U.S. November Retail Sales, Initial Claims - Economy Still Resilient

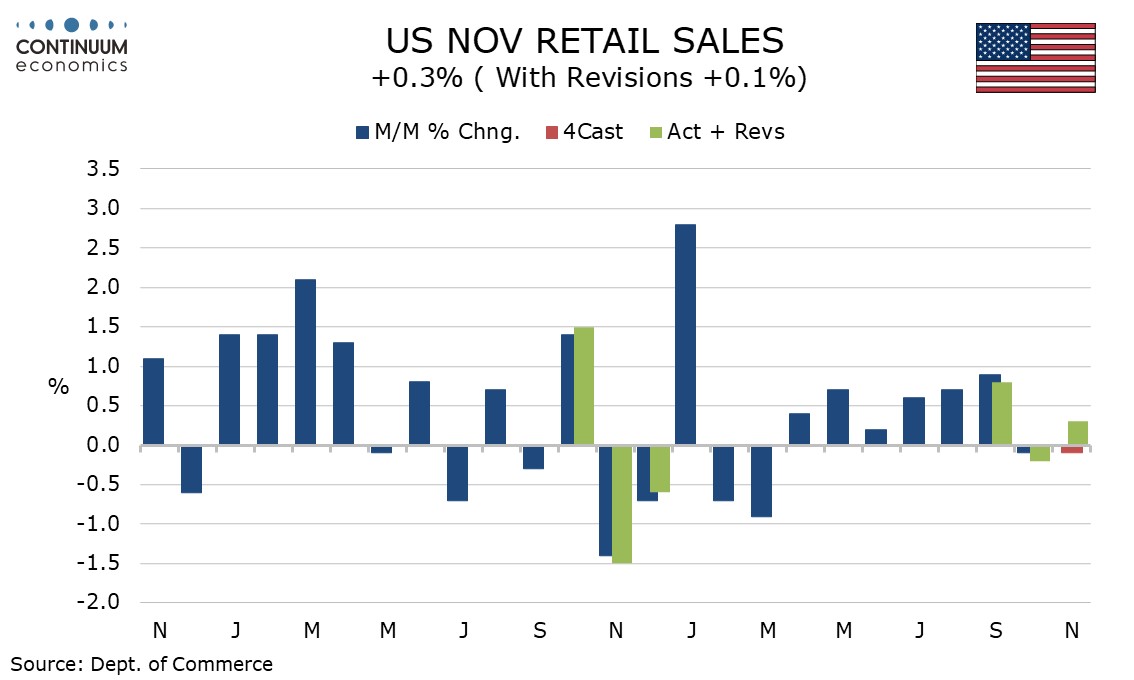

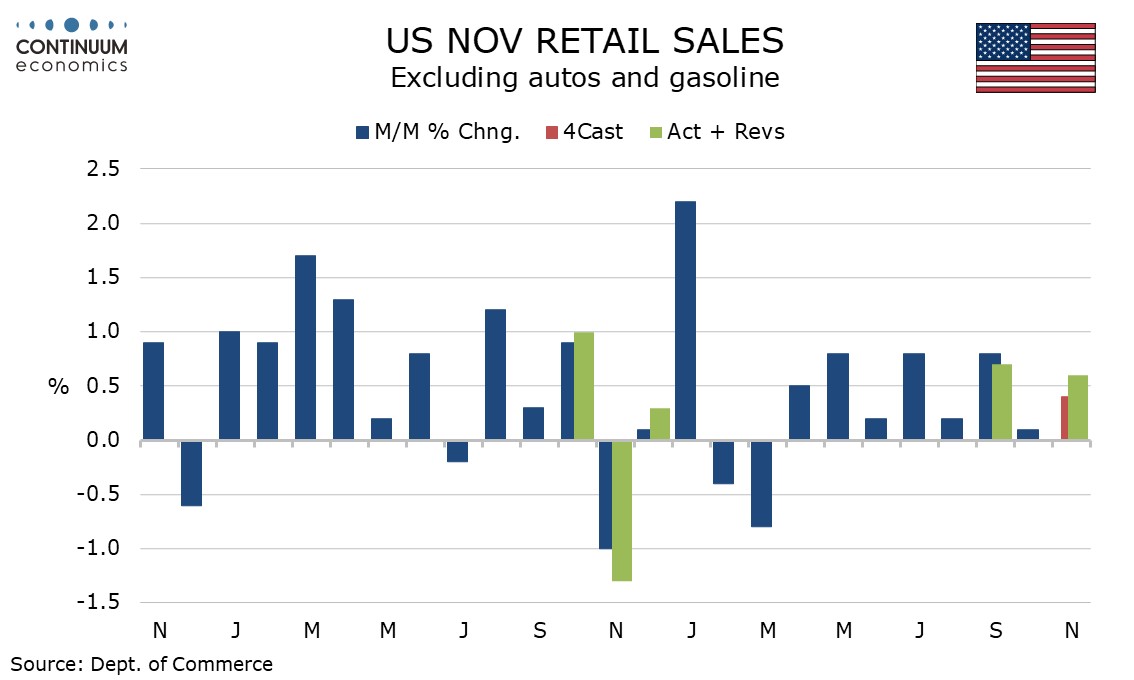

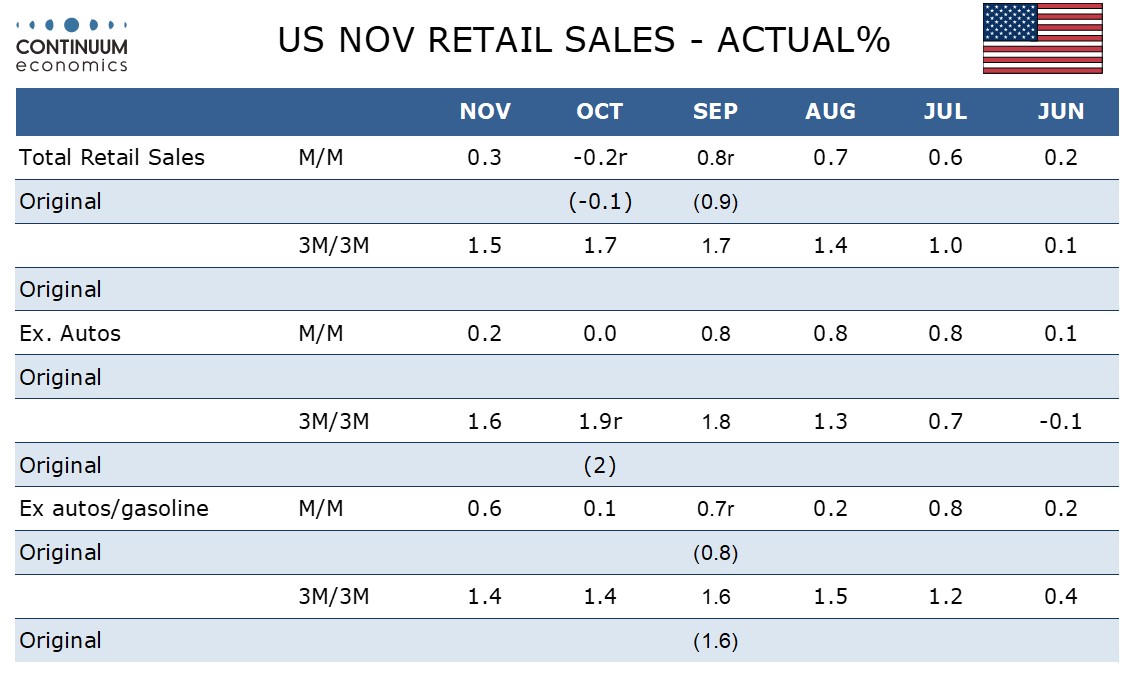

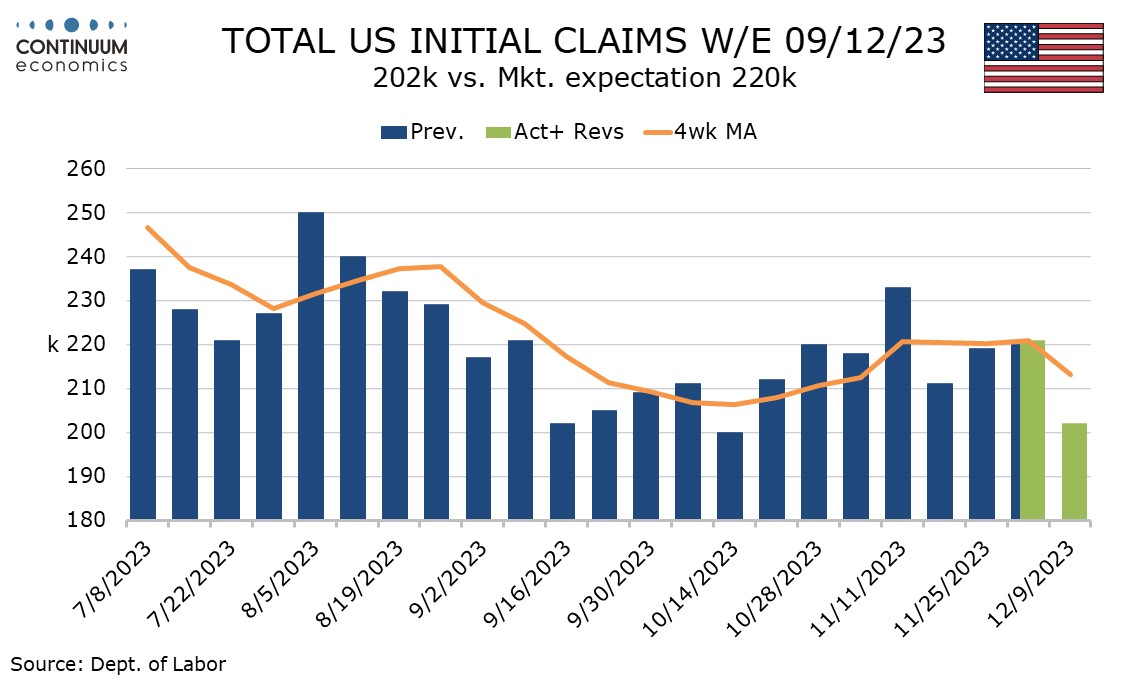

The latest US data casts some doubt on whether the economy is slowing in Q4 as stated by the FOMC in yesterday’s statement, with a sharp fall in initial claims to 202k from 221k and a November retail sales report that exceeds expectations, up 0.3% overall, 0.2% ex autos and a healthy 0.6% ex autos and gasoline.

Auto sales saw a modest 0.5% increase after a 1.1% fall, contrasting signals from the auto industry that sales had seen a second straight dip. Gasoline sales fell by 2.9% on lower prices. Back month revisions were marginally negative, October and September both revised down by 0.1%, to -0.2% and +0.8% respectively.

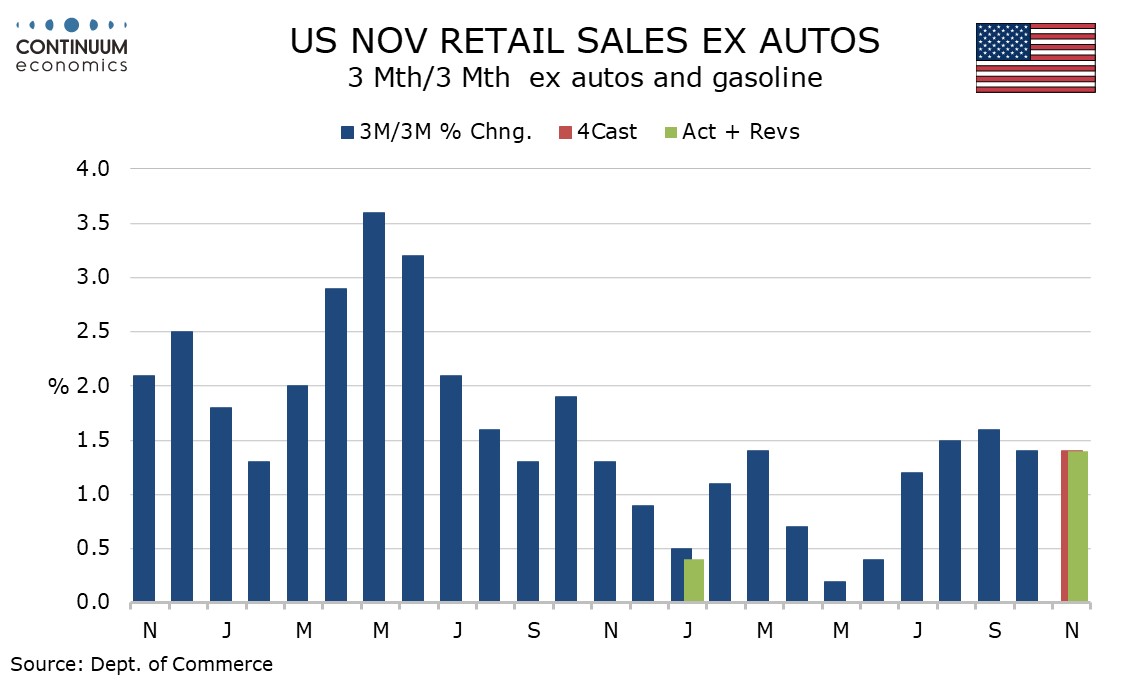

Ex-auto and gasoline data has over the last seven months alternated between healthy gains, May and July at 0.8%, September at 0.7% and now November at 0.6%, and subdued months, with June and August at 0.2% and October at 0.1%. October and November’s combined gain of 0.7% was less than the three preceding pairs, but not by much, and if there is a slowing in trend it is marginal.

November details show the stand out on the upside being a 1.6% rise in eating and drinking places, the strong post-pandemic momentum still persisting. Elsewhere details were mixed.

Initial claims at 202k from 221k are the lowest since October 14 and an upturn in the 4-week average seen into early November appears to be peaking, hinting at resilience in December non-farm payrolls, which will be surveyed next week.

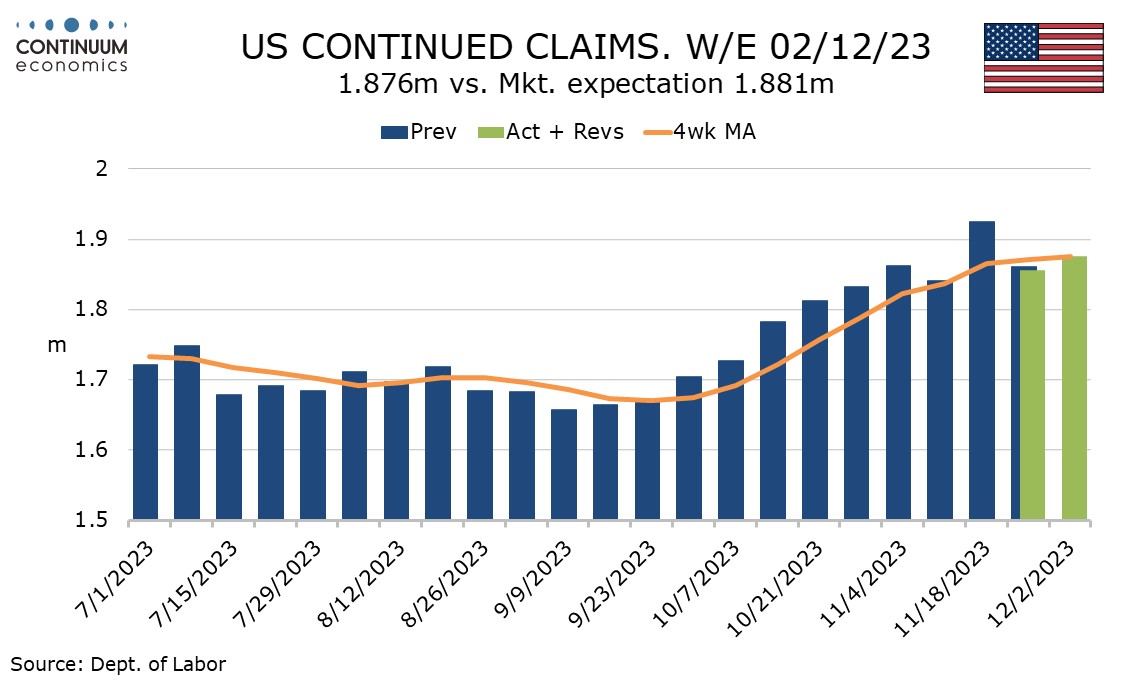

Continued claims, which cover the week before initial claims, rose by 20k to 1.876m, a modest rise rising after a 69k decline in the preceding week. The last four weeks have seen continued claims alternate direction, that following eight straight increases. The 4-week average is still rising, but the pace is slowing.