Published: 2024-06-26T13:23:27.000Z

Preview: Due June 27 - U.S. Final (Third) Estimate Q1 GDP - Higher on construction and net exports

1

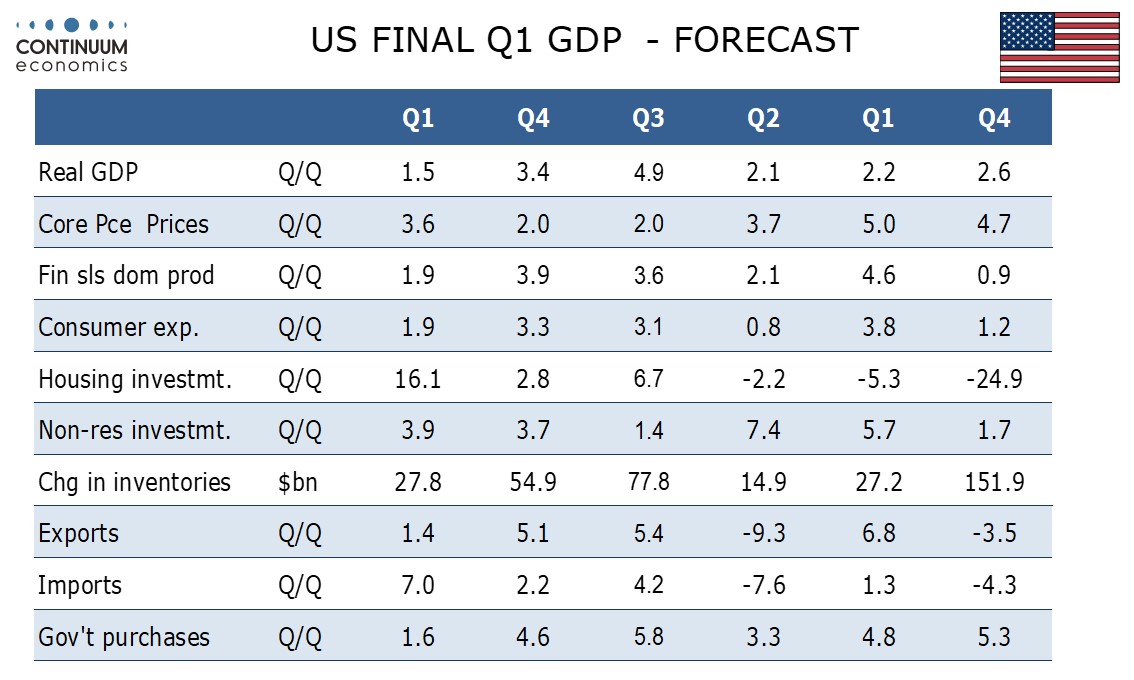

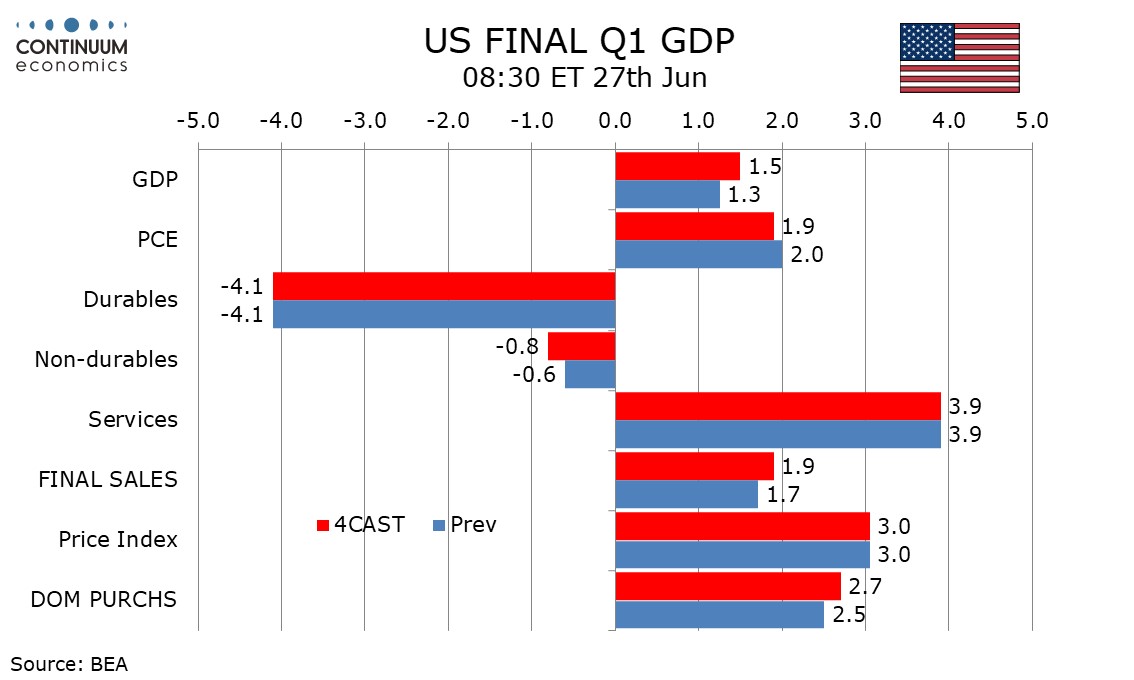

We expect the third (final) estimate for Q1 GDP to be revised up to 1.5% from the second (preliminary) estimate of 1.3%. The revision will come on construction and net exports.

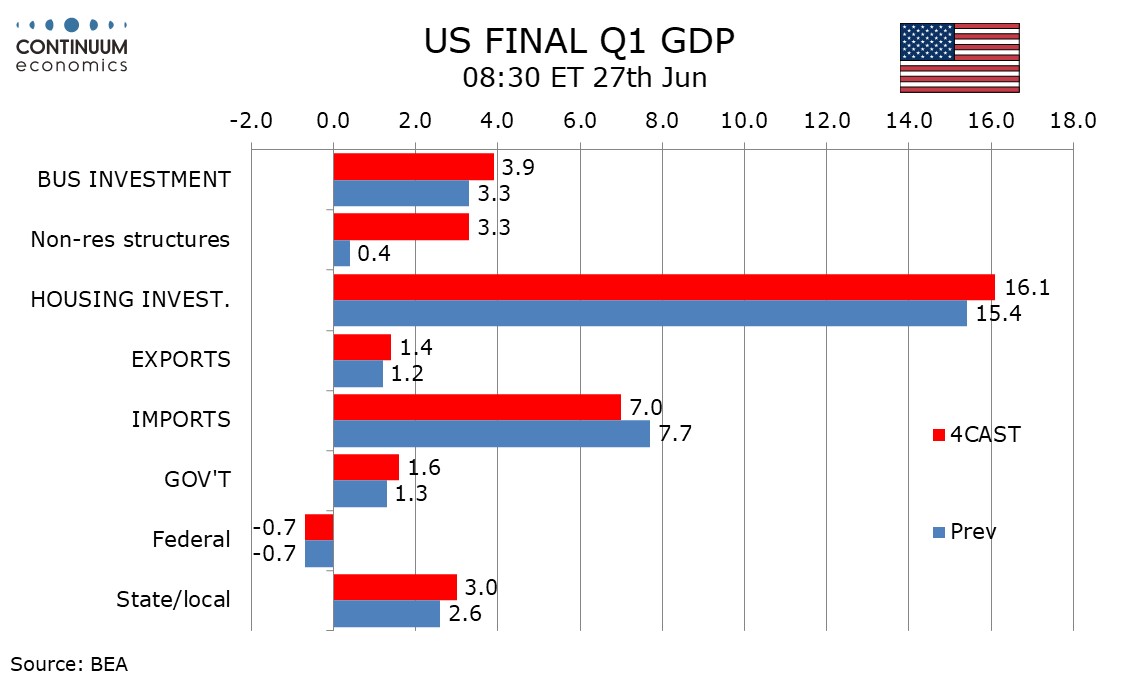

Construction spending has been revised higher in all its three principal components, private non-residential, residential and public. Net exports are also likely to be revised higher, largely on services. This should outweigh a downward revision to March retail sales.

While some of the revision will be from net exports we expect both final sales (GDP less inventories) and final sales to domestic buyers (GDP less inventories and net exports) to both be revised up by 0.2%, to 1.9% and 2,7% respectively, the latter a healthy pace.

We do not expect any revisions to the price indices, from 3.0% for GDP, 3.3% for overall PCE and 3.6% for core PCE, the latter an unwelcome acceleration from two straight quarters that at 2.0% annualized were consistent with target.