CAD flows: CAD rises on strong Canadian employment report

USD/CAD back below 1.41 with CAD yields higher after strong employment report. Risks now balanced and dependent on US data

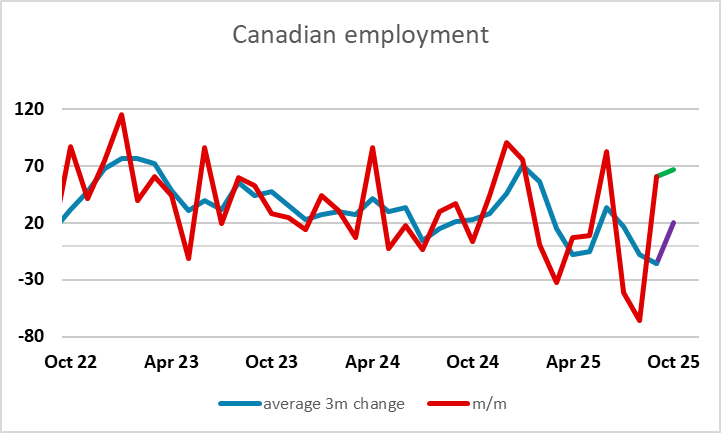

A much better than expected Canadian employment report has sent USD/CAD 50 pips lower. While the last two 60k+ gains in employment only just outweigh the previous two declines, the underlying trend looks to be flattening, while the unemployment rate has fallen back to 6.9%, and this should rule out any further near term BoC easing. Canadian yields are 5bps higher in response, and 2 year spreads no longer suggest any further USD/CAD upside. From here the next move is likely to depend on the Fed rather than the BoC. The market is pricing a 68% chance of the Fed easing at the December 10 meeting, with the outcome likely to be determined by the slew of data that comes out when the government shutdown ends. While the latest US private sector jobs surveys have been on the soft side, they aren’t conclusive by any means and still suggest a flat to slightly positive employment trend, while PMI surveys have been strong. Risks are balanced.