CAD flows: CAD gains as BoC produces a hawkish cut

USD/CAD a little lower, but scope for declines quite modest

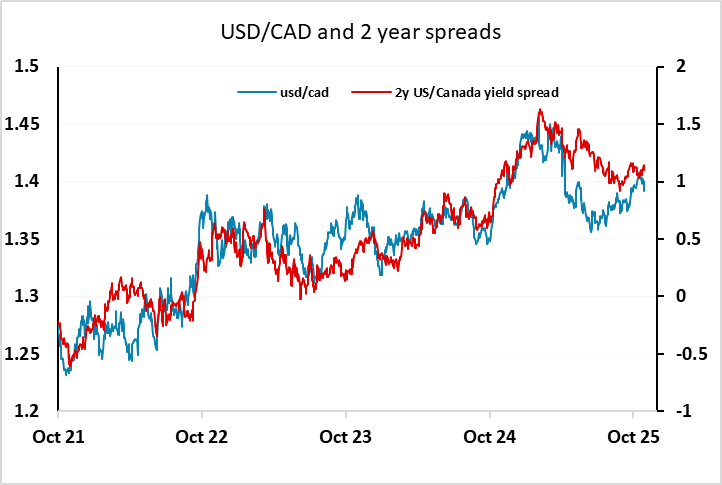

USD/CAD has moved slightly lower in response to the 25bp rate cut from the BoC, with the statement suggesting that they don’t see any more cuts in the future assuming that the economy progresses as expected. USD/CAD has only dropped around 10 pips, but front end CAD yields are up 5bps, so there could be scope for some more CAD gains from here if the Fed don’t sound more hawkish than expected after the FOMC decision later (which is expected to produce a 25bp funds rate cut). However, USD/CAD had already fallen away from the level suggested by the historic yield spread correlation in yesterday’s trading, so downside looks fairly modest. There isn’t much more scope for CAD yields to rise, as the market was not fully pricing another cut after today’s move ahead of the decision, so from here any further USD/CAD declines look likely to be dependent on declines in US yields.