Published: 2025-08-04T19:01:02.000Z

Preview: Due August 15 - U.S. July Industrial Production - Utilities to lead a modest rise

2

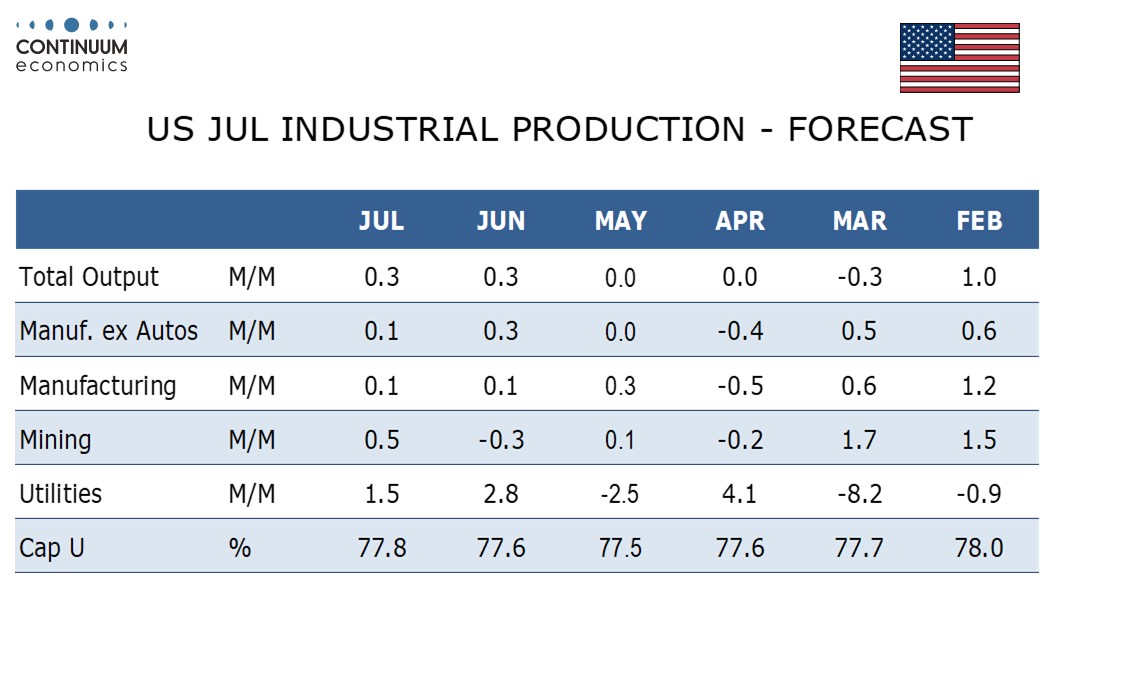

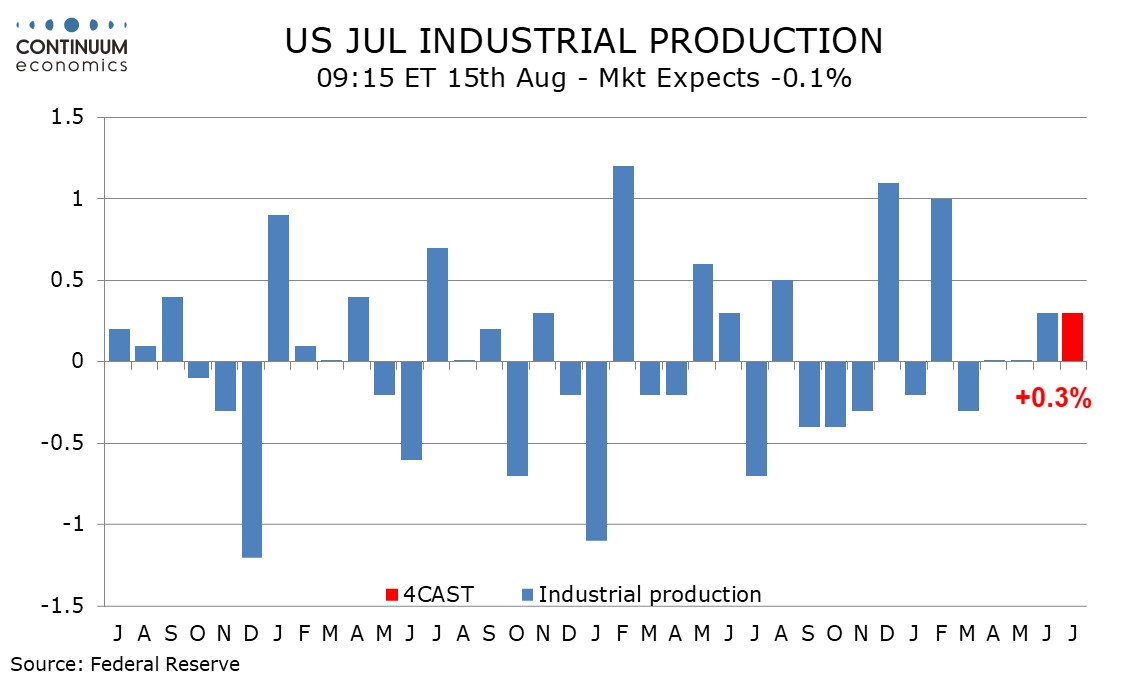

We expect July industrial production to see a second straight 0.3% increase, though for manufacturing we expect only a marginal 0.1% increase, also matching June’s outcome, with utilities again supported by unusually hot weather.

In addition to a 1.5% increase in weather-sensitive utilities, we expect a rise in mining of 0.5% in a rebound from a 0.3% June decline, as suggested by a rise in non-farm payroll aggregate mining hours worked.

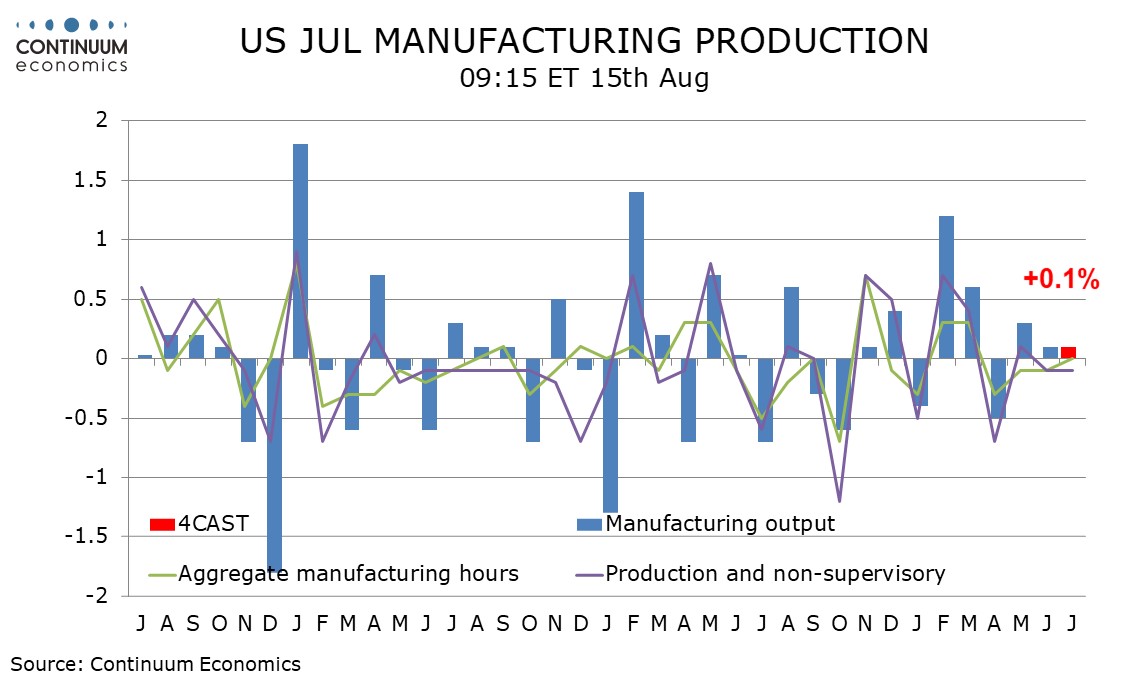

The non-farm payroll showed aggregate manufacturing hours worked unchanged, with a 0.1% decline fir production and non-supervisory workers, suggesting only a marginal increase in manufacturing output even with productivity gains. We expect a neutral contribution from autos after a positive in June and a negative in May, but summer retooling shutdowns complicate auto seasonal adjustments in July.

We expect capacity utilization to rise to 77.8% from 77.6% overall, reaching the highest level since February, but expect manufacturing to be unchanged at 76.9%.