SEK flows: SEK slips lower after Riksbank rate cut

Riksbank cuts rates as most expected, downgrades growth forecast and suggests scope for further easing

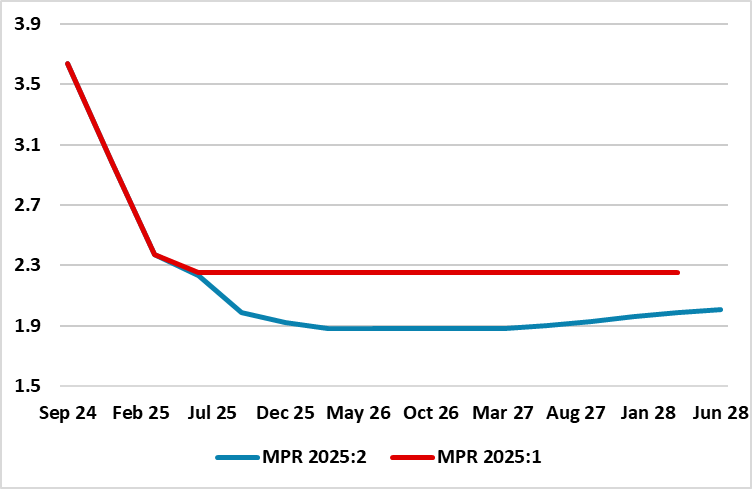

Riksbank policy rate forecast

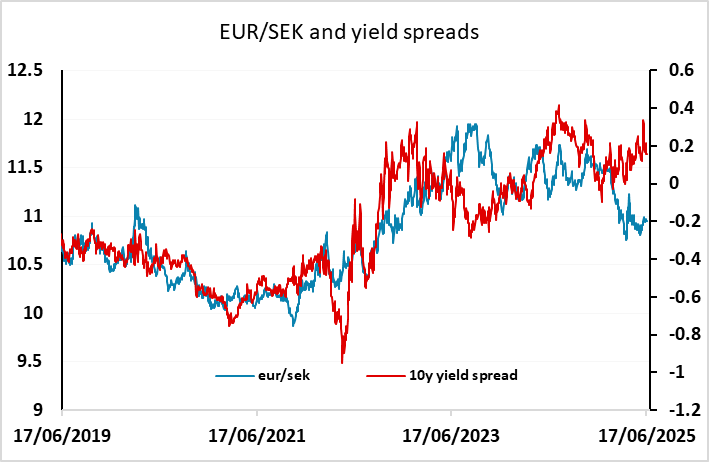

The Riksbank has cut the policy rate 25bps as most expected, and suggested that there may be scope for further cuts this year. As it stands, there is a further 20bps of easing priced into the curve by the end of the year, so there may yet be scope to price in some more. The Riksbank cut their growth forecast for 2025 to 1.2% from 1.9%, saying the economy had lost momentum and was being hampered by tariffs and geopolitical conflicts. EUR/SEK has moved up 4 figures to 11.01 and we see scope for further gains from here as the SEK has outperformed yield spread moves in recent months. This made some sense when the Swedish economy was seen to be accelerating and the European equity market was on the front foot, as the SEK often leads the way in positive European growth cycles. But if a slowdown is underway and rates are being cut further, there may now be scope for the SEK to fall back more in line with the level suggested by yield spreads, which means scope for EUR/SEK well above 11.