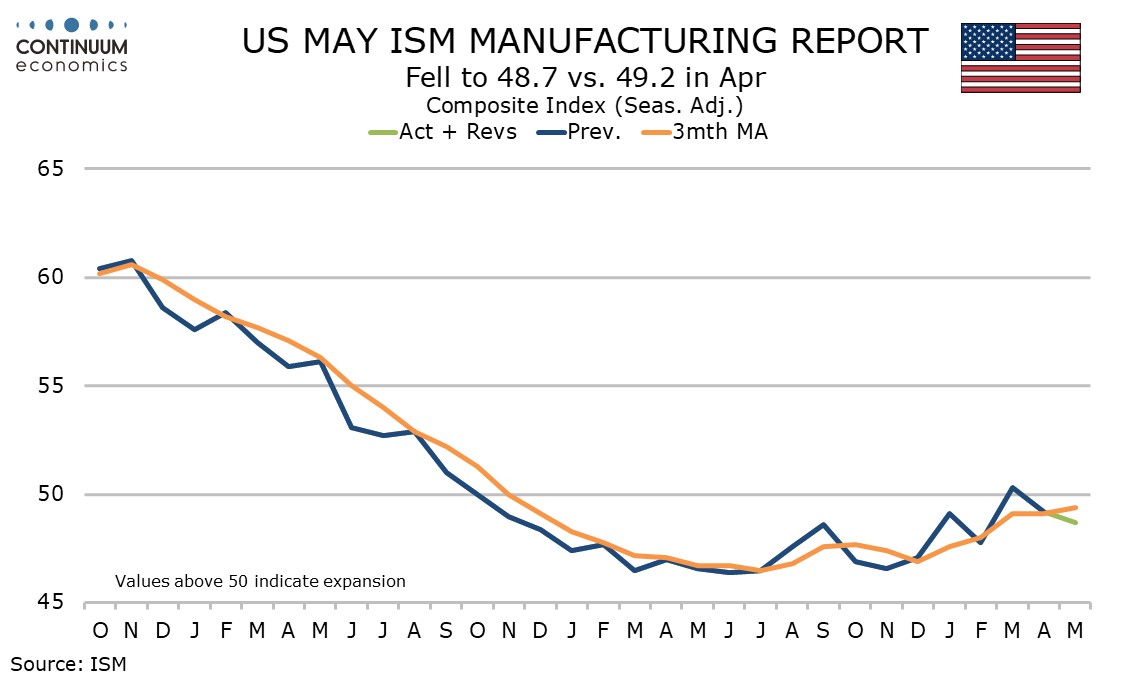

U.S. May ISM Manufacturing - Dips on 12-month low in new orders

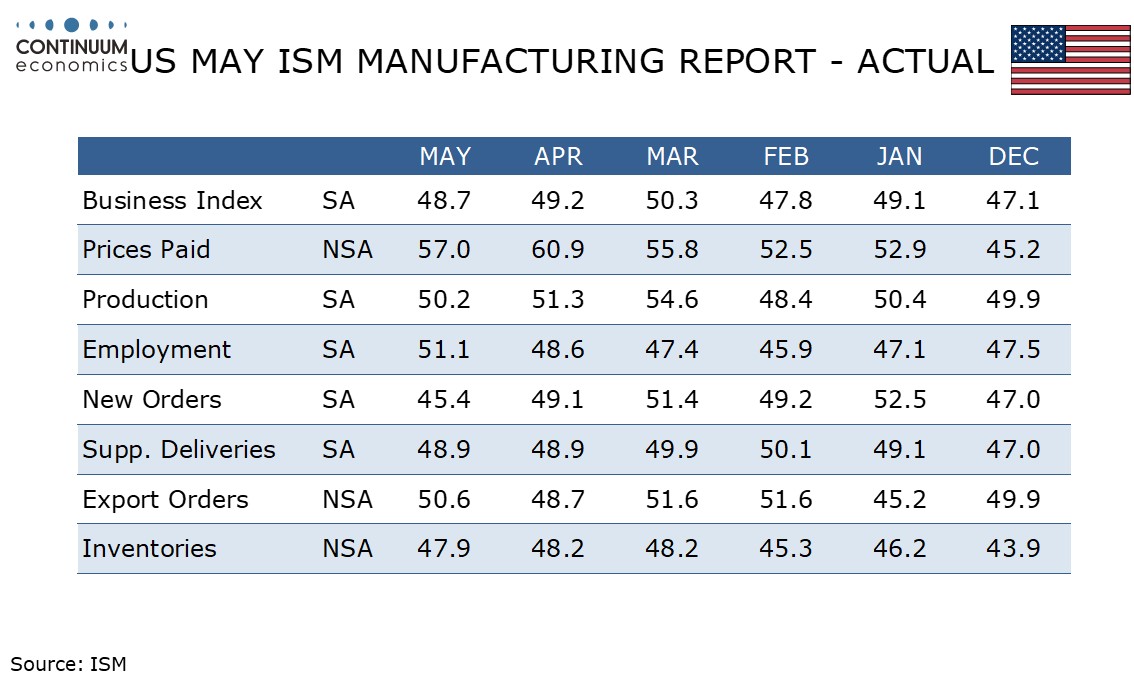

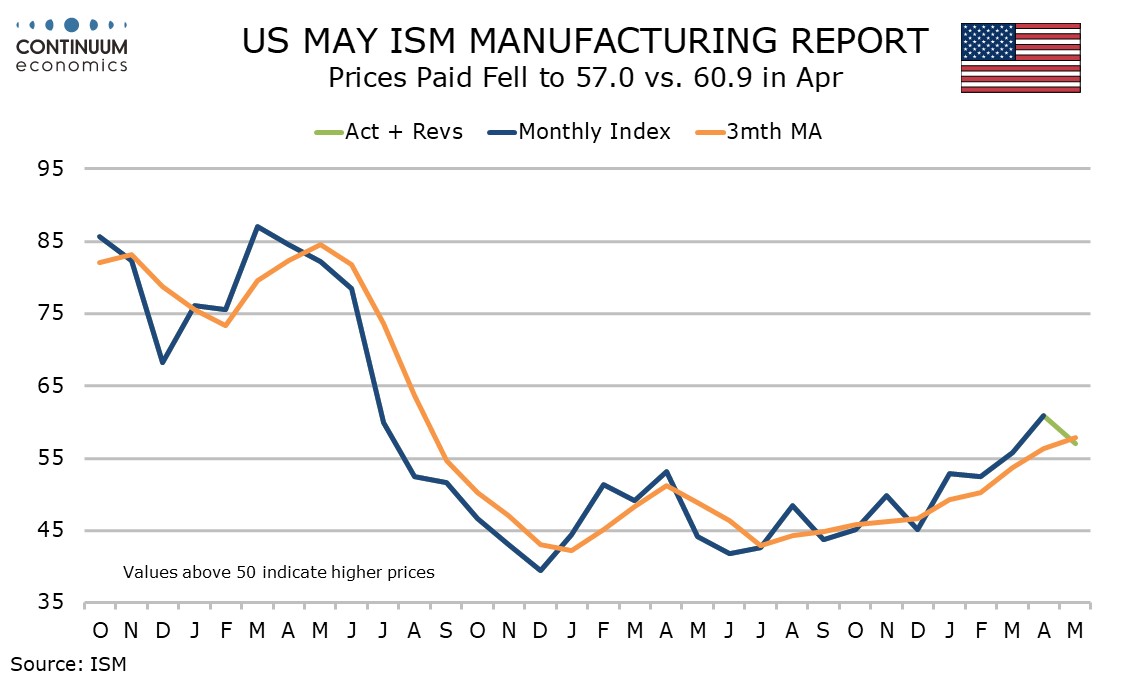

The ISM manufacturing index at 48.7 from 49.2 is slightly weaker than expected with a particularly notable slowing in new orders to 45.4 from 49.1, though employment was resilient, rising to 51.1 from 48.6. Prices paid corrected lower to 57.0 from April’s 60.9 that was the highest since June 2022.

New orders are at a 1-month low while employment is at an 8-month high. New orders as a leading indicator is more significant than employment though the latter does suggest manufacturing payrolls will hold up in May.

Production at 50.2 remains positive if down from 51.2 while inventories slipped marginally to 47.9 from 48.2. Deliveries were unchanged at 48.9 to complete the breakdown of the composite. The downside surprise is largely on new orders, where one weak month does not make a trend.

Prices paid do not contribute to the composite. While correcting lower from April the index is still stronger than every month between August 2022 and March 2024.

April construction spending at -0.1% is slightly weaker than expected after an unrevised 0.2% decline in March. However with February revised up to a 0.9% increase from unchanged the net data is slightly stronger than expected.