Chartbook: Chart USD Index DXY: Range extension before lower levels attract

Anticipated consolidation above the 96.22 current year low of 17 September has given way to a corrective bounce

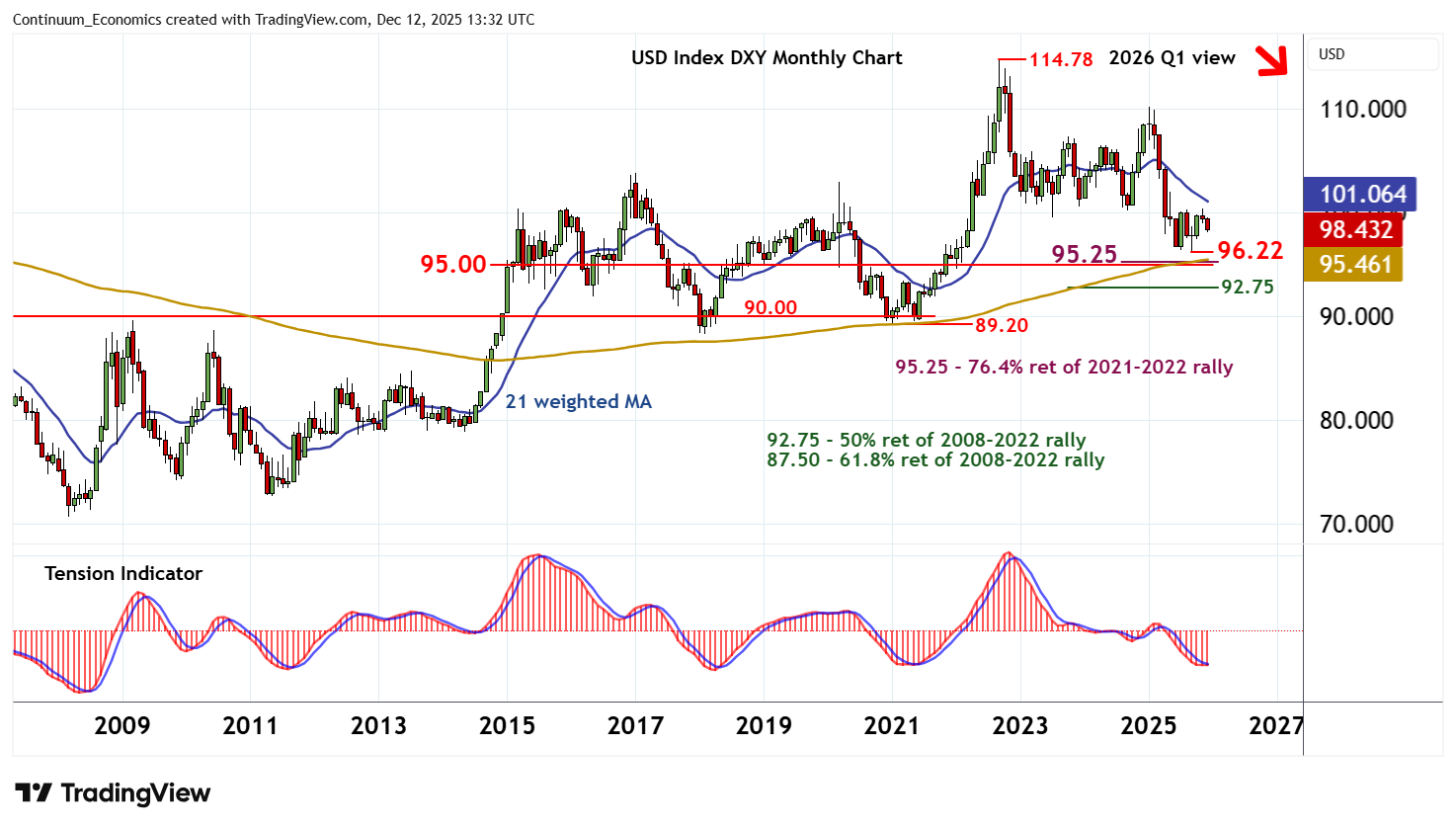

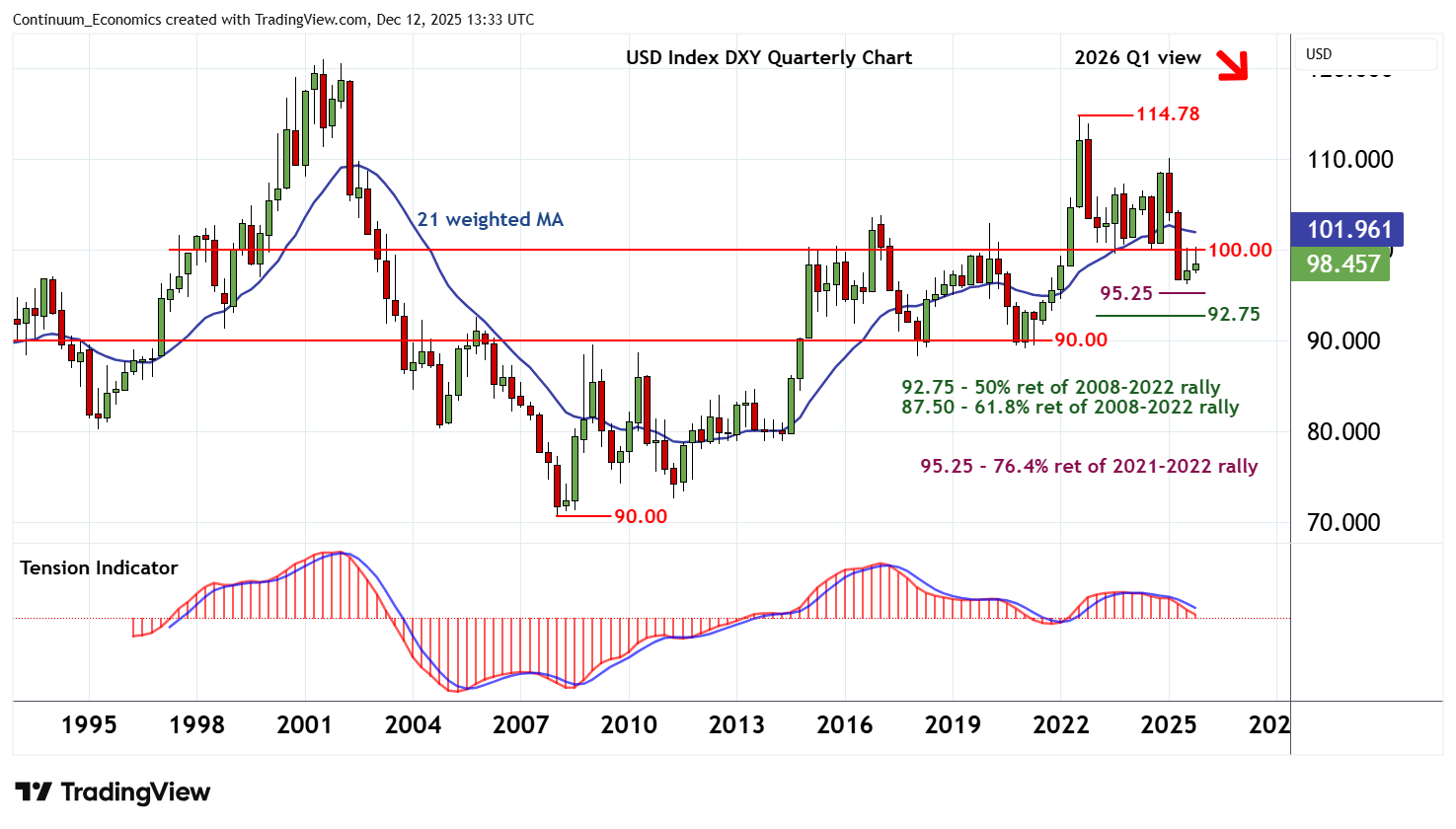

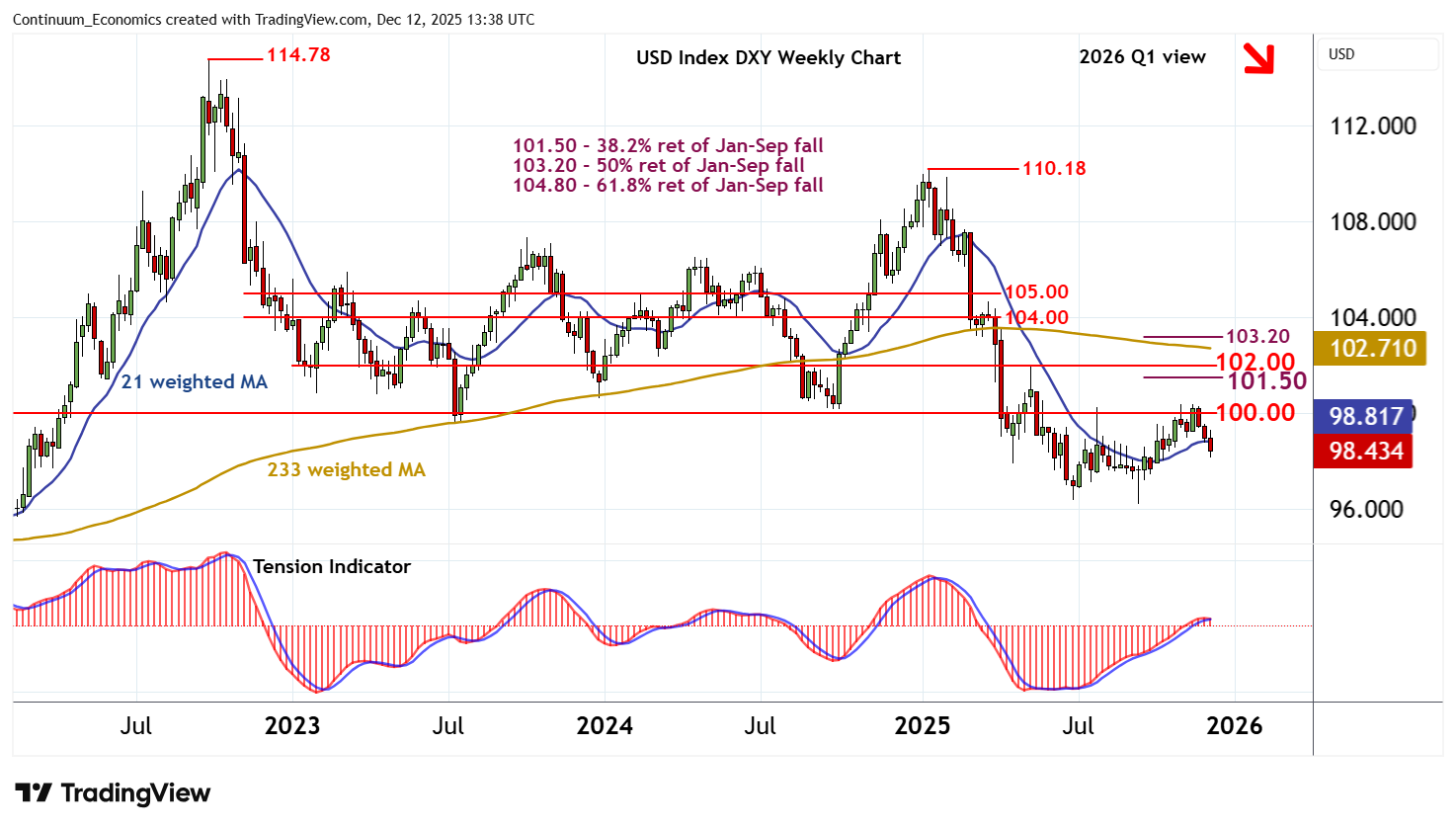

Anticipated consolidation above the 96.22 current year low of 17 September has given way to a corrective bounce to strong resistance at the base of the multi-month distribution top around 100.00.

Fresh selling interest is pushing prices lower once again, but mixed monthly charts are expected to limit initial scope in consolidation/range extension above critical support at 96.22.

Longer-term studies are bearish, however, pointing to a later break beneath here.

A close below 96.22 will turn sentiment negative and complete a multi-month distribution pattern beneath 100.00, as losses from the 114.78 multi-year high of September 2022 extend towards the 95.25 Fibonacci retracement and congestion around 95.00.

Further selling will open up the 92.75 multi-year retracement.

Meanwhile, immediate resistance is at the 100.00 base of the multi-month distribution top.

A close above here, if seen, would delay lower levels and give way to consolidation beneath the 101.50 Fibonacci retracement and the 102.00 break level.

A further close above here, not seen, would signal a more significant corrective bounce within the 2025 bear trend, and open up the 103.20 retracement, where fresh selling interest is expected to appear.