U.S. June ISM Manufacturing - Picture still subdued

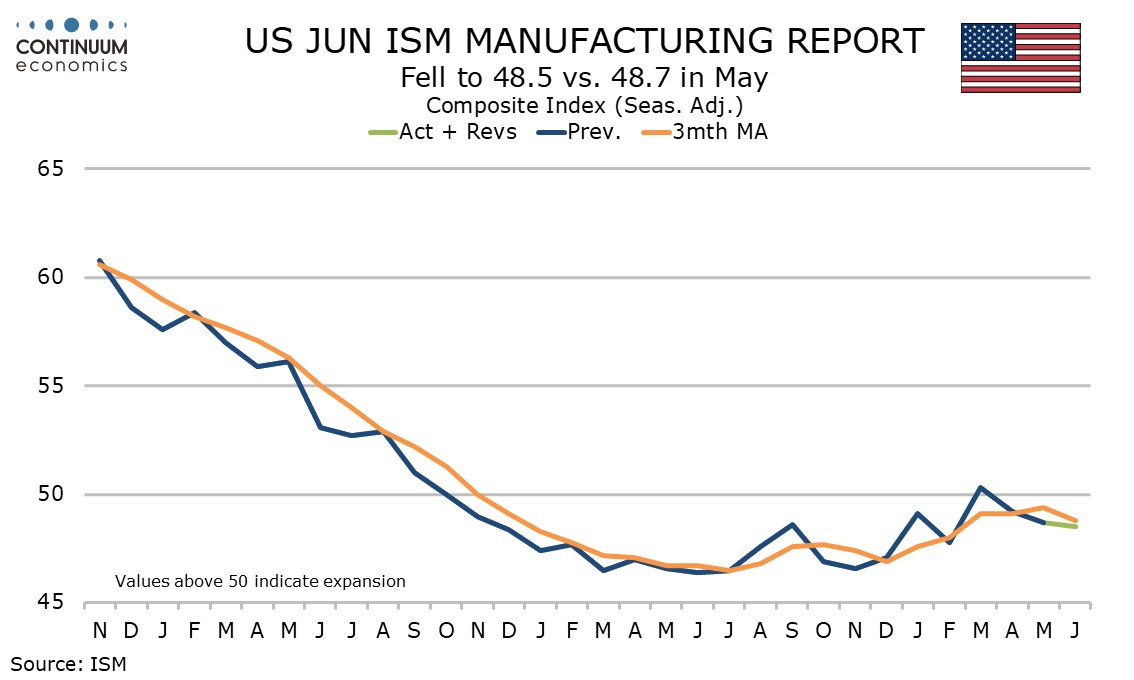

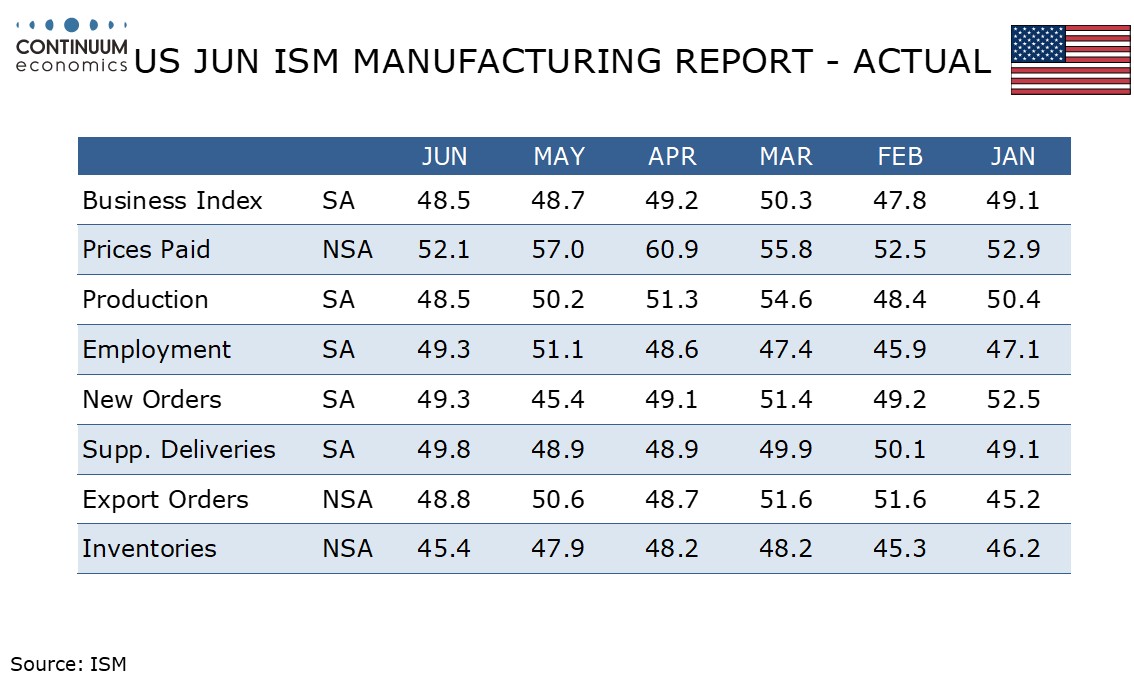

The ISM manufacturing index at 48.5 from 48.7 has seen a third straight marginal slowing in June after March saw a brief move above the neutral 50. This contrasts a stronger June S and P manufacturing PMI index of 51.7, and suggests a continuing subdued manufacturing picture.

The subdued ISM index suggests a stronger tone to May’s manufacturing output data may be difficult to sustain.

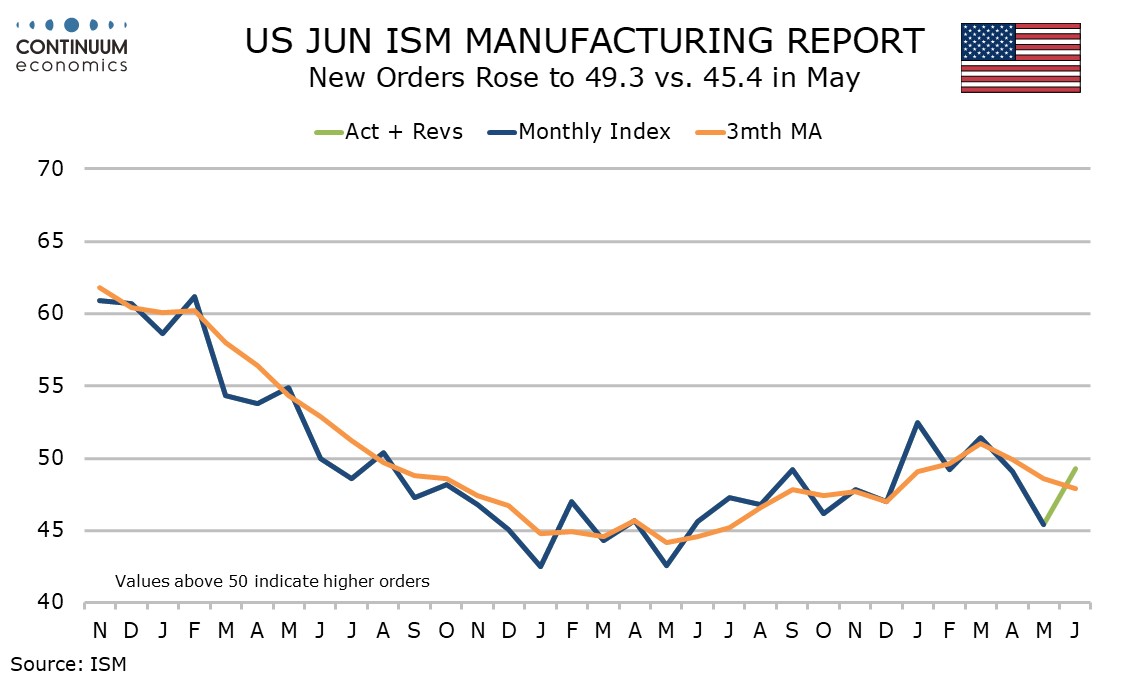

New orders did correct from a very soft May, rising to 49.3 from 45.4, but the only other contributor to the composite to rise was delivery times, to 49.8 from 48.9.

The other three contributors fell, inventories to a weak 45.4 from 47.9, employment to 49.3 from 51.1 and with production falling to 48.5 from 50.2 all five components of the composite are now below neutral.

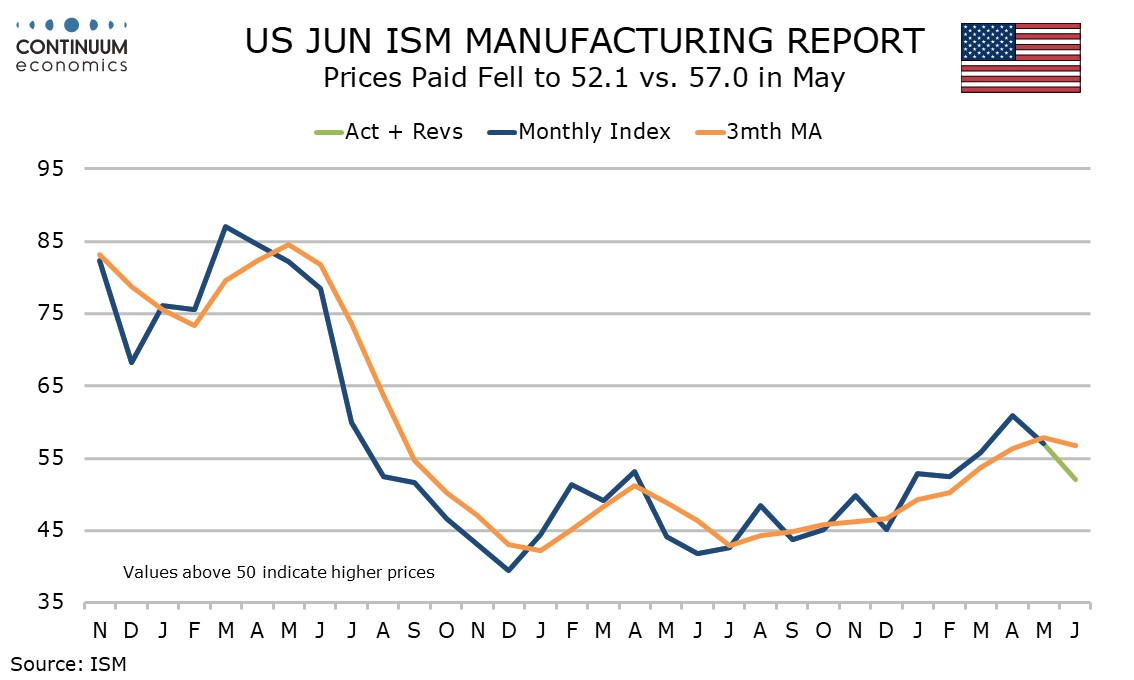

Prices paid at 52.1 from 57.0 saw a significant dip that may be gasoline led. This is the weakest prices index since December.

May construction spending also shows a subdued picture, -0.1% on the month with slippage in the private sector outweighing a modest gain in public construction.