GBP flows: GBP slightly higher as MPC members speak

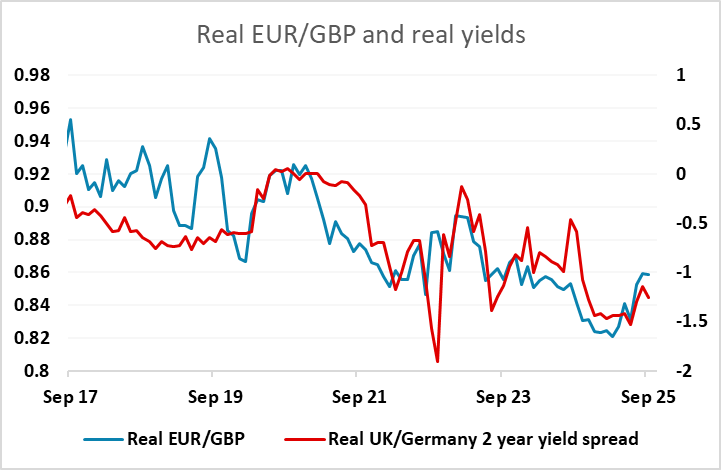

GBP in focus as MPC members speak. Short term ranges likely to hold, but long term risks on GBP downside.

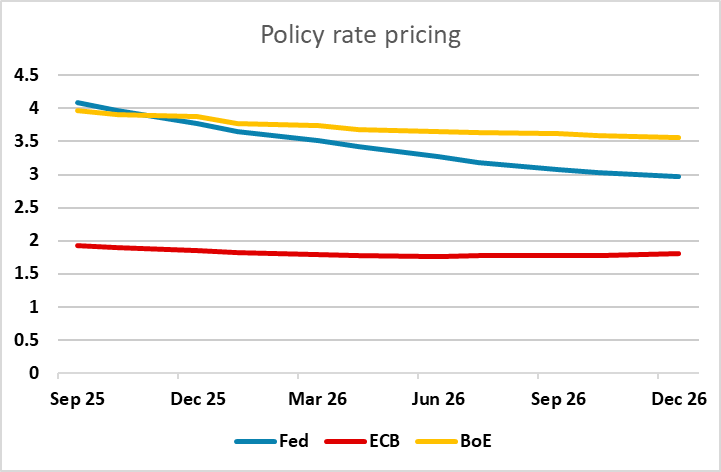

Lots of comments on the wires from the various BoE MPC members testifying to the Treasury select committee, but no great surprises with the main dove, Taylor, sounding dovish and the hawks, Greene and Lombardelli, sounding hawkish. However, it does seem as if Taylor is taking a more forward looking view, with the comments from Lombardelli suggesting she has been influenced by the recent spike in food price inflation. While there is always a risk that this has second round effects, if it does not – and the evidence of weakening in the labour market suggests I won’t – it is more of a reason for easing than tightening, as it represents a decline in real incomes in the short term and is likely to be reversed next year. UK yields are not much changed, but GBP is a little firmer this afternoon, rejecting the test of 0.87. Longer run, we still see scope for a break higher in EUR/GBP as we expect the BoE will turn more dovish, but domestically we may not get much action until November when we have the next MPR and the Budget. Of course global events could still have an FX impact before then, but the risks on that score are also GBP negative as risk premia are already extremely low so that most of the risks are for risk negative moves that will tend to undermine higher yielders like GBP.