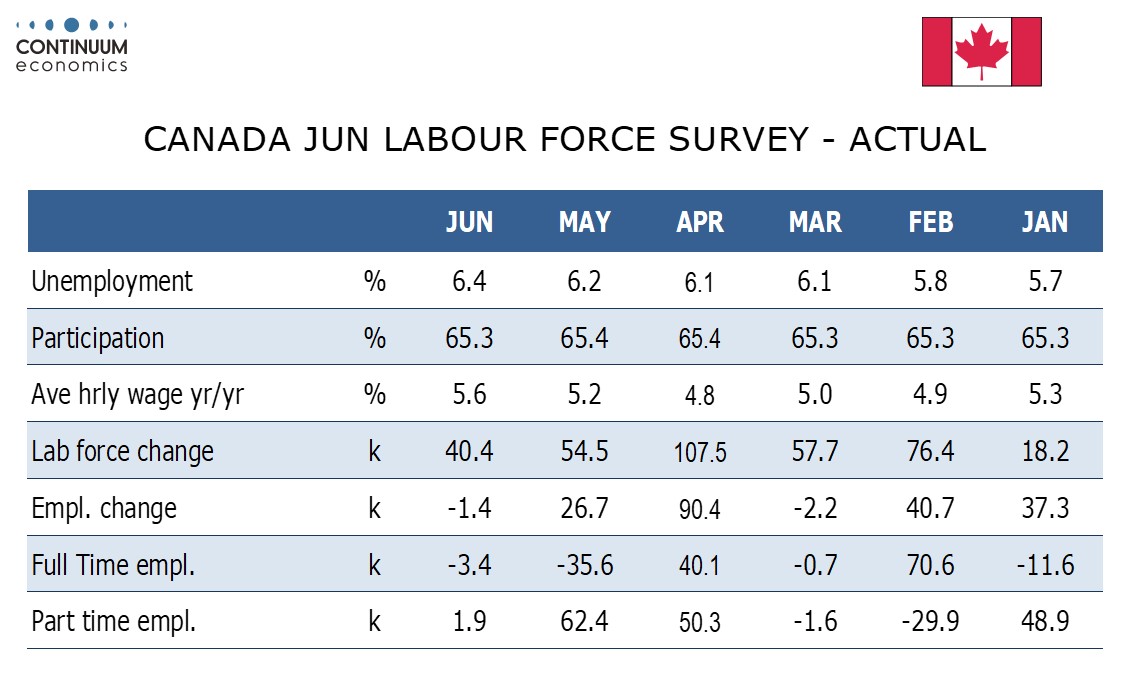

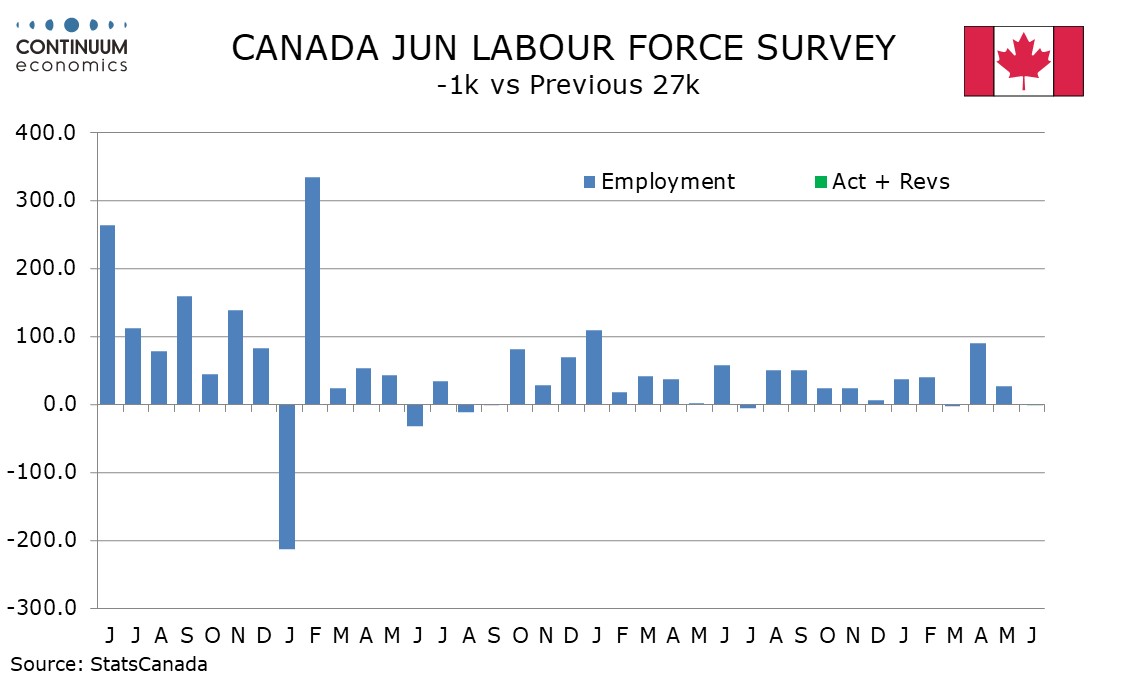

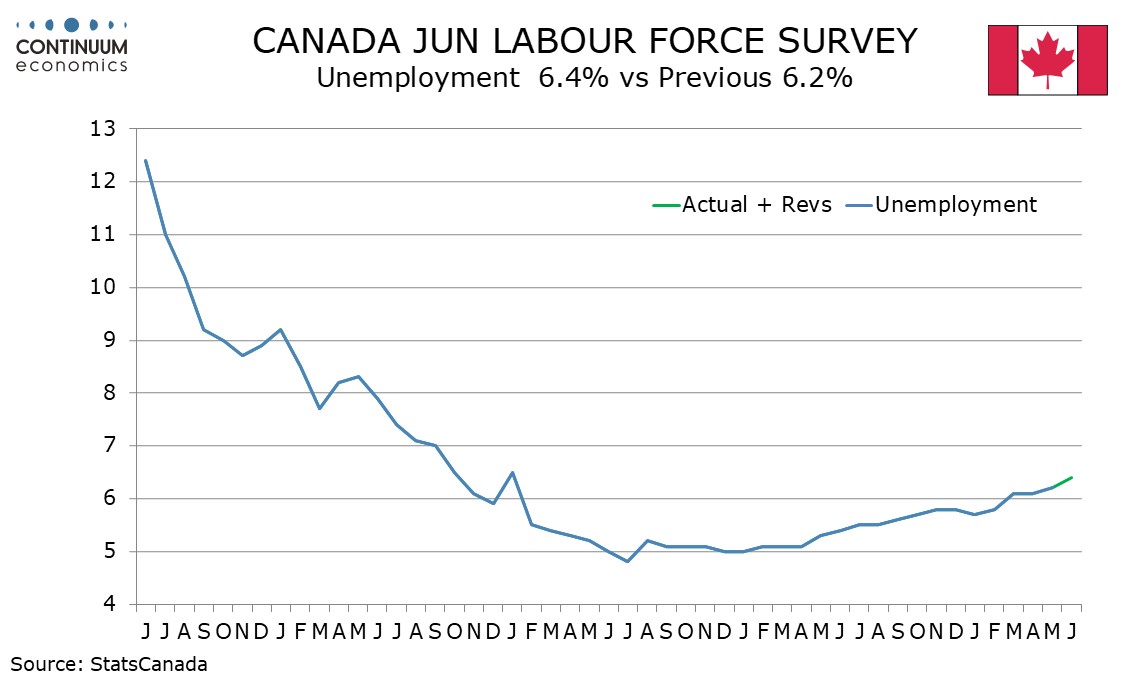

Canada’s June employment is quite weak with a 1.4k decline overall and unemployment at 6.4% from 6.2% reaching its highest since January 2022. There may be some concern over a rise in permanent employees’ wages growth to 5.6% yr/yr from 5.2%, though this may reflect year ago weakness.

The wages series has been trending near 5% for overall a year but June 2023 was well below trend at 3.9%, after a 5.1% gain in May 2023 and before a 5.0% gain in July 2023. The bounce in June 2024 may be largely due to the below trend outcome a year ago. We doubt wages are accelerating, though there is little sign yet that they are slowing despite the rise in unemployment.

Employment detail might be a little less weak than the headline implies, with public sector work seeing a 14.6k decline, though gains in the private sector of 5.4k and self-employment of 7.7k were both modest. The detail of the employment report shows only two components, agriculture at 12.6k and accommodation and food services at 17.2k, while only transportation and warehousing at -11.7k and information, culture and recreation, at -11.0k, fell by more than 10k.

The subdued report suggests that the economy is slow enough to justify further BoC easing though the apparent (if in our view misleading) acceleration in wages may add to caution on inflation generated by a stronger than expected May CPI. After easing in June the BoC may want to pause at its July 24 meeting, though June CPI due on July 16 could tip the balance.