SEK flows: EUR/SEK slightly higher after CPI

Weaker Swedish CPI leads to sligtly higher EUR/SEK, but...

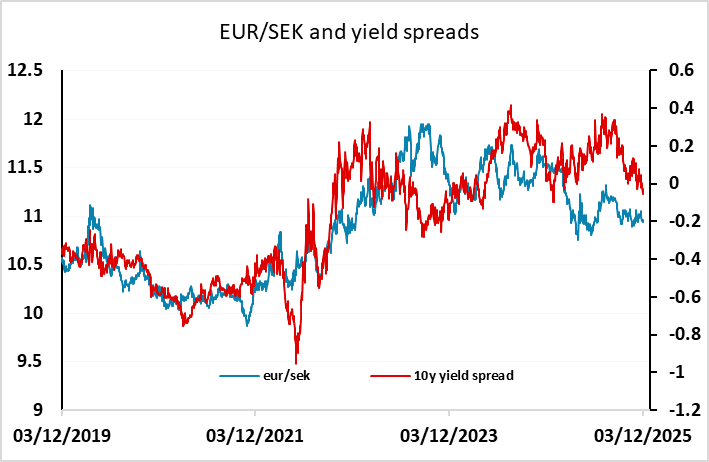

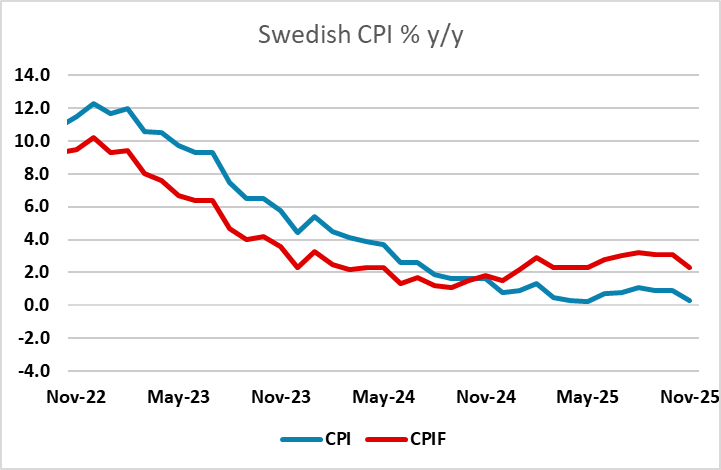

Weaker than expected Swedish CPI data this morning have pushed EUR/SEK slightly higher, gaining a figure to 10.95. Nevertheless, EUR/SEK remains fairly steady just below 11, with little chance of the Riksbank responding to softer inflation with further eaisng. The yield spread has been moving more in favour of the SEK in recent weeks, as Swedish real sector data has come out on the strong side and the market has priced out any expectation of further Riksbank easing. The Swedish curve is now flat out to one year with some risks of tightening now priced in on the 2 and 3 year horizon. However, the SEK had been outperforming yield spreads for much of the last year, so the recent rise in SEK yields has only caught up with the previous movement of the currency. Nevertheless, if we continue to see strong Swedish data there is scope for EUR/SEK to start to move lower, with the Eurozone looking less likely to generate sufficient momentum to trigger any ECB tightening in the next couple of years.