GBP flows: GBP slips on lower February inflation

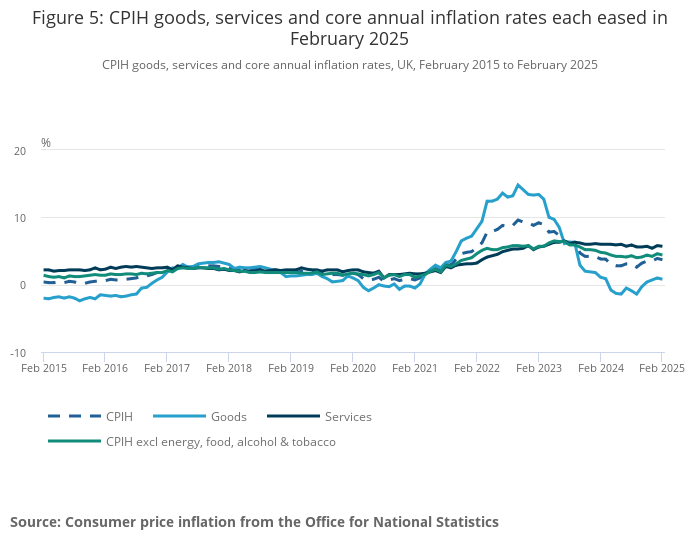

UK inflation comes in a little lower in February, emphasising GBP downside risks ahead of the fiscal statement later

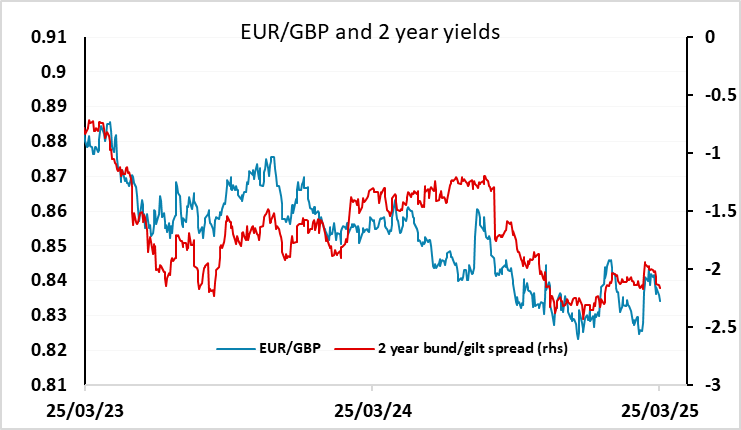

UK February CPI comes in softer than expected, triggering some small losses in GBP. However, EUR/GBP has drifted lower in recent sessions, helped by some widening in yield spreads, and this morning’s bounce doesn’t correct much of the recent decline. The lower than expected CPI probably won’t significantly change the BoE policy stance, as CPI remains at slightly uncomfortable levels, but the chances of a May rate cut still look somewhat greater than the 45% chance currently priced in, so we still see some downside risks for the pound.

However, today’s focus is more on the UK fiscal statement at 10GMT than this morning’s CPI, important though it is. GBP fell back after the Budget statement last time, and is vulnerable if Chancellor Reeves accommodates a further increase in the budget deficit due to weaker growth and higher debt interest than expected. So most of the risks do look to be on the GBP downside, even though we expect that Reeves will broadly maintain the fiscal stance with some more spending cuts.