This week's five highlights

U.S-China Trade Tensions May Escalate Further Before Eventually Fading

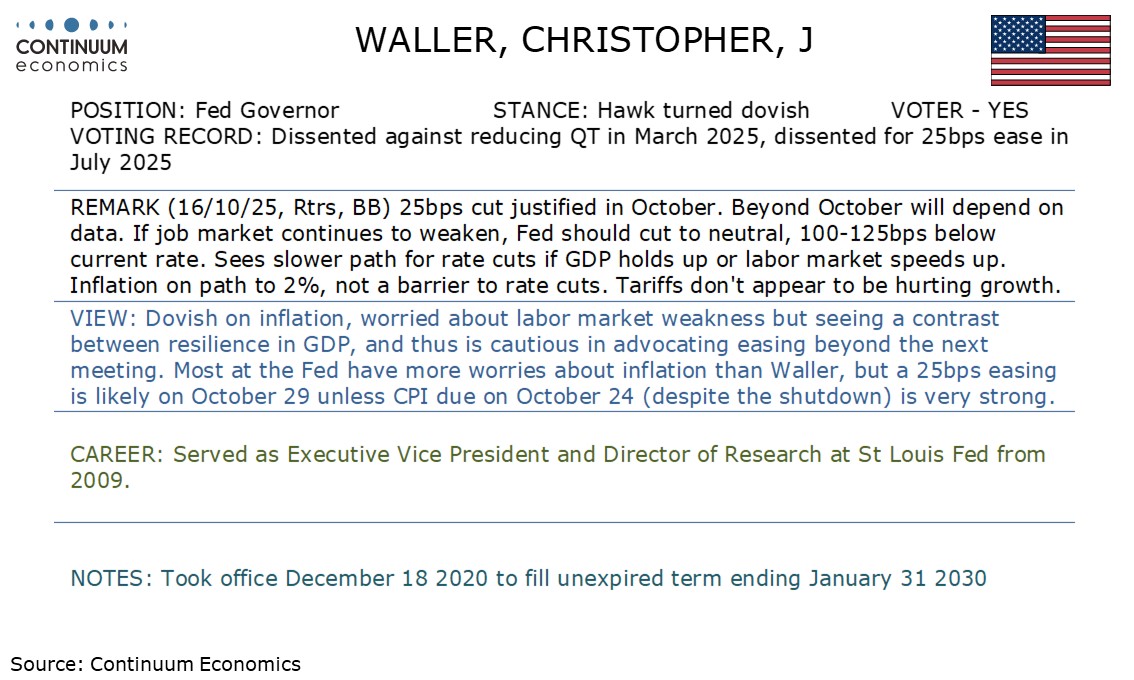

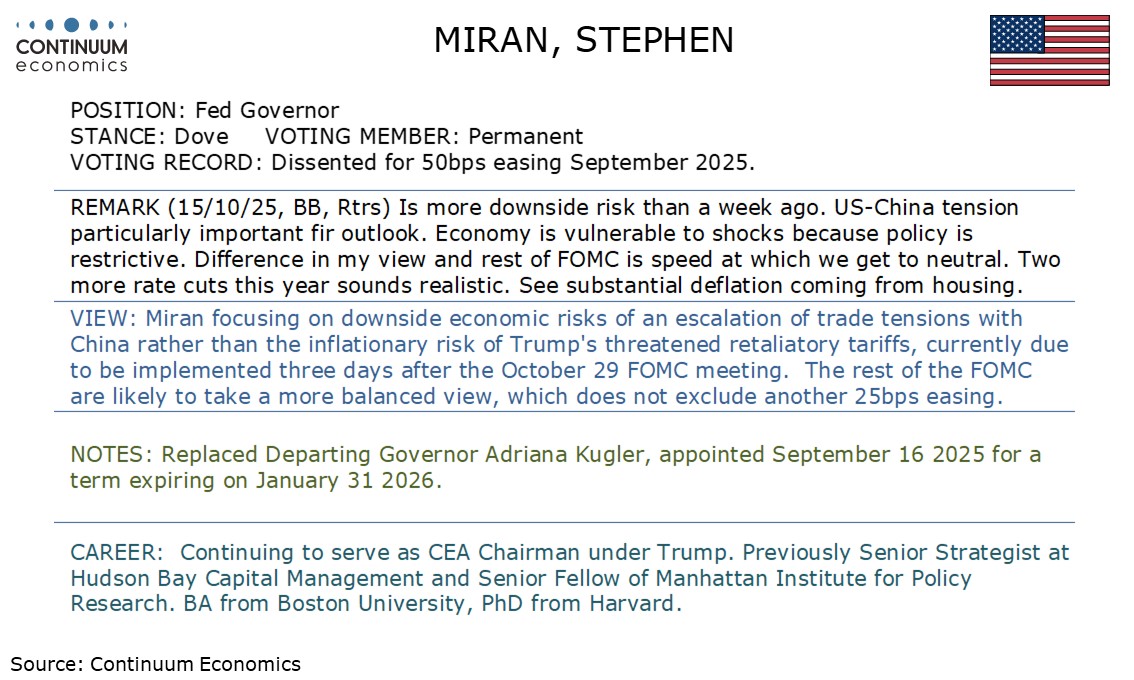

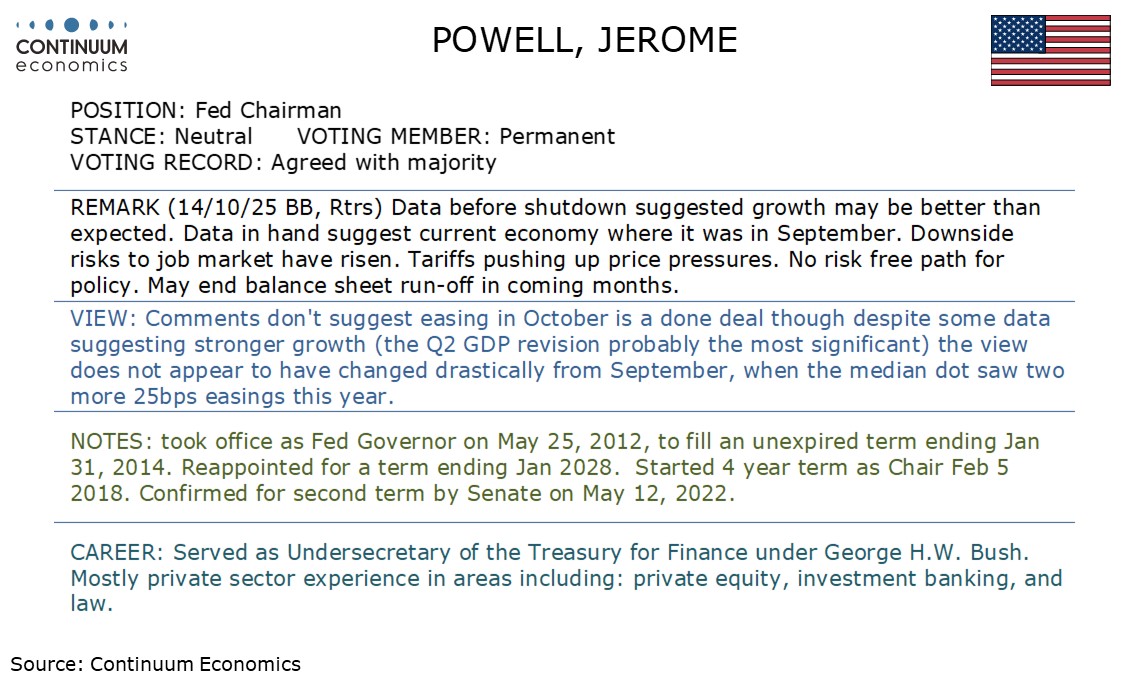

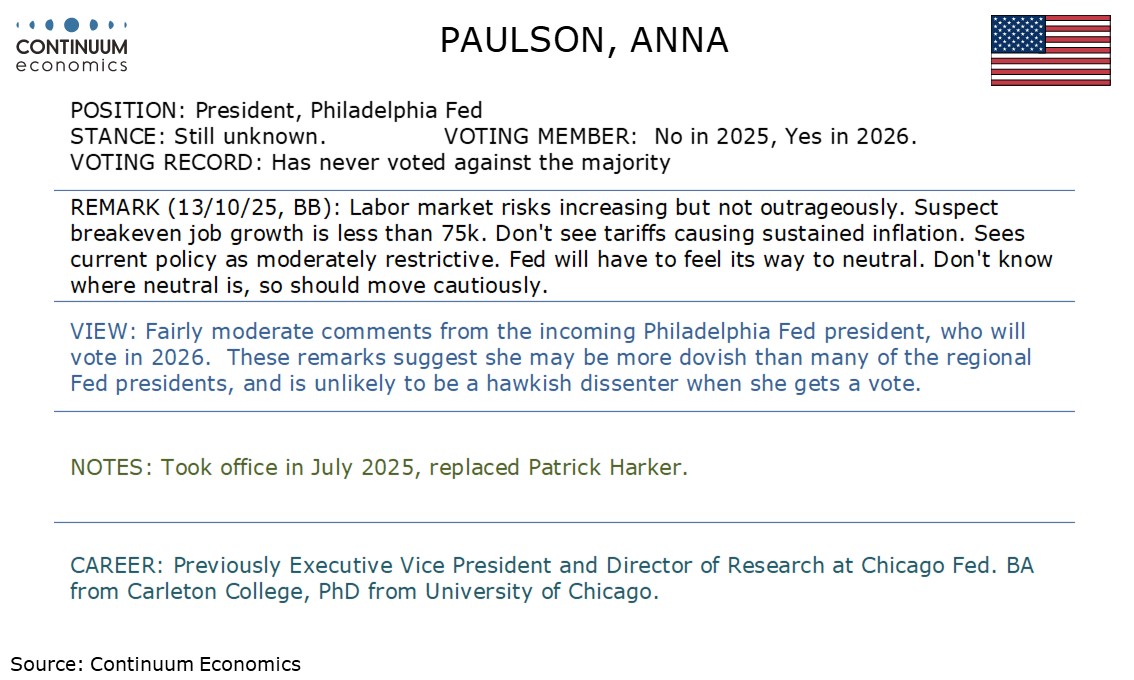

This Week's Fed Speaker

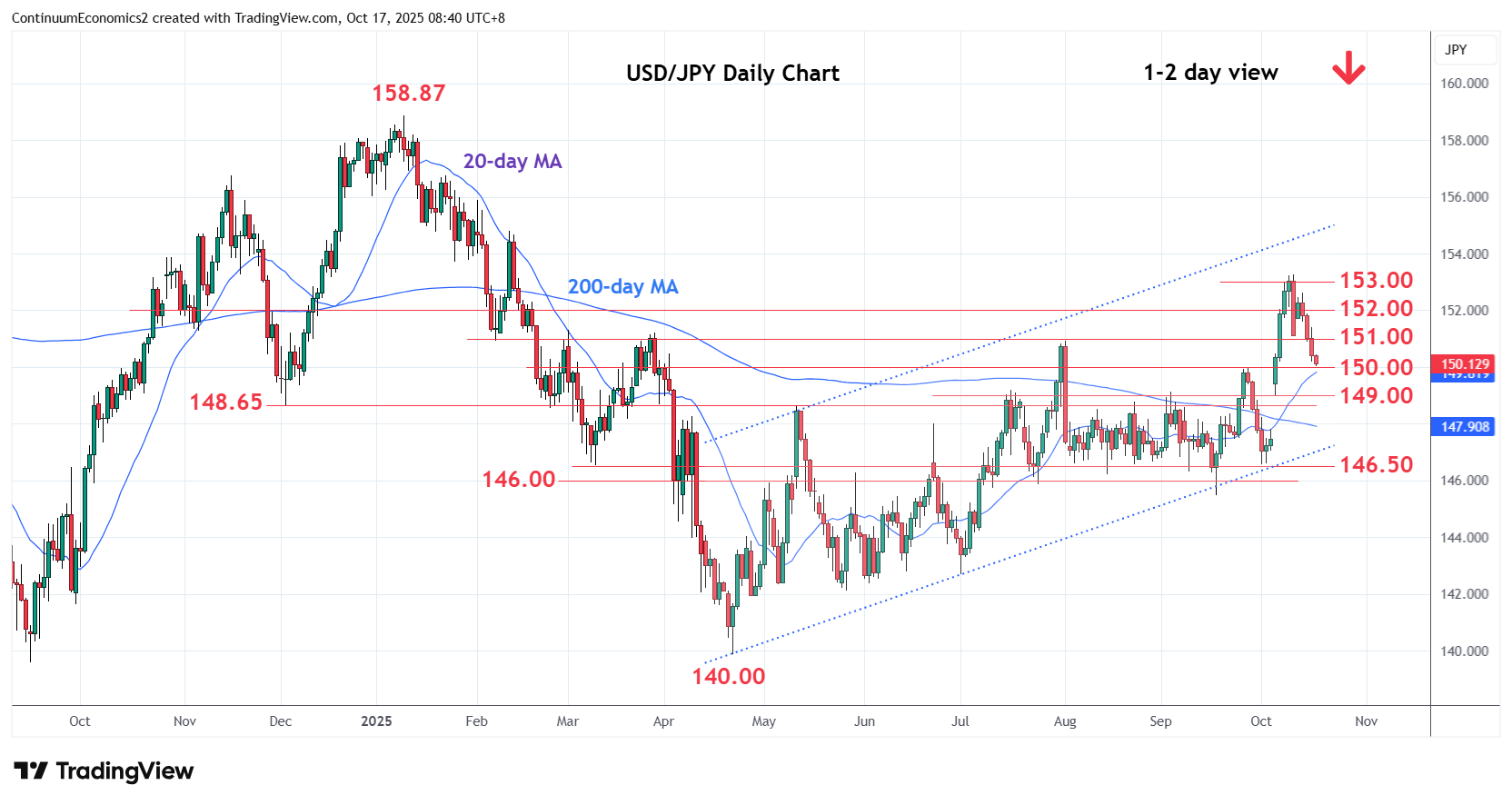

Japan Political Turbulence Strengthen

First Phrase of India–US Trade Negotiations

UK GDP Moving Sideways At Best

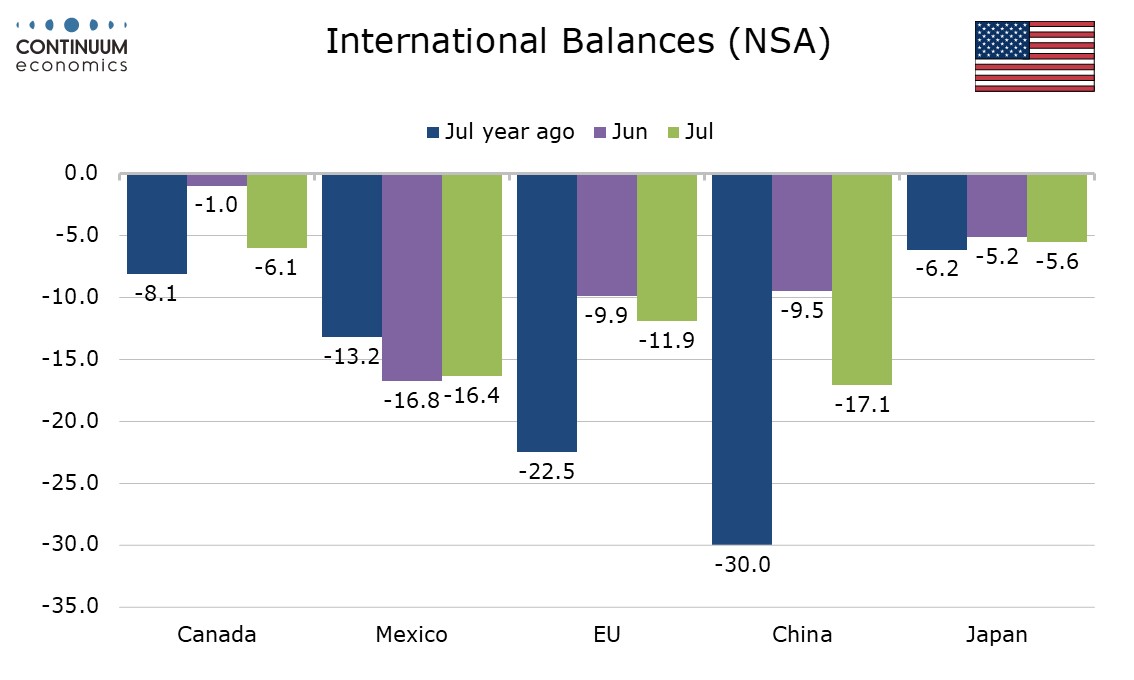

Trump’s more conciliatory words after announcing a 100% tariff on China starting November 1 have eased market worries, though the issue is far from resolved. It is still possible that Trump will follow through with his threat on November 1, but unlikely that tariffs would remain elevated for very long. The issue came to the market’s attention when Trump threatened massive tariffs on China on Friday morning, following through after the close with the announcement that a 100% tariff, above the significant tariffs already existing, would be imposed on November 1. However Trump’s moves were in response to a decision by China to impose restrictions of exports of rare earths and products containing them, and that was in response to a US decision to extend its own export controls of sensitive technology to China to overseas subsidiaries of Chinese firms.

China, due to its current dominance in global supply, has significant leverage over rare earth exports, though this will fade gradually in upcoming years as other countries step up supply. It will be harder for Trump to get a trade deal with China with such clearly US-favoring terms as those he was able to achieve with the EU or Japan, who depend on the US for security. Even Brazil, significantly less powerful than China. has felt strong enough to stand up to Trump’s tariffs. The market appears to be betting on a “TACO trade” in which Trump backs down on the tariff threat, though it is unclear whether Trump would also have to make concessions on US export controls to get China to back down on its rare earth export controls. We suspect he ultimately would, though not without some resistance. His conciliatory words today gave no hint of a climb down on his part, more suggesting China’s Xi would be the one to do so. Trump may have been trying to keep attention away from trade wars while he was getting praise for the release of Israeli hostages from Gaza.

The political turbulence gained traction for Japan this week. Even since Komeito announced their departure from LDP coalition, the political front in Japan remains fluid. It is reported that LDP leader Takaichi has held a meeting with a minor party, Ishin. The Japan LDP and opposition CDP agreed to hold vote to decide next prime minister on Oct 21. The probability of a Taikachi premiership continues to sink and could mean a first non-LDP PM after a few decades. While the JPY has captured the opportunity to correct from its weakness, it is worth to mention the opposition parties are also in favor of cutting taxes and more fiscal spending, even copying Abe to affect BoJ's monetary policy. Until we see some kind of clarity, any major position maybe caught wrong footed.

India and the US are nearing the first phase of a long-awaited Bilateral Trade Agreement, with negotiations in Washington focusing on tariffs, digital standards, and supply-chain resilience.Energy remains the flashpoint, as Washington’s 50% duties tied to India’s Russian oil imports complicate progress. New Delhi’s proposal for a reciprocal energy–trade framework underscores its balancing act between affordability, strategic autonomy, and closer alignment with the West.

India and the US have entered a decisive phase in their trade negotiations, seeking to finalise the first tranche of a long-delayed Bilateral Trade Agreement (BTA) by November 2025. The latest discussions in Washington, led by Commerce Secretary Rajesh Agrawal, mark the most substantive progress in economic diplomacy between the two nations since the revival of the Trade Policy Forum in 2019. Negotiations have focused on four broad areas — market access, supply-chain resilience, digital standards, and tariff reform — with both sides signalling “constructive” progress. Officials hope to reach a partial accord before year-end, a move that could restore momentum to a relationship tested by tariff disputes and shifting geopolitical alignments.

India's Commerce Minister Piyush Goyal said that despite bureaucratic slowdowns in Washington, “the direction of travel remains positive”. Both governments are targeting a doubling of bilateral trade to USD 500 bn by 2030, from US$ 132bn in FY 2024-25, when India’s surplus with the US stood at US$ 40.8bn. The US remains India’s largest export market, led by engineering goods, pharmaceuticals, electronics and petroleum products.

The sharpest point of contention remains Washington’s 50% effective tariff on select Indian exports — a punitive extension of sanctions linked to India’s continued purchases of Russian crude oil. The US argues these flows dilute global efforts to constrain Moscow; India insists its energy strategy is guided by price stability and supply security, not geopolitics. Responding to the controversy, Randhir Jaiswal, spokesperson for India’s Ministry of External Affairs, said recently that India is a significant importer of oil and gas, and the country's priority is to safeguard consumer interests in a volatile energy scenario. His comments followed President Donald Trump’s claim that Prime Minister Narendra Modi had assured him India would halt Russian oil purchases — a statement New Delhi has not confirmed. The MEA later clarified that India continues to diversify its energy basket, including deeper cooperation with the US, underscoring a pragmatic balance between global expectations and domestic needs.

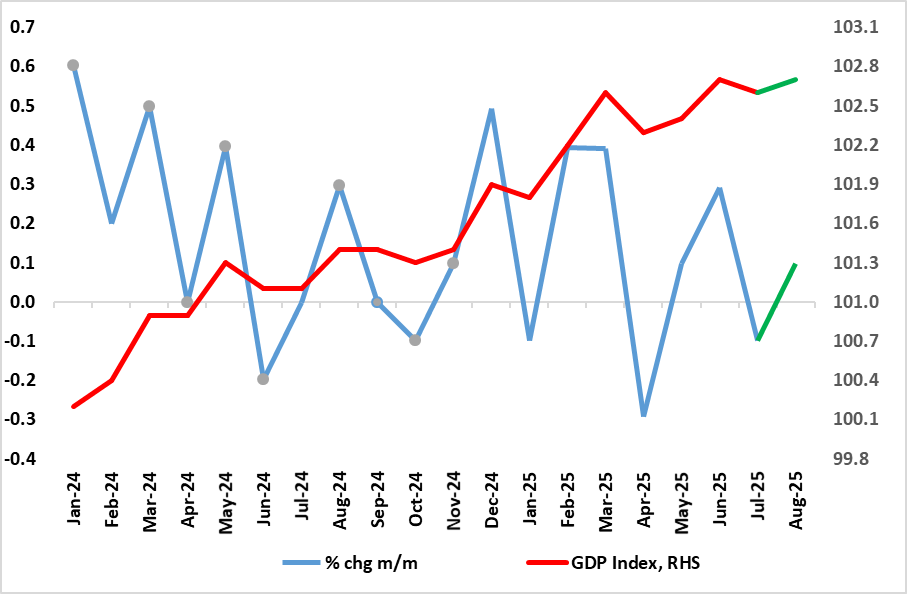

Figure: Solid GDP Growth Ebbing?

Although the revisions up to July GDP data now confirm a small m/m fall for that month), this was unwound in the August numbers with a 0.1% rise (Figure). This put the less volatile three-month rate at 0.3% but we think this overstates what is very feeble momentum, which may actually be nearer zero if not weaker at least according to some business survey data (Figure 2), especially once construction weakness is incorporated. Indeed, GDP has hardly moved since March. Admittedly, solid GDP outcomes early in the year suggest that UK GDP growth in 2025 will be around 1.25% - the highest in the G& according to the IMF this masks what is very much a weak(er) picture in per capita terms, this being a politically important amid current immigration issues. Indeed, the IMF see a cumulative growth of 0.9% for 2025 and 2026, the weakness in the DM would save for a similar soggy outlook for Germany. The data seems to be taking second place to labor market concerns, at last for some MPC member and we still think this may trigger a further rate cut by end-year!

Even so, at this juncture, the still-solid June outcome of 0.3% has created a solid backdrop for the last quarter GDP but we think that the BoE’s 0.3% Q3 forecast may be too high, possibly half being more likely.

To what extent better weather has helped prevent a more discernible further in the month’s GDP is unclear. But gauging the economy is all the more difficult given both conflicting signals and the extent to which the public sector has supported growth and employment of late. The question is whether this latter factor will go in to reverse, sooner but probably later. As for conflicting signals this is best highlighted by recent headline regarding service sector surveys but also where GDP data have diverged from jobs numbers.