CHF, JPY, CAD flows: CHF awaits GDP, CAD firm ahead of CPI

EUR/CHF back above 0.92 ahead of GDP data. CAD firm on general risk bid.

While most of the focus this week is on the potential release of US data delayed by the government shutdown, there is nothing of significance on that front expected today. However, we have Canadian CPI later and Swiss GDP this morning. EUR/CHF has bounced back up above 0.92 after a brief look below last week on the talk of a trade deal with the US, but hasn’t gained from the actual announcement of the trade deal and the tariff reduction that resulted. There may be some reaction to the Swiss GDP data this morning after the Japanese Q3 GDP data overnight showed a 0.4% q/q decline in GDP in Q3, which was seen as being hit by tariffs. This was, however, stronger than expected and followed an upwardly revised 0.6% Q2 gain. EUR/CHF still looks unlikely to break below 0.92 near term, and could move higher on weak GDP data.

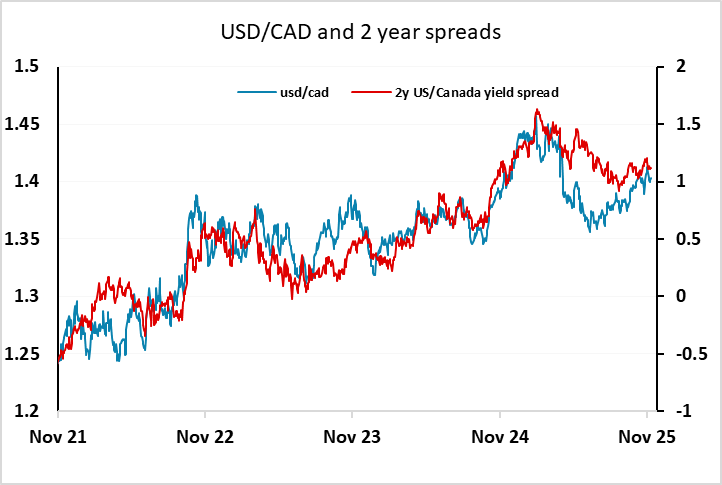

USD/CAD is trading offered in early trade, with a general risk positive tone also boosting the AUD, GBP and to a lesser extent the EUR. We see some risk of slowdown in Canadian CPI data, which may prevent USD/CAD losses from extending sub-1.40.