CAD flows: CAD gains on strong employment data, further upside potential

Third consecutive storng employment report suggests USD/CAD can fall further

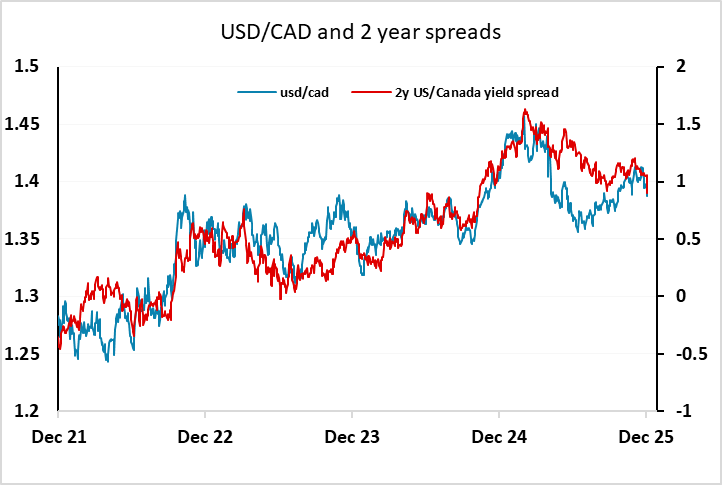

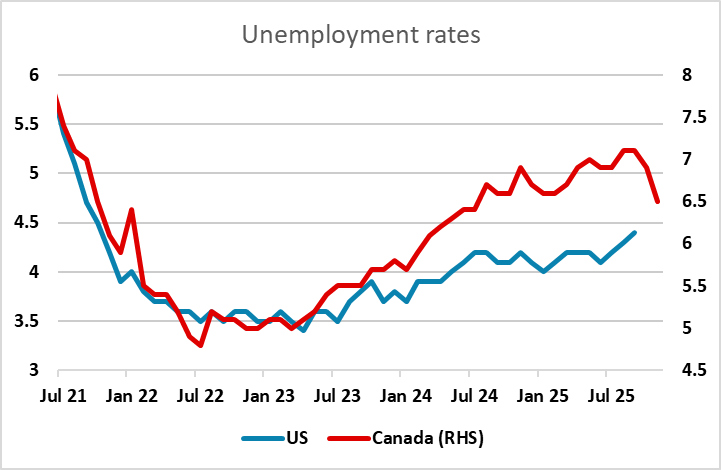

Another strong Canadian employment report has seen USD/CAD drop sharply by 60 pips to its lowest since September, with 2 year Canadian yields rising 17bps in response. The 53.6k rise in employment in November follows two gains of over 60k in September and October, and the drop in the unemployment rate to 6.5% is particularly notable, the lowest rate since July 2024. All in all, the Canadian data is suggesting that the economy has got over the initial impact of the US tariff increases and is bouncing back strongly, with the Q3 GDP data also having come in strong. The market is now pricing in a rate hike towards the end of 2026, and this could be brought forward if the data continues along these lines. However, there is also a possibility that the strength in Canada is mirrored in the US, in which case the 80bps of Fed easing priced in by the end of 2026 will start to look excessive. But for now the risks for USD/CAD should be on the downside.