SEK, CHF flows: SEK and CHF both softer after CPIs

Sweidsh CPI marginally avove consensus, Swiss CPI marginally below, but both SEK and CHF weaker

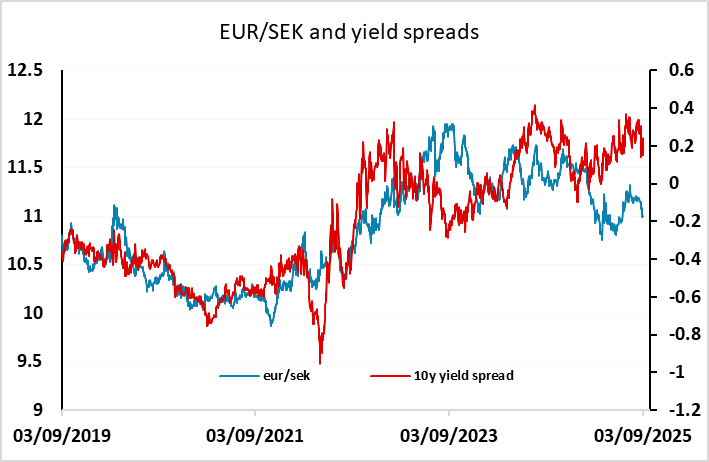

Swedish CPI has come in marginally stronger than expected with the targeted CPIF measure at 3.3% y/y in August, above the 3.2% expected and up from 3.0% in July. EUR/SEK has nevertheless traded slightly higher, but remains close to the 11.00 level, which still looks low relative to recent yield spread moves.

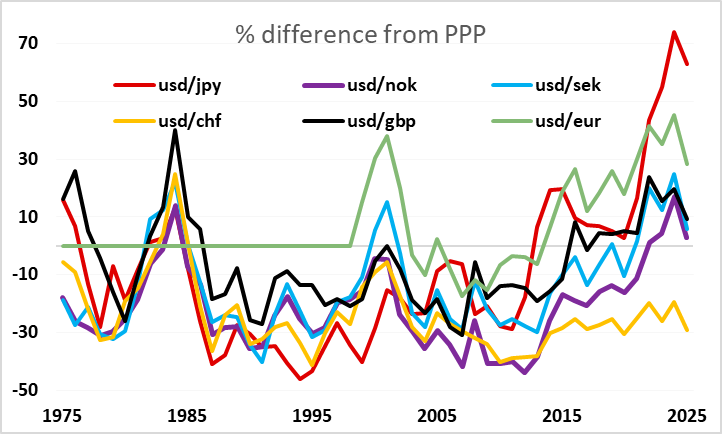

Swiss August CPI has come in weaker than expected on a m/m basis at -0.1%, but y/y is still in line with consensus at 0.2%. This won’t trigger any action form the SNB, as there is a high bar to clear to convince them to move the negative rates. But EUR/CHF is a little firmer on the news, gaining around 10 pips. We still see the CHF as clearly the most overvalued G10 currency, and a major correction does look likely at some point, especially since the high US tariff on Switzerland argues for a weaker currency. But some sort of positive Eurozone growth view may be necessary to propel EUR/CHF higher.